Senate Finance Subcommittee Holds Hearing on the Medicare Trust Fund

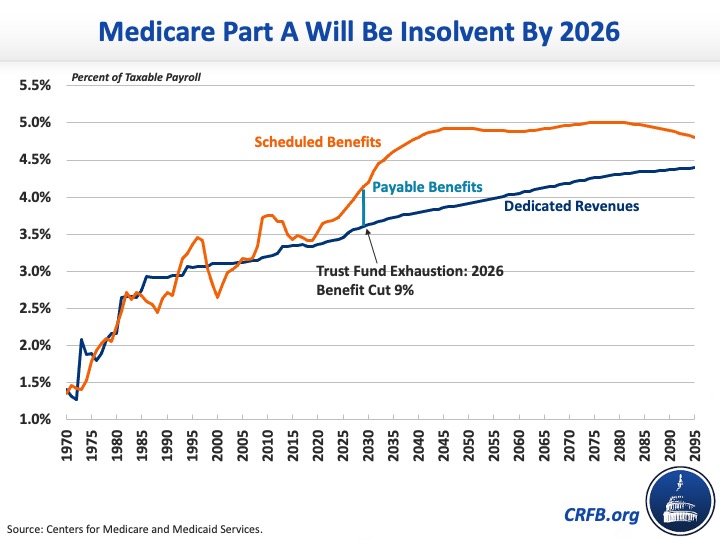

The Senate Finance Committee's Fiscal Responsibility and Economic Growth Subcommittee held a hearing on February 2, 2022, regarding the Medicare Hospital Insurance trust fund and the future of Medicare financing. The Medicare Hospital Insurance (HI) program, also known as Medicare Part A, is financed primarily with a 2.9 percent payroll tax. Since benefit payments exceed the amount of revenue coming into the trust fund each year, the Medicare Trustees currently project that the Medicare HI trust fund will become insolvent in 2026, at which point spending will fall by 9 percent. At the hearing, experts and senators discussed numerous options to restore solvency to the Medicare HI trust fund, including by raising revenue and reducing costs.

During the hearing, the subcommittee heard testimony from Medicare Payment Advisory Commission (MedPAC) chair Michael Chernew, Physicians for a National Health Program president Susan Rogers, Yale Law School professor Amy Kapczynski, University of Chicago professor Katherine Baicker, and American Enterprise Institute senior fellow James Capretta.

Chernew’s testimony highlighted recommendations put forward by MedPAC in recent years to stabilize Medicare’s finances. These recommendations include payment reforms to address specific overpaid providers, reforms to Medicare Advantage, and modifications to the Part D prescription drug benefit.

Rogers’s testimony mainly focused on existing issues in the Medicare Advantage program, along with the Direct Contracting pilot program to enroll Medicare beneficiaries into third-party Direct Contracting Entities without their knowledge or consent. The Direct Contracting Entities may keep up to 40 percent of the fees paid by Medicare as profit, compared to Medicare Advantage plans that are limited to 15 percent.

Kapczynski’s testimony focused on the issue of prescription drugs and laid out the methods by which drug companies extend their patents beyond their given 20-year period, in addition to the consolidation of the drug industry.

Baicker’s testimony discussed how to protect the value of care in the Medicare program through new payment models. She also discussed modifying cost-sharing so that patients face lower copayments for higher-value care and higher copayments for lower-value care, to nudge patients towards making the best choices. Additionally, she advocated for more competition within the Medicare program.

Lastly, Capretta’s testimony included other measures to decrease Medicare spending. He suggested creating a simplified choice structure for enrollees, enacting choice competition, and consolidating Medicare Part A and B into a single cost-sharing structure, which would include the consolidation of the HI and Supplemental Medicare Insurance trust funds. He also discussed our analysis of the President’s proposal to transfer revenues raised by the Net Investment Income Tax to the HI trust fund. Capretta stated that he believed this proposal is problematic because it doesn’t generate additional revenue, but rather takes money out of general revenues and redirects it towards the trust fund.

The table below includes some of the options put forward in the written testimony of the witnesses. These represent just some options – we’ve discussed numerous other trust fund solutions and ways to lower overall health care costs.

| Policy | Savings |

|---|---|

| Pause Skilled Nursing Facility Payment Increase (Chernew) | $10 billion over 5 years |

| Pause Inpatient Rehabilitation Payment Increase (Chernew) | $5-10 billion over 5 years |

| Account for Fee-For-Service and Medicare Advantage Coding Differences (Chernew) | Up to $12 billion in 2020 |

| Replace Quality Bonus Program (Chernew) | $10 billion over 5 years |

| Establish Benchmarks to Share in Efficiencies (Chernew) | $10 billion over 5 years |

| Reform Medicare Part D (Chernew) | $10 billion over 5 years |

| Determine Cost-Sharing by Income and Care Value (Baicker) | Not Specified |

| Enact Competition in Medicare (Baicker) | Not Specified |

| Consolidate Medicare Parts A and B (Capretta) | Not Specified |

| Simplify Choice Structure through Single Portal (Capretta) | Not Specified |

| Enact Premium Competition (Capretta) | 8% of Medicare Cost (2017) |

| Consolidate the Medicare Trust Funds (Capretta) | Not Specified |

On February 17, 2022, the Committee for a Responsible Federal Budget is hosting an event on Trust Fund Solutions where options to stabilize the Medicare trust fund, in addition to the Social Security and Highway trust funds. Some in Congress are beginning to gain a sense of urgency as the Medicare trust fund approaches its 2026 insolvency date, and lawmakers will need to act quickly to prevent insolvency.