Understanding the $1 Trillion in Unspent COVID Relief Funding

The Senate-passed American Rescue Plan will deliver nearly $2 trillion of additional COVID relief on top of the $4 trillion already authorized. Yet, of that $4 trillion already authorized, only about three-quarters has actually been spent up to this point, according to our COVID Money Tracker. This has led some to question why there is still $1 trillion unspent.

The answer is complicated and requires proper context. For the most part, the unspent funds are either meant to be spent out over time or were authorized under the Response and Relief Act, which was enacted just 10 weeks ago. Some of the money has not been spent due to slow or low demand.

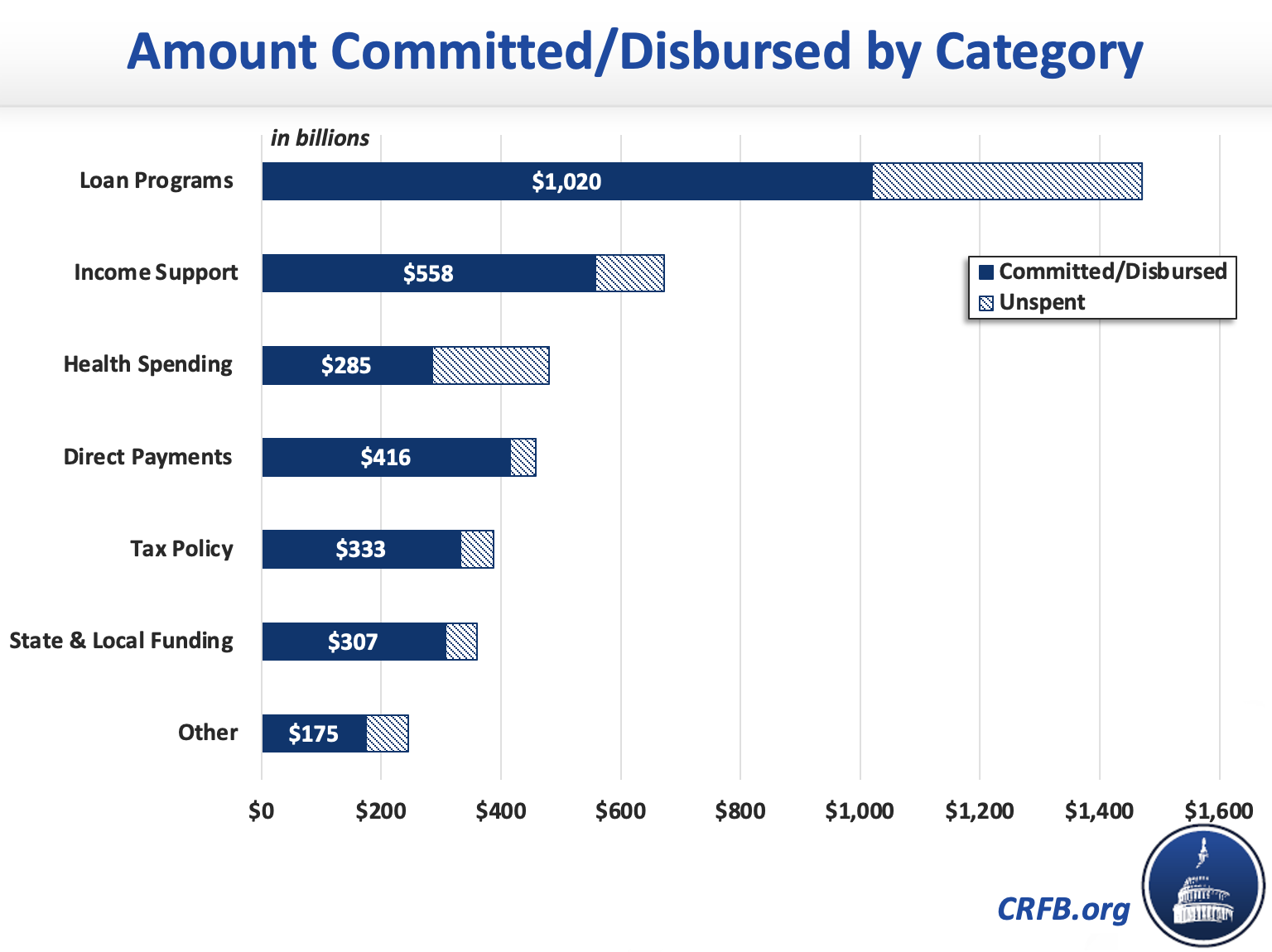

As of March 8, our COVID Money Tracker identified about $3.1 trillion of COVID relief funds that have been committed or disbursed, out of $4.1 trillion in gross support.1 This disbursal is much higher than the $2.7 trillion we detailed in late January, but still leaves a $1 trillion gap.

Four main reasons largely explain the gap.

First, about 40 percent of the money — around $390 billion — is from the Response and Relief Act enacted just 10 weeks ago. While our data shows that almost 60 percent ($550 billion) of that bill has been disbursed, a substantial share of it — especially from the Paycheck Protection Program (PPP), unemployment benefits, and rebates — is still being disbursed and will take time to do so.

Another third of the unspent funds — $340 billion — represents money authorized in prior bills but not yet allocated or committed. Much if this is due to slow and low demand for Economic Injury Disaster Loans (EIDLs).

Another fifth — $185 billion — is from pre-December provisions that are meant to pay out over time, including Medicaid spending, other health care related provisions, and certain tax policies.

The remaining $70 billion (7 percent) can be explained by policies where there is little or no data available and may or may not be committed or disbursed.

Six provisions that are either open for applications or designed to be paid out over time account for 70 percent of the $1 trillion in unspent COVID relief:

- Economic Injury Disaster Loans (EIDL) ($275 billion) – The Paycheck Protection Program & Health Care Enhancement Act authorized roughly $475 billion of Small Business Administration EIDL loans at a net cost of $50 billion. Perhaps because of the availability of PPP forgivable loans (these are much more attractive since they are effectively grants), demand for EIDLs has been relatively slow. Only $200 billion of loans (at a net cost of $27 billion) have been issued so far. According to the Census Small Business Pulse Survey, just 6.7 percent of small businesses have received an EIDL loan to date (compared to 32.3 percent that have received a PPP loan).

- Paycheck Protection Program ($128 billion) – The Response and Relief Act authorized $284 billion of new PPP forgivable loans, including second-draw loans for organizations that have already received one. As of the end of February, about $156 billion of PPP loans have been issued, and issuances are continuing at about a rate of $20 billion per week. The loan program ends on March 31, and it is not clear whether it will be fully subscribed.

- Higher Federal Medicaid Matching Percentages and Continuous Coverage Requirements ($104 billion) – The Families First Coronavirus Response Act authorized the federal government to pay an additional 6.2 percent of each state's Medicaid spending as long as the public health emergency continues and states offer "continuous coverage" for anyone enrolled in Medicaid as of March 18, 2020. CBO has estimated this combination will ultimately cost approximately $165 billion over the length of the public health emergency.

- Unemployment Benefits ($79 billion) – Multiple relief bills have authorized increased unemployment benefits, and the latest extension continues through March 13 for new applicants and early April for people currently on some pandemic-related programs. Spending will continue into April as payments are often made with a delay and as unemployed workers claim back pay from previous periods. The American Rescue Plan would extend these programs into early September.

- Tax Breaks ($55 billion) – Several bills have authorized tax breaks that must be claimed on tax returns. For instance, the new $300 above-the-line deduction for charitable donations is claimed on 2020 tax returns, which are due by April 15. Many business tax credits, such as for paid sick leave and retaining workers, are claimed on quarterly tax filings, which are also due on April 15 for the first quarter of 2021. Another tax break from the CARES Act allowing Health Savings Accounts to be used for over the counter medication was a permanent change, so the estimated $9 billion cost would pay out over the next decade.

- Recovery Rebates ($42 billion) – The CARES Act and Response and Relief Act each authorized a round of stimulus checks, at a combined cost of $458 billion. Payments totaling $416 billion have been sent out based on prior year tax returns, but taxpayers can claim additional amounts based on their 2020 tax returns when they file.

| Source of Difference | Unallocated/Unrecorded Funds | Deficit Impact of These Funds |

|---|---|---|

| Economic Injury Disaster Loans (EIDLs) | $275 billion (out of $475 billion) |

$23 billion (out of $50 billion) |

| Paycheck Projection Program (PPP) | $128 billion (out of $828 billion) |

~$118 billion (out of $805 billion) |

| Higher Federal Medicaid Matching Percentages and Continuous Coverage Requirements | $104 billion (out of $165 billion) |

$104 billion (out of $165 billion) |

| Unemployment Benefits | $79 billion (out of $557 billion) |

$79 billion (out of $557 billion) |

| Tax Breaks | $55 billion (out of $388 billion) |

$55 billion (out of $241 billion) |

| Recovery Rebates | $42 billion (out of $458 billion) |

$42 billion (out of $458 billion) |

| Subtotal | $685 billion | $430 billion |

| Other Spending from Response and Relief Act | ~$185 billion | ~$185 billion |

| Other Spending from previous legislation | ~$115 billion | ~$115 billion |

| Total | ~$1 trillion | ~$730 billion |

There are other programs with smaller allocations in the Response and Relief Act which have not yet been spent. Targeted EIDL Advance grants ($20 billion) and grants to live entertainment venues ($15 billion) have not yet started, while other nutrition, community lending, and health spending has limited data available. Of the $115 billion in unspent COVID relief outside the December relief bill other than those mentioned above, nearly all can be attributed to data that is either publicly unavailable or has a long lag time.

Another way to look at the unspent funds is by support category. The vast majority of direct payments (recovery rebates) and 2020 tax breaks have been disbursed or committed, along with most income support spending, namely on federal unemployment benefits. More will be claimed as people file their 2020 tax returns and are paid expanded unemployment benefits into April. A smaller share of health care and loan program spending is out the door. It seems likely that the EIDL program will not reach its maximum allowed amount, so the "unspent" portion may remain relatively large. However, it is likely that the PPP funds will be exhausted, or close to fully utilized. Health care spending is primarily driven by spending over the course of the public health emergency, and recent health care funding enacted under the Response and Relief Act will likely be spent as the vaccine rollout and COVID response continues across the country.

With time, most of these funds will ultimately spent — some relatively soon. However, some money may never be spent. Not every dollar initially allocated may ultimately be needed.2

As funds continue to be distributed and data is updated, we will continue to track all of the federal COVID relief response at www.COVIDMoneyTracker.org.

1 Our $4.1 trillion estimate is about $100 billion higher than last month as a result of updated subsidy rate estimates for Economic Injury Disaster Loans (EIDLs). According to the Government Accountability Office, the EIDL subsidy rate changed from 13.62% in FY 2020 to 8.92% in FY 2021, which increased the amount of potential support provided with $50 billion in loan credit subsidy from our original estimate of $366 billion to around $475 billion.

2 In several cases, more than 100 percent of the ultimate revenue cost can be disbursed into the economy in the near-term. Several provisions, such as those affecting business losses and charitable deductions encourage taxpayers to claim benefits upfront at the expense of higher taxes in later years. In short, the proposals lower revenues in the short-term, but raise money in later years. Conversely, there are several tax provisions which were utilized much less than originally anticipated, so JCT’s original estimates vastly overstated the cost.