The Tax Break-Down: Cafeteria Plans and Flexible Spending Accounts

This is the seventh post in a new CRFB blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Earlier this week, we profiled the tax-exemption for municipal bonds.

Since 1978, cafeteria plans have allowed workers to divert some of their pre-tax pay toward fringe benefits, thus reducing their tax burden. Some of the most common uses of cafeteria plans are to pay for the employee’s share of health care premiums, supplemental coverage like dental and vision, medical expenses through Flexible Spending Accounts and Health Savings Accounts (FSAs/HSAs), and dependent care costs like child care or day care.

In order to qualify for a cafeteria plan, the employer must offer employees a choice between different compensation packages, hence the “cafeteria” name. As long as employees have the option to take taxable cash instead of benefits, the options under the cafeteria plan can be paid with pre-tax dollars.

Cafeteria plans reduce an employee’s taxable income under both the income tax and payroll tax, in contrast to 401(k) plans which are only deductible for income tax purposes. As a result of the payroll tax deduction, those who contribute more to cafeteria plans both pay less taxes and ultimately receive lower Social Security benefits.

How Much Does It Cost?

According to the Joint Committee on Taxation (JCT), cafeteria plans will cost $32 billion in lost income tax revenue in 2013, or more than $450 billion over 10 years. Repealing the exclusion for cafeteria plans entirely would allow for nearly a 4 percent cut in rates (the top rate would fall from 39.6 percent to 38 percent), based on a similar estimate from the Tax Foundation.

The JCT only measures income tax expenditures; cafeteria plans cost an additional $150 to $200 billion over ten years in lost payroll tax revenues. Most of this would come from the Social Security payroll tax. Repealing cafeteria plans would close 9 percent of the program’s 75-year shortfall, according to our Social Security Reformer.

Who Does It Affect?

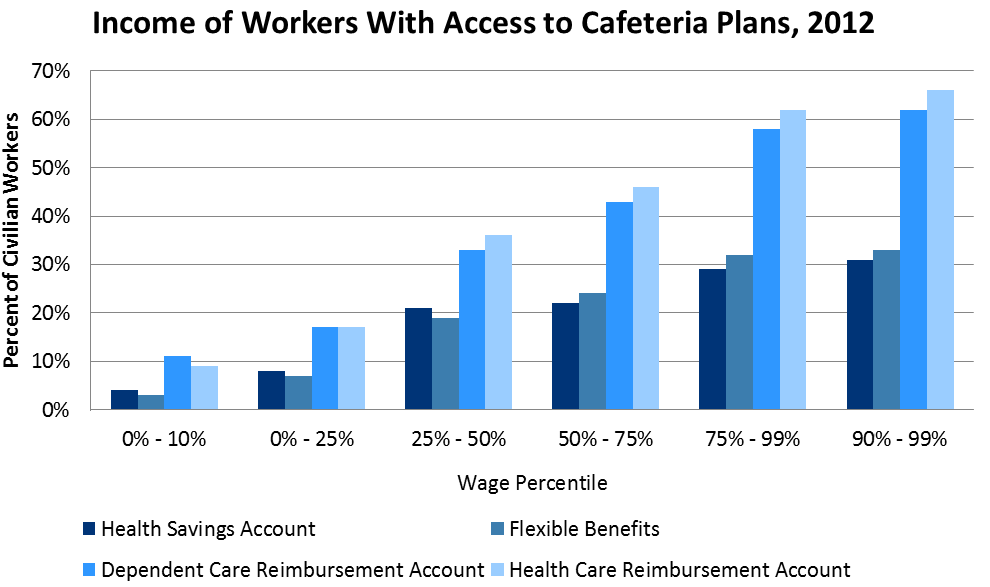

Cafeteria plans are much more likely to benefit high-income employees and those at large firms. Less than one-tenth of workers in the bottom 10 percent of the wage distribution have access to flexible benefits provided under cafeteria plans. By contrast, three-fifths of workers in the top quarter of the wage distribution have access to dependent or health care reimbursement accounts.

Source: Bureau of Labor Statistics, 2012

Large employers are much more likely to offer cafeteria plans, since they are better able to manage the complexity of offering plans and the administrative costs, which average $100 per year per employee. According to the Bureau of Labor Statistics, only 20 percent of employees working at firms with less than 100 employees offer health care or dependent care reimbursement accounts, compared with 70 percent of employees at firms with more than 500 employees.

In many discussions of the tax benefits for health, cafeteria plans are lumped with the exclusion for employer-provided health insurance; most statistics talk about the two together. The linkage is not unfounded: recent studies have shown that four-fifths of workers with an employer sponsored health plan also have access to a cafeteria plan. Because low-income jobs generally do not offer health insurance, and because income exclusions are more valuable to those with a higher tax rate, the benefits of cafeteria plans accrue mostly to the upper end of the income spectrum, though not disproportionately to the ultra-rich. Income distribution is likely similar to the health exclusion, where the top half of the income spectrum receives five-sixths of the benefit, and the top fifth receives nearly half. Because the exclusion comprises a larger percentage of income at the bottom, however, it provides a bigger boost in after-tax incomes to the bottom: 13 percent higher than for those in the middle of the income spectrum.

What are the Arguments For and Against Excluding Cafeteria Plans?

Opponents of cafeteria plans argue they provide an unnecessary vehicle for tax avoidance and offer a regressive benefit since those at higher income tax brackets get a larger effective subsidy. With regards to flexible spending accounts specifically, the “use it or lose it” nature has discouraged many people from signing up, and cost the average employee more than $100 per year in forfeited benefits in 2005. In addition, many argue that excluding cafeteria plans from the payroll tax hurts Social Security’s solvency by ignoring part of an employee’s compensation. Finally, there is a broader concern that offering health benefits with pre-tax dollars encourages individuals to purchase excessively generous health plans, thus driving up health costs.

Proponents of cafeteria plans and flexible spending accounts respond that treating cafeteria plans separately from equivalent preferences offered on the employer side – for example, the employer-provided health exclusion – would result in unequal and unfair tax treatment. Proponents also argue that cafeteria plans encourage employers to offer generous benefit packages and give employees control over their own health care dollars, while helping to strengthen the health care market in the United States. Changing the tax treatment of health care might create special challenges if done simultaneously with the implementation of the Affordable Care Act.

What Have Other Plans Done with Cafeteria Plans and What Are the Options for Reform?

The Wyden-Gregg tax reform bill, Domenici-Rivlin, and the American Enterprise Institute repealed the preference for cafeteria plans entirely. Unlike those three, the Fiscal Commission would have separated different elements of cafeteria plans. It eliminated non-health cafeteria plans immediately, along with most other tax expenditures. The income tax portion of cafeteria plans spent on health premiums was phased out over 25 years along with the employer-provided health exclusion.

The Center for American Progress didn’t touch cafeteria plans as part of their tax reform proposal, but did propose changes as part of their plan to improve Social Security solvency. Specifically, they would treat cafeteria plans like 401(k)s—exempt from income tax, but subject to the payroll tax and counted as wage income for the purpose of calculating Social Security benefits.

Although many tax reform plans completely repeal cafeteria plans, options exist to trim the exclusion short of repeal. For example, cafeteria plans could be repealed only for the payroll tax or just for the income tax. Cafeteria plans could also be trimmed by disallowing certain types of benefits: restricting the ability to pay for health premiums, health FSAs, or child care, for example; or by changes to the rules within any of those contribution categories.

This year and last year, Congress has also considered numerous options to expand the cafeteria plan exclusion, by repealing the annual $2,500 cap on flexible spending accounts or expanding health savings accounts, for instance.

The below table includes rough estimates for the amount of revenue raised by changing the tax treatment of cafeteria plans, based on other official revenue estimates.

| Revenue from Reform Options on Cafeteria Plans |

|||||

| Policy | Savings (2014-2023) |

||||

| Repeal entire tax exclusion for cafeteria plans | $600-650 billion | ||||

| Make cafeteria plans subject to the income tax, but still exempt from the payroll tax | $400-450 billion | ||||

| Make cafeteria plans subject to the payroll tax, but still exempt from the income tax | $150-200 billion | ||||

| Repeal Health FSAs only | $60 billion | ||||

| Eliminate tax-free benefits for employer-provided child care | $15 billion | ||||

| Allow unused portions of FSAs to be returned to the employee at the end of the year | - $10 billion | ||||

Where Can I Read More?

- Congressional Research Service – Health Care Flexible Spending Accounts

- Internal Revenue Service – Publication 15-B Employer’s Tax Guide to Fringe Benefits

- Employers Council on Flexible Compensation – Consumer Directed Benefit Accounts

- Joint Committee on Taxation - Present Law And Background On Federal Tax Provisions Relating To Retirement Savings Incentives, Health And Long-Term Care, And Estate And Gift Taxes

- Cato Institute – Overcoming Obstacles Facing the Uninsured: How the Use of Medical Savings Accounts, Flexible Spending Accounts, and Tax Credits Can Help

- Urban Institute – Timely Analysis of Immediate Health Policy Issues

- Jonathan Gruber – The Tax Exclusion for Employer-Sponsored Health Insurance

- National Conference of State Legislatures – State Use of “Cafeteria Plans” to Provide Health Insurance

- Joint Committee on Taxation – Present Law and Background Relating to the Tax Treatment Of The Cost Of Over-The-Counter Medicine As a Medical Expense

* * * * *

The tax break for cafeteria plans encourages employers to offer and employees to choose more generous benefit packages, by allowing their employees exclude those benefits from taxation. Most, but not all, of cafeteria plan dollars go towards health and in many cases drive up health care spending. Repealing cafeteria plans could help, along with other reforms, to reduce health care spending. On the other hand, repealing or reducing the provision in isolation may create new inequities with nearly identical exclusions offered directly to employers. Still, repealing or reducing this tax break as part of a broader package offers an opportunity to reduce economic distortions and raise revenue that can reduce rates or reduce the deficit.

Read other pieces in the Tax Break-Down here.