Telling the Whole Story on Interest and Long-Term Debt

In a recent blog, New York Times columnist and economist Paul Krugman criticized Donald Trump's recent suggestion that he'll "negotiate forgiveness on U.S. debt." We too have questioned that idea. He also questioned why politicians are worrying about the debt in the first place. Unfortunately, Krugman completely misses the mark on this latter criticism by not showing the whole picture when it comes to interest spending and our nation's long-term debt challenges.

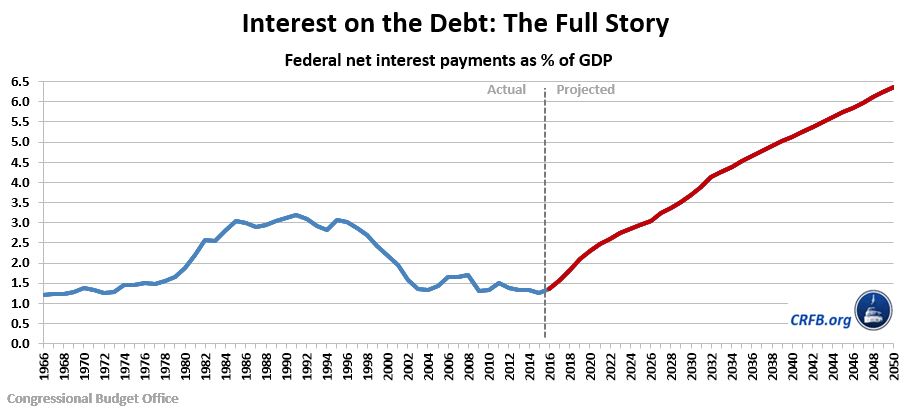

In his blog, Krugman uses data from the Congressional Budget Office (CBO) to show that federal net interest payments have declined in the last two decades. As he points out in a related column, "federal interest payments are only 1.3 percent of G.D.P." in 2015.

Yet Krugman's graph focuses only on today and fails to look at what is projected to happen tomorrow. When using CBO projections as well as historical data, it shows that interest rates are projected to grow significantly in the coming years. CBO projects interest payments to grow from 1.3 percent of Gross Domestic Product (GDP) last year to 3.0 percent by 2026 and 6.1 percent by 2050. In other words, interest payments will hit a post-war record-high by 2027 and nearly quintuple relative to GDP by 2050. These aren't the signs of a sustainable debt situation.

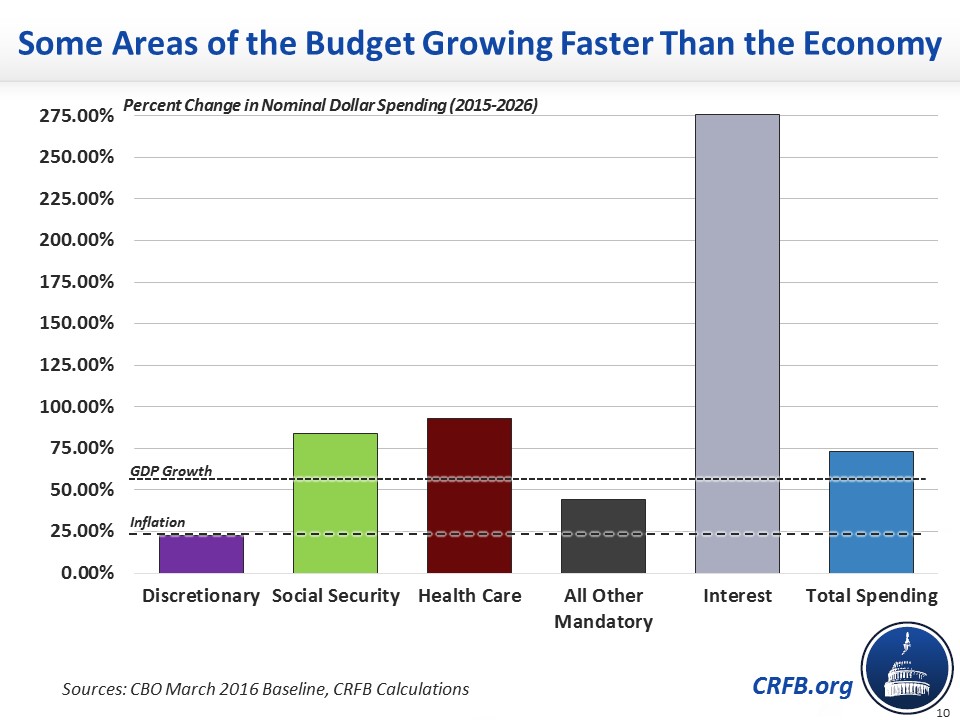

As we've explained before, interest on the debt is projected to be the fastest growing part of our budget over the next decade. Between 2015 and 2026, nominal interest costs will grow by about 275 percent. That's about 3 times as fast as health care spending and 4.5 times as fast as all other spending.

And as interest costs grow, they will crowd out other spending. While they only consumed one-fifteenth of revenue in 2015, they will consume one-sixth by 2026 and close to one-third by 2050.

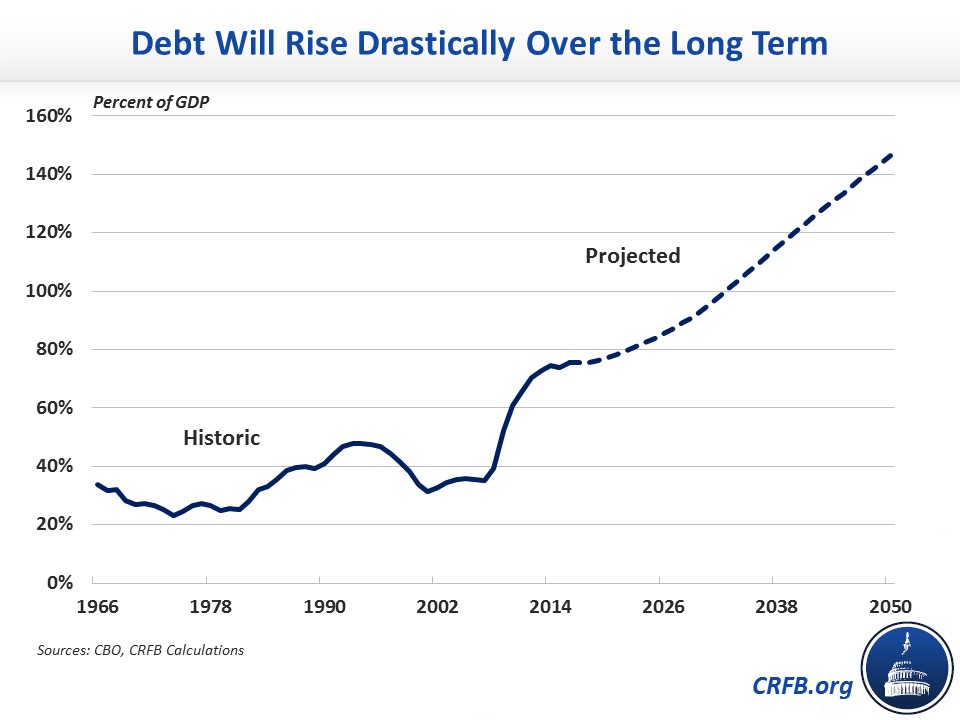

Importantly, these rising interest costs are largely the result of our high and growing federal debt. Under CBO's baseline, interest rates are projected to remain well-below historic levels (if interest rates rose, debt would rise significantly). Currently, debt held by the public totals about 75 percent of GDP – the highest at any point in U.S. history other than around World War II. And based on CBO's estimates, debt is projected to continue to grow, exceeding 100 percent of GDP by 2033 and 150 percent just after 2050.

As CBO has explained, "such high and rising debt relative to the size of the economy would dampen economic growth and thus reduce people’s incomes compared with what otherwise would be the case," and its continued growth "would ultimately be unsustainable."

While Krugman is right that interest costs are low now, he's not telling the whole story – that interest costs are on the rise as both debt and interest rates increase. Interest payments are headed to above historic levels. Experts from across the ideological spectrum agree that these rising debt and interest costs are unsustainable. Of course, we shouldn't solve our mounting debt by defaulting on our obligations. But we cannot afford to ignore the problem altogether.