VA Cap Adjustment Could Cost Over $55 Billion

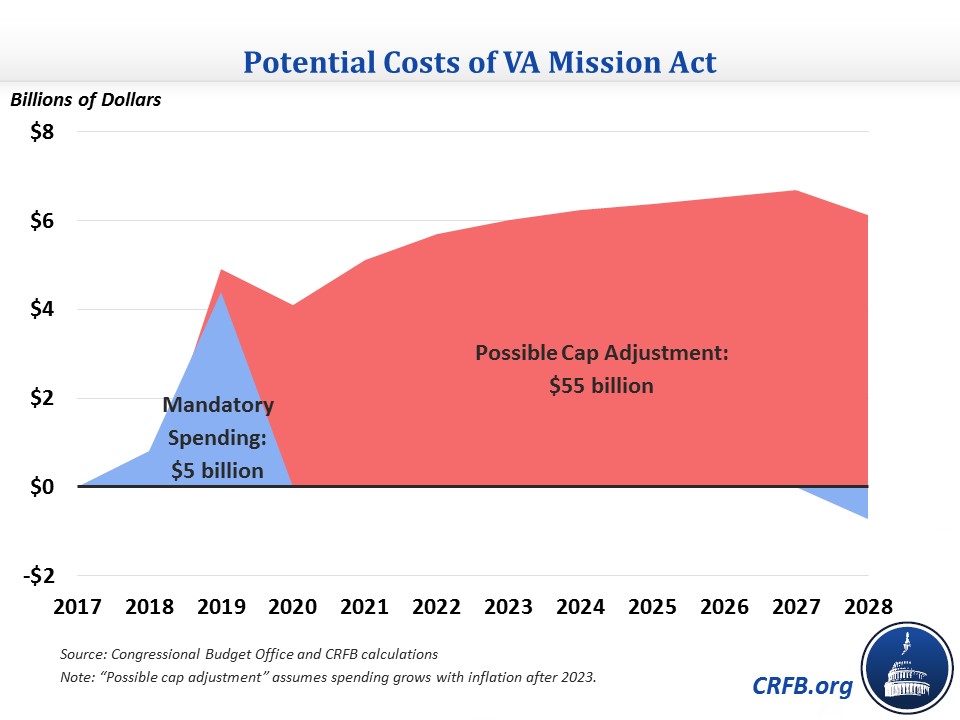

The VA MISSION Act that passed both Houses of Congress last month may get a whole lot more expensive. As part of the Veterans Affairs (VA) appropriations bill, some policymakers have proposed increases in current and future discretionary spending caps to allow deficit-financed spending on veterans' health care. We estimate this cap adjustment would cost $55 billion or more over the next decade.

The VA MISSION Act as passed by Congress would temporarily extend the Veterans Choice Program and then permanently replace it with a new Veterans Community Care Program (VCCP). While policymakers did not follow our advice to fully offset the $5 billion of mandatory Veterans Choice funding, they proposed the new VCCP as discretionary funding that would be appropriated under the current caps. That means under current law, any increased spending for VCCP would need to come out of other discretionary spending – at least until caps expired in 2021. This proposed cap adjustment would change that.

Official cost estimates find the VCCP will cost almost $5 billion in 2020 and grow from there. If this money came from increasing discretionary spending levels rather than reprioritizing spending, it could mean $60 billion of new spending (including the initial $5 billion from the Choice Program) over the next decade.* If other parts of the VA MISSION Act were also effectively exempt from the caps, that cost could rise to well over $100 billion.

With trillion-dollar deficits just around the corner, adding tens of billions more to the deficit is simply unacceptable.

Rather than allowing appropriators to bust the budget caps to pay for a new spending program, policymakers should fully offset the cost of any new spending.

Offsets for increased appropriations should come from within the discretionary budget as the original legislation intended. That shouldn't be a problem at all in 2019, given recent large cap increases; if caps in 2020 and beyond are loo low, they could be increased as part of a fiscally responsible budget deal to extend discretionary caps and pay for any sequester relief. Alternatively, if lawmakers choose to provide a cap adjustment for veterans' health, they should fully offset the actual and hypothetical future cost of such adjustments with mandatory savings or revenue. Lawmakers could also fund the program through a mix of discretionary, mandatory, and revenue offsets.

Recently, we presented a number of illustrative offset options within the veterans and military space, though offsets could come from anywhere.

Potential VA Funding Offsets

| Provision | Ten-Year Savings |

|---|---|

| Discretionary Spending Options | |

| Make working-age military retirees ineligible for TRICARE Prime | $60 billion |

| End VA health system enrollment for higher-income groups with conditions less related to military duty | $28 billion |

| Cap basic pay raises for military service members at the growth of the Employment Cost Index minus 0.5% | $25 billion |

| Increase TRICARE enrollment fees and cost sharing for working-age military retirees | $16 billion |

| Replace some military personnel with civilian employees | $15 billion |

| Reduce annual adjustment for military retirees under age 62 | $10 billion |

| Mandatory Spending Options | |

| Eliminate concurrent receipt of retirement pay and disability compensation for disabled veterans | $139 billion |

| Introduce minimum out-of-pocket requirements under TRICARE for Life | $27 billion |

| Exclude disabilities unrelated to military duty for veterans' disability compensation eligibility | $256 billion |

| Restrict VA's individual unemployability benefits to disabled veterans below the Social Security age | $40 billion |

| Institute a time limit for disability benefit applications after leaving active duty | $10-30 billion |

| Use highest five instead of highest three earning years to determine federal pensions and eliminate supplement | $5 billion^ |

| Reduce VA housing allowances to DoD levels | $3 billion |

| Reinstate round-down of VA cost-of-living adjustments | $2 billion |

| Adjust threshold for certain VA medical evaluations and simplify compensation net-worth calculations | $1 billion |

| Modify rules for education benefits transferred to dependents under Post-9/11 GI bill | $1 billion |

| Cap Post–9/11 GI Bill benefits for flight training | $1 billion |

| Revenue Options | |

| Eliminate exclusion of veterans' disability payments | $94 billion |

| Eliminate exclusion for armed forces benefits | $70 billion |

| Eliminate exclusion for GI Bill benefits | ~$20 billion |

| Eliminate exclusion for combat pay | $15 billion |

| Eliminate exclusion for military disability pensions | $2 billion |

Sources: CBO, JCT, OMB, and CRFB calculations.

Note: Discretionary spending options can only be used to offset other discretionary spending unless spending caps are also lowered.

^Includes savings from both civilian and military retirement. Savings from just military retirement are $2 billion.

Failing to offset costs all together would only exacerbate the effects of recent debt-financed tax cuts and discretionary spending increases. We cannot afford to keep adding new "priorities" the national credit card.

*Technically, budget caps are only in effect through 2021 and so actual cost is unknown from 2022 through 2028. However, the size and allocation of the discretionary budget in 2021 is likely to have significant influence on 2022 and beyond. Our estimates assume total discretionary spending is allowed to grow with inflation, as under CBO's baseline.