What Will Build Back Better Mean for Inflation?

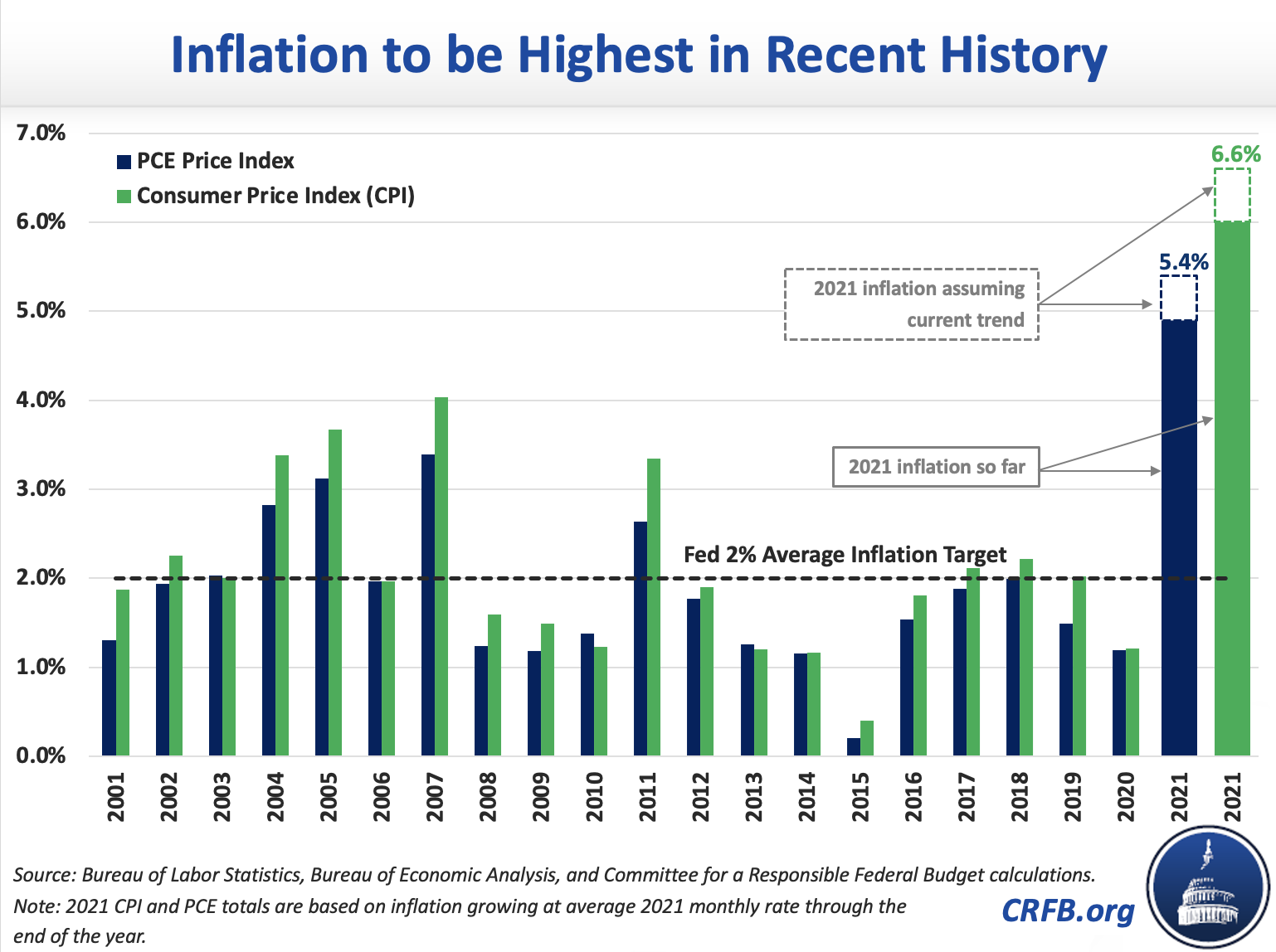

With inflation on track to reach its highest annual rate since 1990, experts and advocates are in disagreement over whether the Build Back Better Act will worsen inflation or help to quell it.

Overall, the legislation includes both inflationary and disinflationary elements, rendering the overall impact theoretically ambiguous. However, in our assessment, the very front-loaded and relatively progressive nature of Build Back Better means that it is more likely to be inflationary in the short term. This inflationary effect appears likely to be both small and temporary, but it carries undesirable risks of contributing to a possible inflationary spiral in a time of already high inflation. Fully paying for near-term costs up front and other improvements to the legislation could help to reduce these inflationary pressures and risks.

Build Back Better’s Effect on Inflation is Theoretically Ambiguous

There are both inflationary and inflation-moderating aspects of Build Back Better. Inflation generally occurs when demand far exceeds supply.

Policies that boost spending and demand for goods, services, or labor will tend to increase inflation while policies that temper demand, lower prices, or boost supply (through higher labor supply or labor productivity) will tend to reduce inflation. Some policies may also push up overall prices while lowering the prices paid directly by consumers – these policies will be economically inflationary but may reduce cost of living and some measures of inflation.

| Inflationary Effects | Inflation-Moderating Effects |

|---|---|

| Demand-boosting spending and tax cuts | Demand-tempering offsets |

| Price-boosting subsidies | Labor-boosting subsidies |

| Wage conditions and requirements | Productivity-enhancing investments |

On the inflationary side, Build Back Better includes over $200 billion of spending and tax cuts in the first nine months, over $1.5 trillion over the first five years, and $2.4 trillion over a decade (the longer the time horizon, the less relevant for inflation purposes). Much of this funding will directly or indirectly boost demand, including from the expanded Child Tax Credit; raising the cap on the state and local tax deduction; increased health care and long-term care funding; and a variety of other grants, transfers, and tax credits.

Some of this spending may also boost inflation in other ways. For example, prevailing wage and Buy America rules, along with union bonuses, will tend to boost wages for a given level of production. While this result is in many ways beneficial, it should also tend to put upward pressure on inflation. Some of the subsidies in Build Back Better – for child care, for example – could further boost prices.

On the other hand, many elements in Build Back Better could reduce inflation. Offsetting tax increases and spending reductions to pay for Build Back Better would tend to temper demand. Drug-pricing related offsets in particular are likely to lower public and private prescription drug costs and health premiums.

Build Back Better may further reduce inflation by lifting supply to meet demand. Policies to support pre-K, child care, and long-term care, for example, may help parents and caretakers to remain in or re-enter the workforce; support for housing construction may reduce rental prices; and investments or support for infrastructure, research, and other capital may boost labor productivity. However, many of these potentially inflation-moderating aspects of Build Back Better are generally longer term polices that are unlikely to have much short-term effect on supply.

Build Back Better is Likely Mildly Inflationary

Despite pressures in both directions, it is our assessment that on net the Build Back Better Act is likely to modestly boost near-term inflation relative to what it would otherwise be.

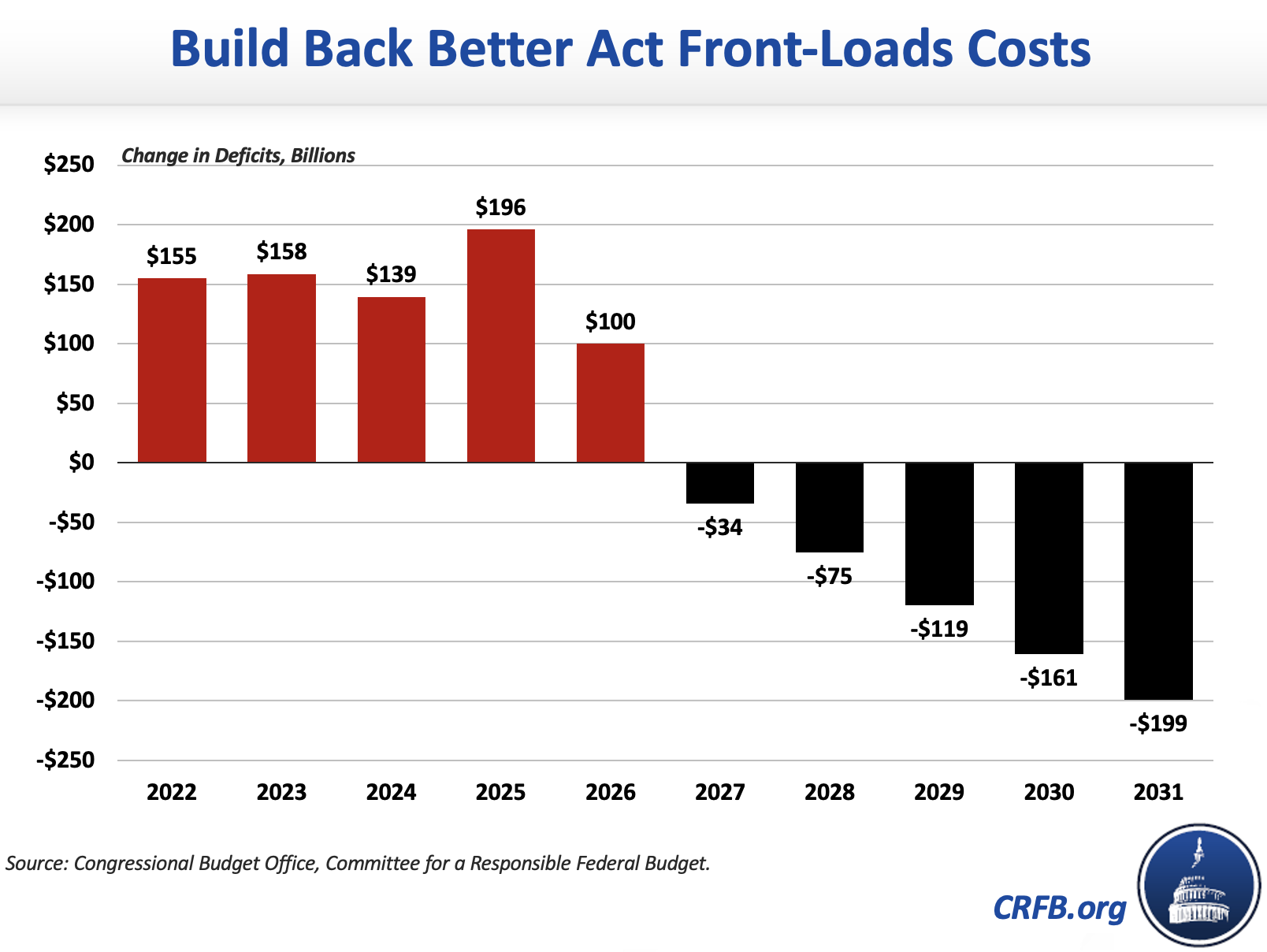

The key reason for this inflationary effect is that the bill does little to offset new spending and tax cuts in the early years. As written (without extensions), Build Back Better adds $155 billion to the deficit in the first nine months and $750 billion over the first five years, adding inflationary pressure into the demand side of the economy. Extensions would increase those pressures further, though the effect will likely be small since their effects are backloaded and monetary policy is likely to play an increasingly central role in determining inflation as time goes on.

In addition, the offsets themselves are generally unlikely to substantially temper demand and reduce inflationary pressures. For the most part, Build Back Better is paid for with taxes on corporations and households making over $10 million per year — these households are unlikely to respond to higher taxes by substantially reducing their spending.

While Build Back Better will likely boost inflation on net, inflationary pressures will be relatively modest in size in the most likely scenario. The $155 billion net cost in the first nine months is 0.8 percent of Gross Domestic Product (GDP), an order of magnitude smaller than the roughly $2 trillion (11.7 percent of GDP) of COVID relief distributed in the first nine months of 2021. It would also take place in the context of a deficit that would still fall from $2.8 trillion in fiscal year 2021 to (a still very high) $1.3 trillion in 2022 with passage of Build Back Better.

In addition, the Federal Reserve can and likely will act to reduce or offset inflationary pressures. If overall inflation remains elevated, the Federal Reserve can speed up tapering of their asset purchases or raise interest rates faster or higher. This tightening can counteract some or more of the inflationary effects of Build Back Better, though likely on a lag.

As discussed earlier, Build Back Better includes inflation-moderating features that will also partially offset the inflation-boosting elements.

Importantly, the view that Build Back Better will moderately increase inflation is widely shared by economists and forecasters alike. This includes economists at Bank of America, JP Morgan Chase, Penn Wharton Budget Model, and elsewhere. Moody’s Analytics recently estimated that the infrastructure bill and Build Back Better legislation combined would add 30 basis points to CPI inflation in 2022, 40 basis points in 2023, and 10 basis points in 2024.

Adding to Inflation is Risky

While the inflationary effects of Build Back Better are likely to be small and temporary, there are risks that they will be larger or could contribute to a de-anchoring of inflation expectations considering current inflationary trends.

This year, Consumer Price Index (CPI) inflation is likely to be between 6.0 and 6.6 percent, while the Personal Consumption Expenditure (PCE) price index is likely to grow by 4.9 to 5.4 percent. These inflation rates are extremely high, whether compared to their historic average (1.7 and 1.5 percent over the past decade, respectively), the Federal Reserve’s average inflation target (2 percent for PCE), forecasts made earlier in the year, or international comparison.

Today’s high rates of inflation may disappear quickly, or they may persist for several years as higher wages beget higher prices and rising inflation expectations lead to higher actual inflation.

While the inflationary effects of Build Back Better are likely to be small, there is a risk they feed into existing inflationary pressures, raising inflation expectations, and contributing to “de-anchoring” them from the Federal Reserve’s 2 percent average inflation target.

The Federal Reserve could step in to prevent such a spiral by aggressively ratcheting up interest rates, but that carries risks as well. A rapid increase in interest rates could slow the economic recovery, crowd out private investment, and increase the costs of borrowing for both the private sector and federal government. To the extent higher rates flow through to federal bonds, each ten-basis-point boost in interest rates would add more than $200 billion to the deficit over a decade.

* * *

Overall, Build Back Better includes elements that will boost inflation and elements that will contain inflation. On net, we and other experts believe the most likely effect will be a small and temporary increase in inflation.

However, there is a risk the modest inflationary effect of Build Back Better would build on existing inflationary pressures, potentially de-anchoring expectations and increasing the economic cost of bringing inflation back under control.

It would be unwise for policymakers to take these risks at a time when inflation is so high already. Policymakers could reduce these risks by modifying the Build Back Better Act with an eye on its inflationary impact, especially by ensuring it is fully paid for in the short and medium terms.

We have put forward several options for lawmakers to reduce the Build Back Better Act's inflation risk.

Read more options and analyses on our Reconciliation Resources page.

Note (12/9/2021): This piece has been updated to reflect a subsequent analysis of how to reduce the Build Back Better Act's inflation risk.