Senate Finance Committee Hearing Highlights Need to Secure Highway Trust Fund

The Senate Finance Committee held a hearing last month titled “Funding and Financing Options to Bolster American Infrastructure,” covering the need to sustainably fund our infrastructure, the consequences of the impending insolvency of the Highway Trust Fund (HTF), and ways to finance new investments. The hearing included testimony from Joseph Kile, Director of Microeconomic Analysis at the Congressional Budget Office (CBO); Victoria Sheehan, president of the American Association of State Highway and Transportation Officials; Heather Buch, chair of the Transportation Steering Committee Highway/Highway Safety Subcommittee of the National Association of Counties; and Shirley Bloomfield, CEO of NTCA–The Rural Broadband Association.

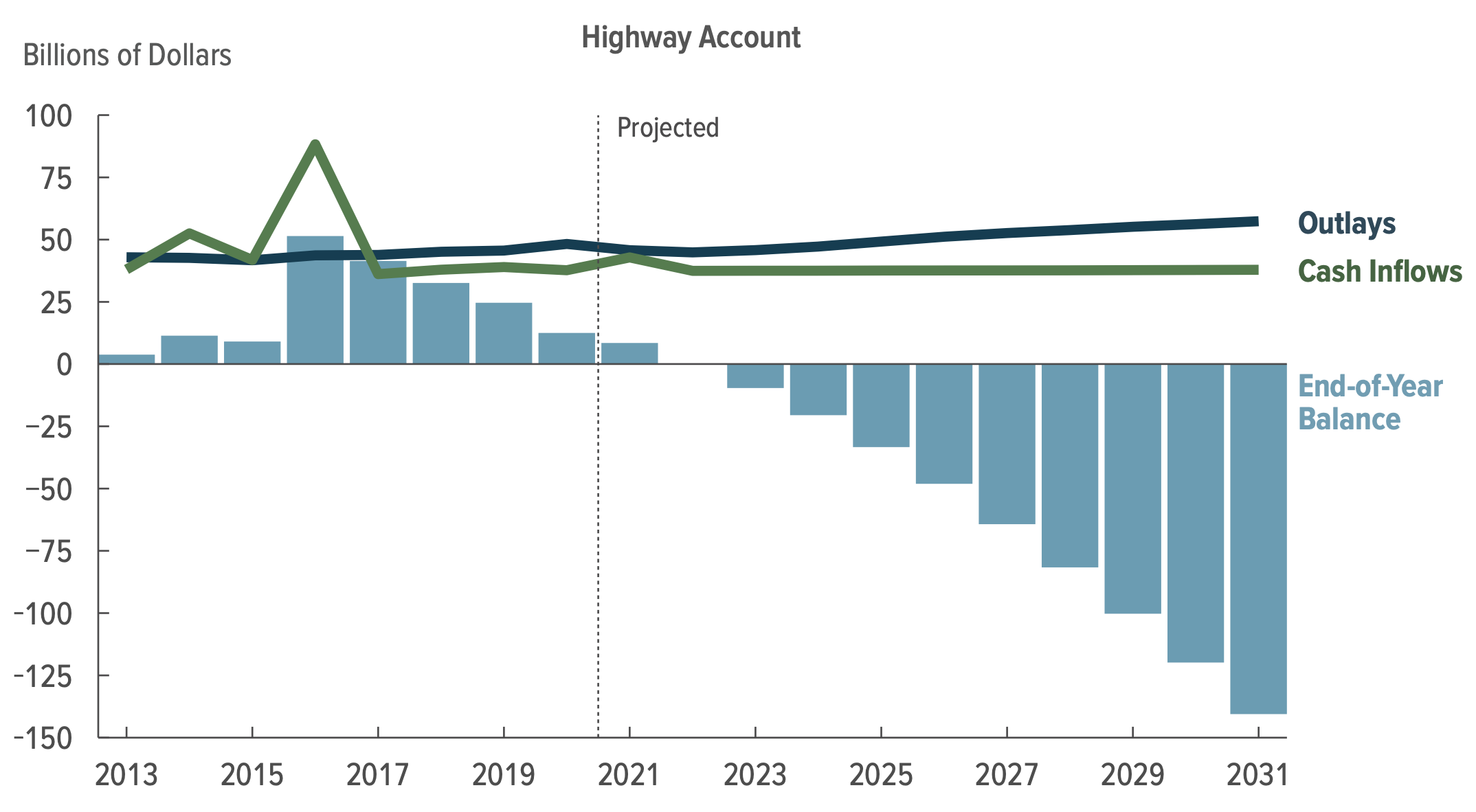

Most federal transportation spending is paid for from the HTF, which is funded mainly from an 18.4-cent-per-gallon gas tax, a 24.4-cent-per-gallon diesel tax, and other transportation-related revenue. While one-time general revenue transfers have kept the HTF afloat in recent years, they’ve also allowed for a growing disconnect between revenue and spending. CBO projects the HTF will run out of reserves sometime in Fiscal Year (FY) 2022 and faces a ten-year cumulative shortfall of $195 billion. Upon insolvency, there will be too little revenue to fund expected highway costs.

The Highway Trust Fund is Headed Toward Insolvency

Source: Congressional Budget Office,

Kile's testimony addressed HTF solvency, explaining that policymakers could either cut spending, increase dedicated revenues, or transfer general revenue to make up the difference. He highlighted several options to shore up the trust fund’s finances and close the structural imbalance between spending and revenue.

On the revenue side, the most straightforward option would be to raise the gas tax. CBO estimates that increasing the gas and diesel tax rates by 15 cents per gallon in October 2022 and indexing them to inflation in future years would raise an additional $291 billion between 2023 and 2031. This would eliminate the HTF’s shortfall and provide $95 billion of new revenue that could fund additional spending above the baseline. A larger increase in the gas and diesel tax rates – for example, raising both by 35 cents per gallon in October 2022 and indexing them to inflation in future years – would raise $627 billion of revenue, enough to eliminate the HTF’s shortfall and provide $432 billion of new revenue to fund additional spending through 2031.

Alternatively, policymakers could levy a new tax on vehicle miles traveled (VMT). CBO estimated in 2019 that a VMT tax imposed on commercial trucks alone could have raised $26 billion of revenue over ten years – enough to close 13 percent of the HTF’s shortfall. Another alternative would be a new fee on electric vehicles (EV), whose users do not pay current fuel taxes due to not using gas. CBO estimates that if policymakers imposed a $100 annual fee on EVs starting in October 2021, it would raise an average of $0.2 billion of revenue per year over the next five fiscal years, the equivalent of 1.6 percent of the HTF's shortfall. A third alternative would be to impose a tax on freight traveling by highway, similar to the tax levied on freight transported by plane or ship. CBO previously estimated that a tax of 30 cents per mile for trucks and 12 cents per mile for rail would raise $360 billion of revenue – enough to close 185 percent of the trust fund’s shortfall.

Kile noted that policymakers could make changes to federal programs that support state and local highway capital projects by making such investments less costly to finance. These options include raising the cap on highway Qualified Private Activity Bonds (QPABs), instituting a tax credit bond program to give state and local governments the option to issue debt to finance capital spending, expanding the Transportation Infrastructure Finance and Innovation Act (TIFIA) program by either increasing the maximum federal share of eligible projects’ costs or extending TIFIA assistance to a wider array of projects, and allowing states to collect more tolls on interstate highways.

Importantly, Kile's testimony highlighted just several of the many options to shore up the HTF. As part of our Trust Fund Solutions Initiative, we published a piece with ten policy options to secure the HTF. In addition, our Budget Offsets Bank includes roughly three dozen options to fund or more efficiently spend on infrastructure, and we’ve published more policy options over the years.

Policymakers will need to act in the next four months to enact at least a temporary solution to the exhaustion of the HTF and the expiration of the highway spending authorization law. Recently, the Senate Environment and Public Works (EPW) Committee unanimously passed a bipartisan highway reauthorization bill, though the bill is not offset. We encourage the Senate Finance Committee, at the appropriate time, to add offsets to any highway bill and applaud the Committee for holding a hearing that covered this important topic. Any infrastructure package should be fully paid for over the next decade.