Updated Budget Projections Show Record Debt by 2031

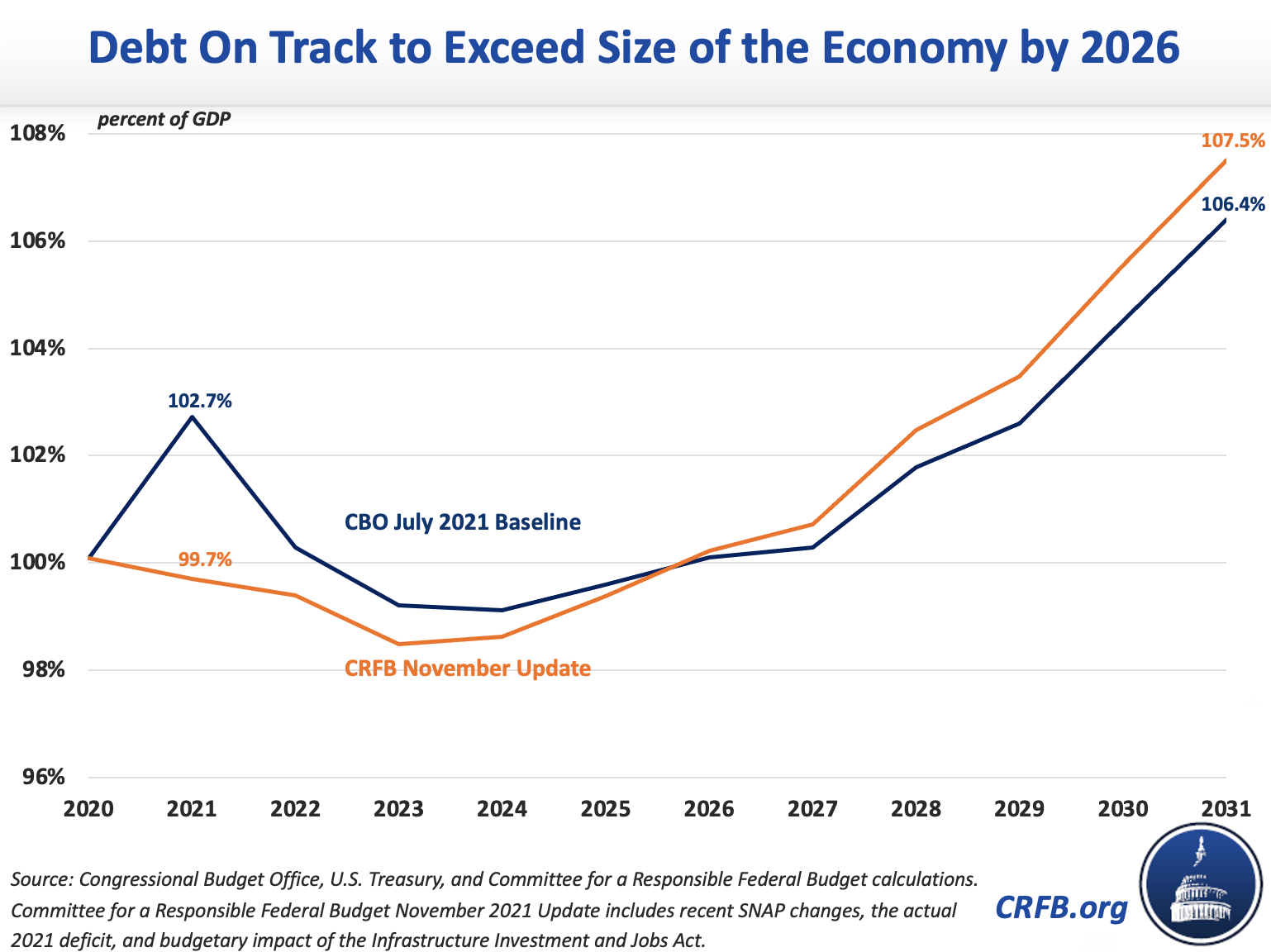

New estimates from the Committee for a Responsible Federal Budget project that debt as a percentage of Gross Domestic Product (GDP) is on track to reach a record 107.5 percent by 2031, about a percentage point higher than in the Congressional Budget Office's (CBO) July baseline. This is due to a combination of the just-signed Infrastructure Investment and Jobs Act (IIJA), recent changes to Supplemental Nutrition Assistance Program (SNAP) benefits, and a lower-than-expected deficit in fiscal year 2021.

CBO's July baseline projected debt held by the public would total 100.3 percent of GDP this year, remain relatively stable through 2027, then resume an upward trajectory, ultimately reaching 106.4 percent of GDP by 2031. Incorporating the recent changes into our baseline, we now project debt will total 99.4 percent of GDP this year, stabilize through 2025, and begin to rise through the end of the decade, reaching 107.5 percent of GDP by 2031. The previous record of 106.1 percent of GDP was set in 1946, just after World War II; over the past 50 years, debt has averaged 46 percent of GDP.

In nominal dollars, CBO projected that debt would grow by $12.8 trillion, from $23.0 trillion at the end of 2021 to $35.8 trillion by the end of 2031. We now project debt will increase by $13.9 trillion over that same period, rising to $36.2 trillion by the end of 2031.

Overall, we now estimate debt will be around $380 billion and 1.1 percent of GDP higher in 2031 than CBO previously projected. Driving this increase is a $185 billion change to the calculation of food stamp (SNAP) benefits and $400 billion of borrowing as a result of the recently-signed bipartisan infrastructure bill. Pushing in the opposite direction, the FY2021 budget deficit was around $230 billion lower than CBO projected, largely due to higher incomes and stronger revenue collection. Higher overall budget deficits will add $25 billion, on net, to debt service costs.

Debt Bridge in 2031: CBO July Estimate to November CRFB Estimate

| Dollars | Percent of GDP | |

|---|---|---|

| Debt held by the public 2031 (July CBO Estimate) | $35,827 billion | 106.4% |

| Lower-Than-Projected FY 2021 Deficit | -$230 billion | -0.7% |

| SNAP Thrifty Food Plan Changes | +$185 billion | +0.5% |

| Infrastructure Investment and Jobs Act | +$400 billion | +1.2% |

| Debt Service | +$25 billion | +0.1% |

| Debt held by the public 2031 (November CRFB Estimate) | $36,203 billion | 107.5% |

Numbers may not sum due to rounding.

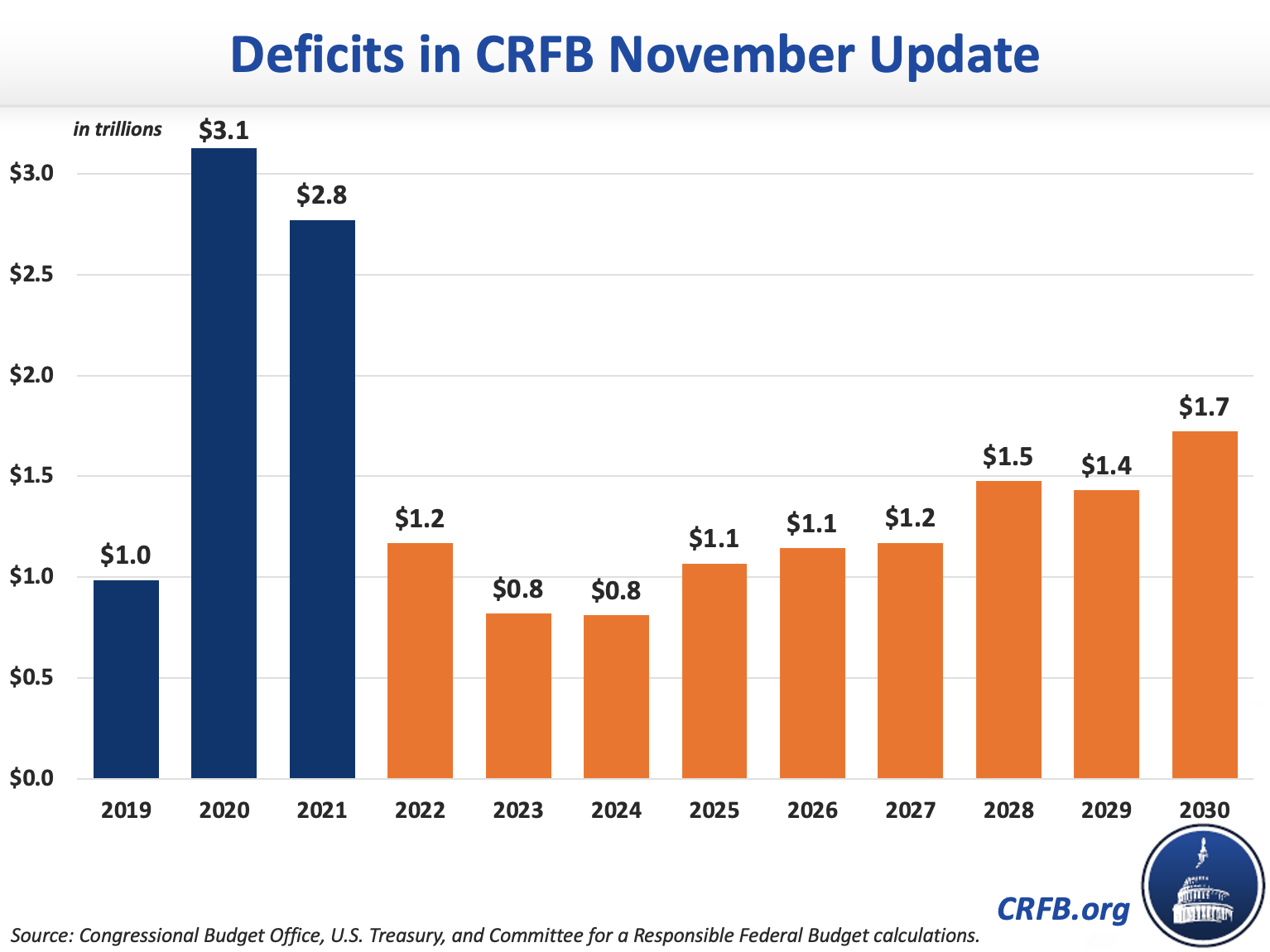

With the enactment of the infrastructure bill, we project deficits will total $12.7 trillion over the 2022-2031 budget window, a $600 billion increase over CBO's prior estimate of $12.1 trillion. Measured as a share of the economy, the deficit will total 4.8 percent of GDP this year and average 4.4 percent over the coming decade. The deficit was previously expected to total 4.7 percent of GDP in FY 2022 and average 4.1 percent over the 2022-2031 period. The FY 2021 deficit was $2.8 trillion, down from the $3.0 trillion estimated by the CBO in July and around $360 billion lower than last year’s record-breaking $3.1 trillion deficit.

Importantly, our new baseline does not incorporate potential changes to the economic outlook, nor increases to Social Security and other payments stemming from higher-than-projected inflation this year. Nor do our estimates incorporate any effects of the Build Back Better reconciliation package, which has not passed either House of Congress. We estimate the House version of the Build Back Better Act will add roughly $800 billion to deficits over the next five years and reduce deficits by $600 billion in the following five years. With unpaid-for extensions, it would add over $3 trillion to the debt, driving debt to 117 percent of GDP by the end of the decade.

With the national debt headed toward record levels by the end of the decade, it is important that new priorities, including those in the Build Back Better reconciliation package, be fully paid for.