What’s in the Senate Budget Committee’s Budget Resolution?

The Senate Budget Committee recently reported out a budget resolution for Fiscal Year (FY) 2025 through 2034 and will soon consider it in the full Senate. The budget resolution calls for debt to stabilize below 100 percent of Gross Domestic Product (GDP), reaching 99 percent of GDP by 2034. It would reduce baseline deficits by $7.8 trillion over ten years – the result of $11.5 trillion of largely unspecified spending cuts and $3.7 trillion of tax cut extensions.

The budget also includes reconciliation instructions that would allow committees to report up to $517 billion in net deficit increases. Senate Budget Committee Chairman Lindsey Graham says its intention is to increase spending on defense, border security, and energy by $85.5 billion per year for four years, offset with equal amounts of spending cuts - resulting in a target of $342 billion of spending increases and cuts, however this is not reflected in the text of the resolution.

Potential Debt Impact of Senate Budget’s Reconciliation Instructions (FY 2025-2034)

| Committee of Jurisdiction | Reconciliation Instruction (billions) |

|---|---|

| Homeland Security and Governmental Affairs | Up to $175 |

| Judiciary | Up to $175 |

| Armed Services | Up to $150 |

| Commerce, Science and Transportation | Up to $20 |

| Environment and Public Works | Up to $1 |

| Deficit Increases | Up to $521 |

| Agriculture, Nutrition and Forestry | At least -$1 |

| Energy and Natural Resources | At least -$1 |

| Finance | At least -$1 |

| Health, Education, Labor and Pensions | At least -$1 |

| Deficit Reductions | At least -$4 |

| Allowable Deficit Increase | Up to $517 |

| Interest | ~$140 |

| Total | ~$660 |

Sources: Senate Budget Committee, CRFB estimates.

Most of the deficit reduction in the budget resolution comes from nearly $9.0 trillion in unspecified savings, which are assumed to start immediately and reduce the deficit by $960 billion in FY 2025 – even though we are already five months into the fiscal year. This also significantly reduces net interest payments.

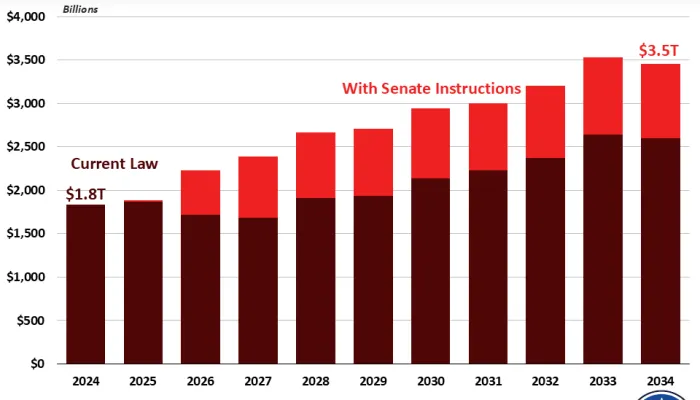

However, given that these savings are largely unspecified and unactionable, the more meaningful component of this budget resolution is its reconciliation instructions. If lawmakers compile a reconciliation bill that sticks to the instructions specified in this budget for each committee – a net $517 billion of deficit increases from a $4 billion floor of required savings and a $521 billion ceiling of allowable deficit increases – debt would reach 119 percent of GDP by the end of FY 2034, compared to 117 percent under current law. If the $3.7 trillion in revenue reductions called for in the budget are also accounted for, debt would reach 129 percent of GDP in 2034.

Importantly, the Senate budget does not include any process measures that would limit its deficit increase – such as, for example, the Conrad rule prohibiting reconciliation from adding to the deficit. The budget also exempts its resulting reconciliation legislation from fiscally responsible budget enforcement measures like Senate PAYGO.

The Senate Budget Committee deserves credit for putting forward a budget resolution with realistic economic growth assumptions and an aggressive but achievable fiscal goal of stabilizing debt. However, this budget relies on unrealistic, unspecified spending cuts and would allow lawmakers to add to the debt when they should be reducing it.

As the full Senate considers this budget, lawmakers should amend it to at least require equal amounts of deficit reduction and deficit increases. Ideally, it should require more deficit reductions than deficit increases to ensure reconciliation ultimately reduces debt.