Good News and Bad News for Federal Trust Funds

CBO’s latest budget outlook contained good news and bad news for some of the federal government’s largest trust funds. First, the bad news: CBO continues to predict that without legislative action, the Highway trust fund and Social Security’s Disability Insurance (DI) trust fund will be exhausted in the next few years. The good news, however, is that CBO's Hospital Insurance (HI) outlook is far more optimistic than the projections in their February baseline.

Federal Trust Funds

Trust funds are just one of the many accounting mechanisms the federal government uses to link tax revenues designated for a specific purpose with their corresponding expenditures. The federal government has numerous trust funds, the largest being Social Security’s Old-Age and Survivor’s Insurance (OASI) Trust Fund. Under current law, trust funds cannot incur negative balances or borrow money to pay their obligations. However, CBO assumes that all trust fund obligations will be paid in full when calculating their budget baseline, implicitly assuming any shortfall would be covered with general revenues.

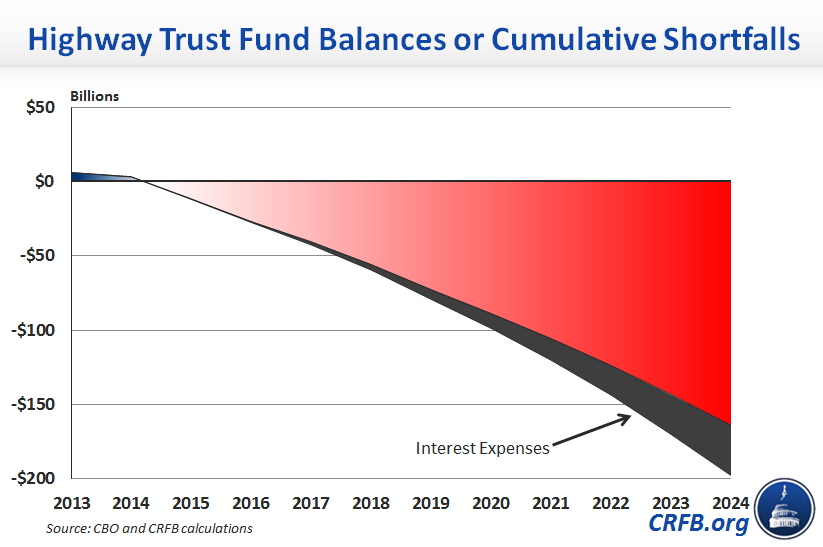

Highway Trust Fund

The Highway trust fund faces the most immediate financing shortfall of any of federal trust fund. CBO projects that the highway and transit accounts of the Highway trust fund will be exhausted in FY 2015, with the highway account possibly forced to delay some of its payments during the latter half of 2014. Years of covering shortfalls with general revenues while doing nothing to bring trust fund revenues in line with costs have set the stage for a "transportation funding cliff" in FY 2015, at which point trust fund outlays would need to be cut by about one-quarter to bring spending in line with revenues. By 2024, the highway account's cumulative shortfall will be $120 billion while the transit account's cumulative shortfall will be $44 billion, giving the trust fund a combined cumulative shortfall of about $164 billion (if the additional interest charges to the general fund were included, the total would increase to nearly $200 billion).

Because the trust fund’s outlays have tended to outpace its receipts since 2000, lawmakers have repeatedly transferred money from the general fund to the Highway trust fund. Since 2008, Congress has transferred roughly $53 billion in general revenues to the Highway trust fund, with only the latest transfer of $18.8 billion being offset with savings elsewhere in the budget. Speaker Boehner has recently spoken out against another bailout of the Highway trust fund, and the budget resolution passed by the House included a provision which would score a general revenue transfer to the Highway trust fund with a cost that would need to be offset if the House-passed budget is deemed for purposes of budget enforcement in the House.

There are a number of ways lawmakers could address the Highway trust fund's solvency issues. CBO estimates that increasing the taxes on motor fuels used to finance the trust fund by about 10 cents per gallon by FY 2015 would close the shortfall through 2024. President Obama’s budget dedicates $150 billion in transition revenue from corporate tax reform to the Highway trust fund, while House Ways & Means Chairman Dave Camp's Tax Reform Act of 2014 would deposit temporary revenues from repatriation into the fund (though those revenues are also used to pay for rate reductions).

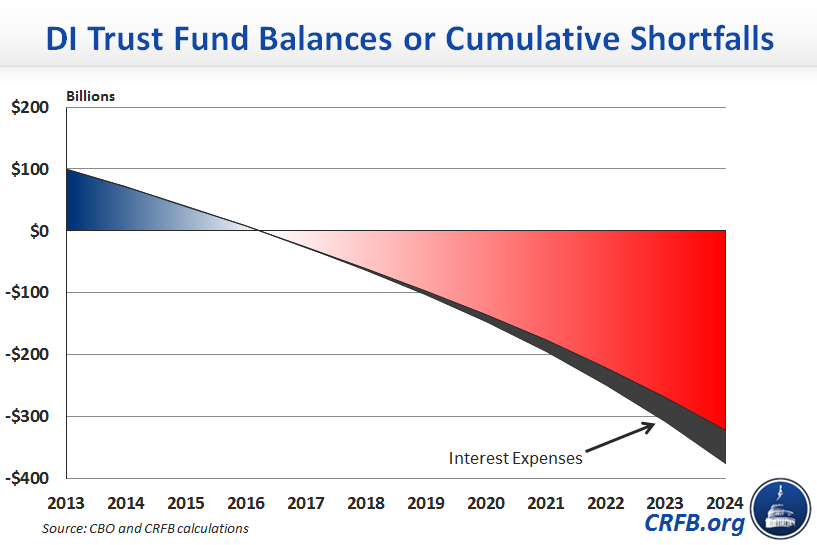

Disability Insurance Trust Fund

CBO currently estimates that the DI trust fund will be exhausted in fiscal year 2017, while the Social Security Trustees project the fund will run out in calendar year 2016 (both estimates may be correct, as three months of FY 2017 fall in calendar year 2016). At that point, current law will require a 20 percent across-the-board reduction in disability benefits. While the trust fund exhaustion date has not changed from CBO's last estimate, the size of the shortfall has slightly increased. By 2024, CBO expects the DI trust fund to face an annual shortfall of $53 billion ($67 billion including interest), and a cumulative shortfall of $322 billion ($375 including interest).

In the past, Congress has addressed the DI trust fund's insolvency by reallocating a portion of the payroll tax from the OASI trust fund to the DI trust fund. However, relying on this approach indefinitely would bring the OASI trust fund two years closer to exhaustion (from 2033 to 2031). Given that the OASI fund's own insolvency date is fast approaching, it is not clear if such an option is desirable today.

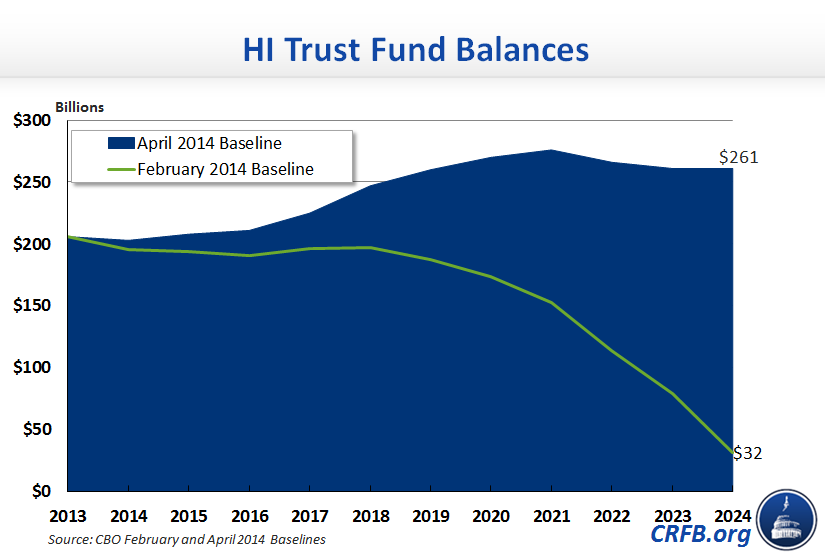

Hospital Insurance Trust Fund

While CBO’s latest baseline had nothing but bad news for the DI and Highway trust funds, the latest outlook for the HI trust fund (which pays Medicare Part A benefits) is significantly better than CBO’s last estimate. Whereas the agency's February baseline projected that the trust fund would run deficits in eight out of the next ten years, the new baseline shows the trust fund running surpluses for most years, with much smaller deficits in those years where outlays do exceed total income. While CBO's February baseline estimated that the HI trust fund would run a cash-flow deficit of $51 billion ($47 billion with interest) in 2024, the CBO now expects a much smaller cash-flow deficit of $12 billion (income including interest would meet expenses).

By 2024, the HI trust fund will have a balance of $261 billion, more than eight times the balance CBO projected just a few months ago. Since CBO's February and April baselines do not project beyond 2024, it is unclear how much longer the trust fund would remain solvent, but the new projections clearly show a further away insolvency date. The improved outlook for the HI trust fund is mostly due to lower projected outlays (a decrease of about 7 percent in 2024), but CBO also projects trust fund income will be slightly higher than previously projected (about 3 percent in 2024).

Policymakers should use the looming exhaustion of the Highway and DI trust funds as an opportunity to review the financing and operations of these programs and enact reforms that put them on a sustainable path. CBO has already provided Congress with a number of different options for improving the finances of the Highway, Disability Insurance, and Hospital Insurance trust funds without resorting to transfers or temporary fixes that leave the underlying problems in place. While the Highway and DI funds will soon require Congressional action, the HI trust fund’s healthier fiscal position should not dissuade lawmakers from addressing growing Medicare costs. Waiting for federal programs to reach the brink of insolvency before addressing them only makes the problem harder to solve.