Trump Will Face Highest Debt-to-GDP Ratio of Any New President Since Truman

When President-elect Donald Trump takes the oath of office on January 20, 2017, debt as a share of the economy will be higher than at the start of any other presidency, save Truman’s.

By our estimates, the national debt will total about 77 percent of Gross Domestic Product (GDP) when Trump takes office, compared to 103 percent when Truman took office at the end of World War II, 58 percent when Eisenhower took office, and 46 percent when Clinton took office.

And not only would President-elect Trump begin with higher debt levels than any president other than Truman, but he also faces an unsustainably growing national debt which would rise far more rapidly if he followed through with his costly campaign proposals.

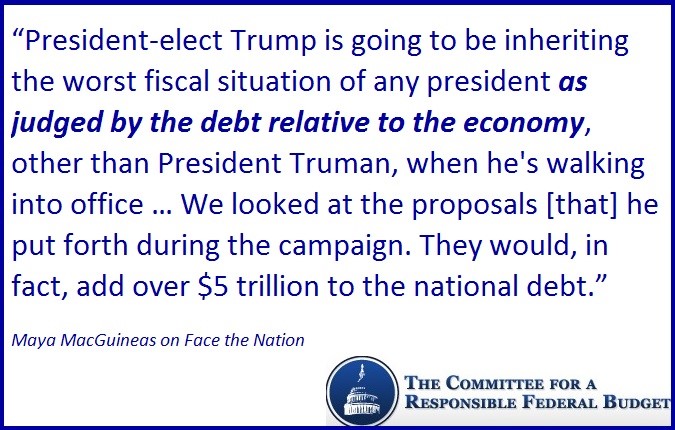

This weekend, CRFB President Maya MacGuineas made these points on CBS’s Face the Nation. Unfortunately, some misunderstood her comments to be referencing the economy, the annual budget deficit, or some other measure. Others took it as an indictment of the Obama presidency.

As we’ve explained before, rising debt in recent years is the result of existing structural deficits, a weak economy, and legislation passed by Congress and signed by President Obama – and certainly cannot be attributed simply to the president alone. We are not looking backwards to assign blame, but we are looking forward and ringing warning bells.

The economy is healthy in some areas, weak in others, and is doing much better than when President Obama inherited it. The deficit has come down from its recent high following the economic crisis, but it is now on the rise again. But MacGuineas’s comments focused on the national debt held by the public as a share of the economy – which is considered by the Congressional Budget Office (CBO), Office of Management and Budget (OMB), and others to be the most meaningful measure of the country’s current fiscal standing. As MacGuineas argued, the next president and Congress should respond to this peace-time record-high debt with thoughtful tax and spending reforms rather than massive unpaid-for tax cuts and increases in defense and infrastructure spending.

Debt is currently approaching 77 percent of GDP, the highest it has been since the aftermath of World War II. Even under current law, it will rise to nearly 86 percent of GDP within a decade and exceed the size of the economy within two decades. Under Trump’s campaign proposals, debt would exceed the size of the economy before the end of a theoretical second term and approach 150 percent of GDP after two decades.

These are troubling trends that should be reversed soon.