Three Scenarios for Projecting Debt

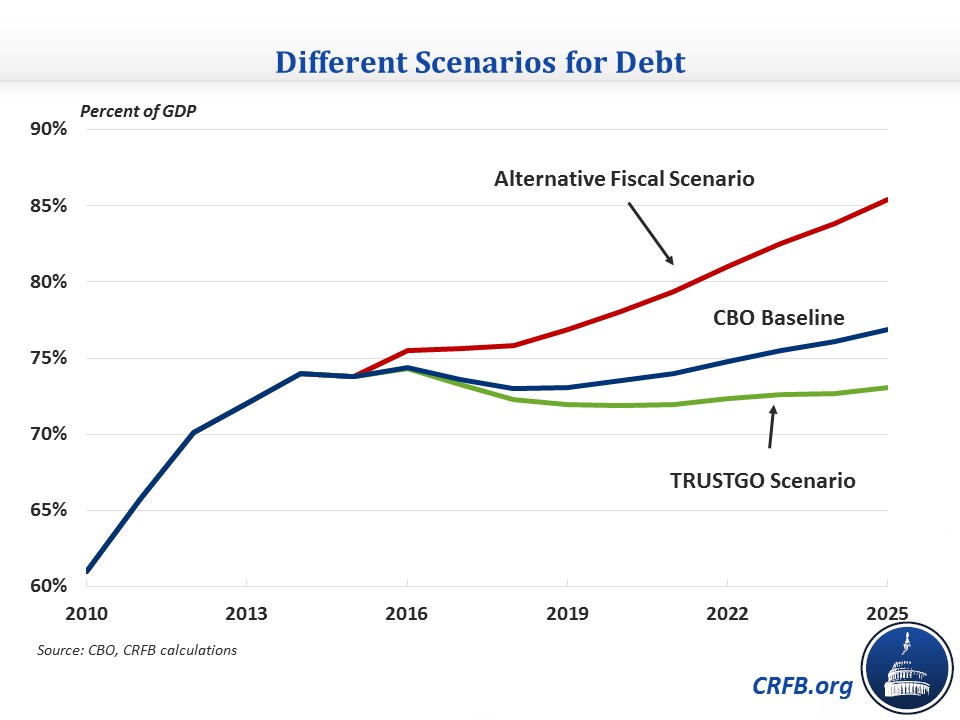

Our recent analysis of the Congressional Budget Office's (CBO) August baseline focused on CBO's official current law baseline projections, which show debt declining very slightly in the near term from 74 percent of Gross Domestic Product (GDP) this year to 73 percent by 2018 and then rising to 77 percent by 2025. As it turns out, however, the situation could be notably better or notably worse depending on how policymakers handle a few outstanding matters – many a part of the gathering fiscal storm Congress will face this fall.

If lawmakers ignore fiscal responsibility as they have been recently, debt will rise much more rapidly. In our paper we estimated an Alternative Fiscal Scenario (AFS) based on past assumptions CBO has used. The AFS extends expired and expiring tax provisions and permanently repeals the sequester-level discretionary spending caps. And under the AFS, debt will rise continuously every year from about 74 percent of GDP today to 78 percent by 2020 and 85 percent by 2025. Earlier this year, CBO estimated that this level of debt growth could shrink the economy by as much as 7 percent by 2040 compared to the baseline.

On the other hand, responsible actions and a relatively strict adherence to actual current law (read more here) could put the debt on a much more favorable path. To represent this scenario we constructed a "TRUSTGO Scenario" which assumes lawmakers abide by Pay-As-You-Go (PAYGO) rules on an annual basis, draw down spending on overseas wars, and keep all trust funds solvent by ensuring no spending in excess of available trust fund resources. Within the 10-year window, that means assuming lawmakers will close the $150 billion shortfall facing the Highway Trust Fund and a shortfall roughly twice as large facing the Social Security Disability Insurance Trust Fund.

Under this "TRUSTGO Scenario," debt would fall from about 74 percent of GDP today to 72 percent by 2020 and then rise slightly to 73 percent by 2025. Over the long run, strictly abiding by TRUSTGO by making Social Security and Medicare solvent might even reduce debt levels over time.

Of course, acting to make trust funds solvent is no easy feat, and lawmakers haven't shown the willingness to do that on a lasting basis. It requires tough choices about revenue and spending that are politically difficult. But it is key to improving the budget outlook. Similarly, it is vital that Congress fully offset the cost of any sequester relief, tax extender continuation, or any other tax cut or spending increase it chooses to enact.

These scenarios show that outside of CBO's official numbers, there are many ways that lawmakers could affect the budget picture. They should strive to do it in a way that makes the long-term debt path sustainable.