Saving Social Security and Medicare Could Help Fix the Debt

The Congressional Budget Office's (CBO) Long-Term Budget Outlook shows debt rising continuously as a share of the economy over the next 30 years and rising to unprecedented levels within a dozen years if temporary tax cuts and spending increases are extended. However, if policymakers pay for all new (and extended) tax and spending changes and restore solvency to various federal trust funds, the country has a much brighter fiscal future.

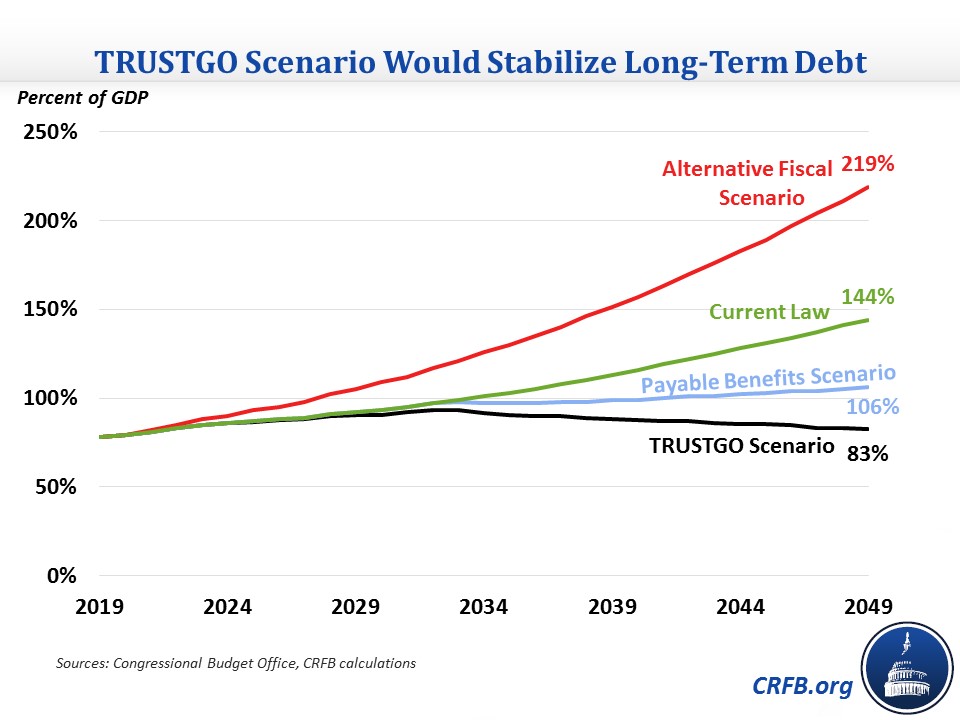

Under our "TRUSTGO" scenario – where the Medicare, Social Security, and Highway trust funds are brought into balance – we estimate debt would stabilize and ultimately fall as a share of Gross Domestic Product (GDP). Rather than rising to 144 percent of GDP by 2049 under current law or 219 percent under CBO's Alternative Fiscal Scenario, we project debt would total about 83 percent of GDP under our TRUSTGO scenario.

Five Trust Funds are Close to Insolvency

CBO projects that five federal trust funds will run out of reserves in the next 13 years: the Highway Trust Fund in 2022, the Pension Benefit Guaranty Corporation (PBGC) Multi-Employer trust fund in 2025, the Medicare Part A Hospital Insurance (HI) trust fund in 2026, the Social Security Disability Insurance (SSDI) trust fund in 2028, and the Social Security Old-Age and Survivors Insurance (OASI) trust fund in 2032.

Though 2032 may seem far off, it is actually quite soon. Today's youngest retirees will be only 75 years old when the Social Security trust fund is depleted, according to CBO, and at that point they will face an immediate across-the-board 24 percent benefit cut to match spending with revenue. Other trust funds are even closer to insolvency. Use our interactive tool to find out how old you'll be when Social Security's trust fund runs out (and Tweet the tool ).

).

Insolvency Dates for Major Trust Funds

| Trust Fund | Insolvency Date |

|---|---|

| Highway Trust Fund | 2022 |

| Pension Benefit Guaranty Corporation Multi-Employer Trust Fund | 2025 |

| Hospital Insurance Trust Fund | 2026 |

| Social Security Disability Insurance Trust Fund | 2028 |

| Social Security Old-Age and Survivors Insurance Trust Fund | 2032 |

Source: Congressional Budget Office.

Saving Trust Funds Can Help Fix the Debt

By law, trust funds cannot spend more than they take in once they run out of money. CBO's baseline assumes that (other than for PBGC) spending continues, which effectively means they are assuming a debt-financed general revenue transfer. Avoiding this transfer by making trust funds solvent would significantly reduce debt compared to CBO's baseline.

In its Long-Term Budget Outlook, CBO estimates a "Payable Benefits Scenario" where Social Security benefits are cut to match revenue when the (theoretically) combined trust fund runs out in 2032. Under that scenario, debt would rise to 106 percent of GDP in 2049, as opposed to 144 percent under current law.

Our TRUSTGO scenario builds off of this by also assuming the SSDI, Medicare Part A, and Highway trust funds are made solvent with benefit and/or revenue changes when their reserves are exhausted. Under this scenario, debt would still rise from 78 percent of GDP this year to 90 percent by 2029 but would peak at 93 percent in 2033 and then decline slowly to 83 percent of GDP by 2049. This would still leave a relatively high level of debt, but it would be declining over the longer term and would be much lower than in CBO's current law and Alternative Fiscal Scenario estimates.

Some important estimating notes: CBO's Payable Benefits Scenario assumes that not only will borrowing be lower, but due to dynamic feedback, the economy (and revenue) will be stronger. Specifically, they estimate real Gross National Product (GNP) will be 2.3 percent higher, and interest rates will be 20 basis points lower by 2049. Since some of these improvements are due to lower debt and some due to specific assumptions of how Social Security is made solvent, we conservatively use CBO's dynamic assumptions for our TRUSTGO scenario rather than assuming additional improvements from even lower debt.

In truth, there are many ways to reform Social Security, disability programs, Medicare, and the Highway Trust Fund that could include new revenue, changes to benefits, improved efficiencies, or some combination.

Most comprehensive plans to save these trust funds would improve economic growth and income. All would significantly improve our nation's fiscal situation.

As the TRUSTGO scenario shows, the first key to fixing the debt is to stop making it worse. The next step is to save Social Security, Medicare, and the Highway Trust Fund. That makes sense in its own right, and it can put the debt on a more sustainable path as a result.