What's In and What's Out of the Extenders Bill

Update: Two days later, the Senate Finance Committee amended the legislation to extend nearly all of the provisions that had been allowed to expire. See our blog post for analysis of the final package.

The Senate Finance Committee released draft legislation yesterday that would extend some of the tax provisions that expired last year. Over 50 provisions expired on December 31, 2013, but Congress has often extended these provisions retroactively, which is possible because most people do not pay their 2014 taxes until 2015.

The package extends nearly three-quarters of these provisions for 2014 and 2015. The provisions that are extended also represent about three-quarters of the total cost of extending all of the expired provisions. Of the draft's $67 billion cost, over two-thirds goes to extending business provisions. The largest business provisions extended are the research and experimentation credit ($15 billion) and a provision on active financing that allows financial companies to defer taxation on their overseas income ($2 billion).

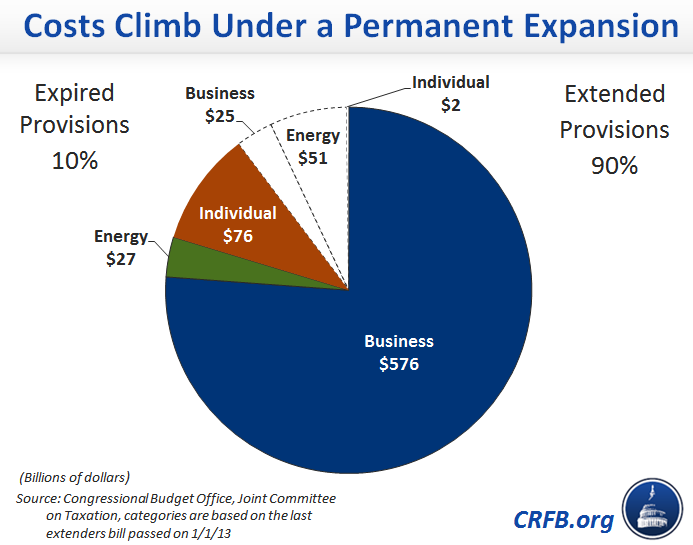

Despite Chairman Wyden's statement that this is the last time a tax extenders bill will be considered, many of these provisions have been extended year after year. One of the most prominent, the research and development tax credit, has been extended at least 15 times since 1981. (See our "Tax Break-Down" on the extenders for the history of many of the others.) If the 45 provisions extended by Wyden's draft are extended permanently, costs dramatically increase. This phenomenon is due to several provisions, mostly bonus depreciation, which cost money upfront but regain it after the provision expires. For instance, a two-year extension of bonus depreciation costs less than $3 billion, but a permanent extension costs about $300 billion over the next ten years. Bonus depreciation was enacted as temporary stimulus in response to the Great Recession and should not be treated as a normal tax extender, but it risks becoming one if it is extended again.

The table below lists some of the more costly provisions included and excluded from the extenders legislation, but some of the most heavily reported on tax breaks are not very large. The draft extends the special depreciation schedule for racehorses for two years, while it allows special provisions for film production and NASCAR tracks expire.

Major Extenders In and Out of the Finance Committee Draft

| Policy | 2014-2024 Cost of a Two-Year Extension (Billions) |

| Business Provisions in the Draft |

|

| Credit for Research and Experimentation | $15 |

| Subpart F for Active Financing Income | $10 |

| Special Depreciation for Leased and Restaurant Equipment | $5 |

| Small Business Expensing | $3 |

| Bonus Depreciation | $3 |

| 22 Other Business Provisions | $10 |

| Subtotal, Business Provisions in the Draft |

$47 |

| Individual Provisions in the Draft | |

| Deduction for Sales Taxes | $6 |

| Tax Relief for Mortgage Debt Forgiveness | $5 |

| Tax-free Donations from IRAs | $2 |

| Five Other Individual Provisions | $3 |

| Subtotal, Individual Provisions in the Draft | $17 |

| Energy Provisions in the Draft |

|

| Tax Credits for Renewable Diesel Fuel | $3 |

| Incentives for Other Alternative Fuels | $1 |

| Credit for Energy Efficient Homes | $0.6 |

| Six Other Energy Provisions | $0.25 |

| Subtotal, Energy Provisions in the Draft | $4 |

| Total, All Provisions |

$67 |

| Provisions Allowed to Expire | |

| Renewable Energy Production Tax Credit | $13 |

| Payments Between Corporate Subsidiaries | $2 |

| Credit for Energy-Efficient Home Upgrades | $2 |

| Nine Other Expired Provisions | $2 |

| Total, provisions allowed to expire |

$19 |

Source: JCT. Numbers do not add to totals due to rounding.

The bill deserves credit for allowing some provisions to expire. Unfortunately, the Finance Committee is not offsetting the approximate $67 billion cost of the provisions it continues, so the price of the extenders package will add to the federal debt. The Senate Finance Committee's approach of charging these tax breaks to the nation's credit card is less responsible than the approach taken by Ways & Means Chairman Dave Camp and President Obama, who both pay for the tax provisions they choose to extend. Lawmakers should not add back provisions and further increase the bill's costs without proposing offsetting savings.

Further, this bill continues a disturbing trend of Congress repeatedly extending these provisions without paying for them. If Congress continues extending these provisions without offsets, they will cost almost $700 billion over the next decade (or almost $850 billion with interest).

The best approach to the tax extenders was taken by Chairman Camp: comprehensive tax reform which evaluates the merits of each provision. The next best option would be for Congress to at least pay for the extenders package and avoid making our current unsustainable fiscal situation even worse.