164 Ways to Reduce the Deficit

CRFB has released a new compendium of over 150 options to reduce mandatory spending and raise revenue. Despite declining in deficits in recent years, the debt is still projected to rise substantially over the long term. In addition, a series of upcoming Fiscal Speed Bumps will force lawmakers to make decisions about spending and revenue that could require large amounts of offsets, or potentially add almost $2 trillion to the debt.

Click here to see the full list of options.

Our list of options is meant to assist in finding fiscally responsible Speed Bump solutions, achieve some of the unspecified savings in the budget resolution, and help make the country's fiscal situation sustainable.

This paper updates and expands a health care and revenue options report released during the fiscal cliff discussions in late 2012. The new list also focuses on revenue and health care but also includes options for other mandatory (non-health, non-Social Security) spending that may be useful in the months ahead.

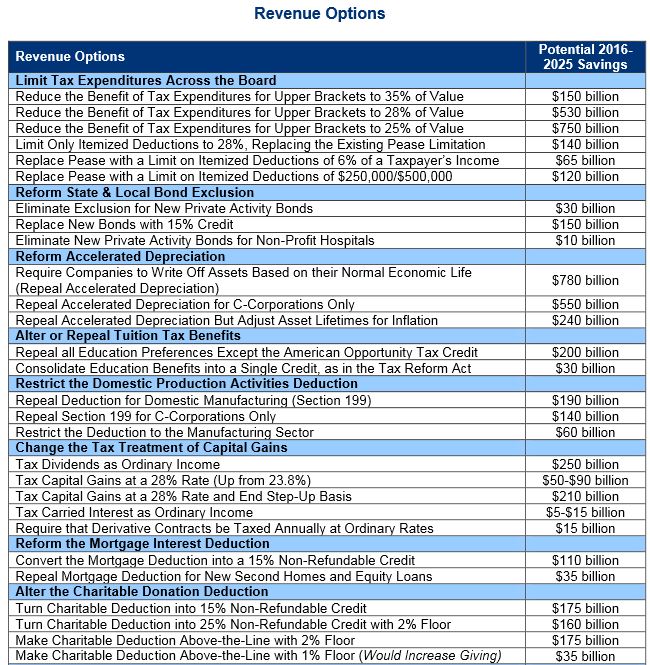

The revenue options include tax expenditure reductions and eliminations, income tax increases, excise tax increases (including gas tax options to fund the Highway Trust Fund), and various other options. The health care options focus on Medicare savings from providers and beneficiaries but also some Medicaid and system-wide reforms. The other mandatory options span many categories of the budget, including transportation, federal retirement, agriculture, education, and natural resources.

Some of the new options compared to the 2012 report include taxing capital gains at 28 percent and eliminating step-up basis, reforming accelerated depreciation, slowing the growth of post-acute care payments, increasing various user fees, and reducing higher education subsidies.

Overall, the compendium provides numerous possibilities – although definitely not the only possibilities – for deficit reduction that can be used to deal with upcoming Fiscal Speed Bumps or to go further and put debt on a downward path. Most importantly, it shows that lawmakers have no excuse for shrugging their shoulders when the need for offsets arises – there are so many options available.

Click here to see the full list of options.