The Ryan Budget in the Long Term

According to CBO’s report on the budget targets specified by Chairman Ryan and his staff (not a more traditional scoring of policies for whatever results those yield), Ryan’s budget targets would reduce the federal debt to 10 percent of GDP by 2050. By our calculations, these targets would transform deficits into surpluses starting in 2035.

Chairman Ryan's plan would do so through dramatic reductions in most federal spending. At the same time, Ryan would largely leave current policy revenue projections in place, albeit under a reformed tax system, and he would make no specific changes to Social Security spending, although he does propose a process for Social Security reform.

The Ryan budget has the following long-term features:

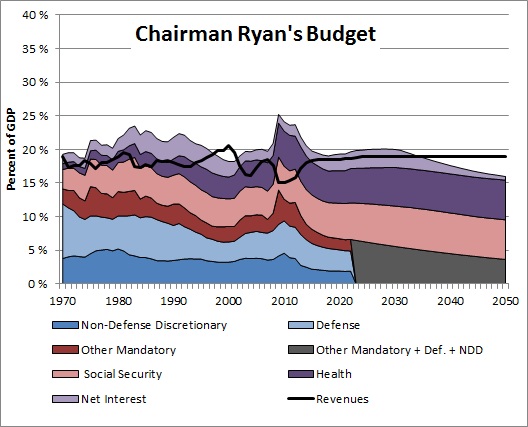

- Revenue: The budget has a revenue target of current policy, although it would cap revenues at 19 percent of GDP (which would happen by around 2025). However, as we noted yesterday, to achieve revenue-neutrality under his proposed rates, Ryan would have to eliminate virtually all tax expenditures, such as the mortgage interest deduction, the Child Tax Credit, and employer-provided health insurance exclusion. According to Tax Policy Center's analysis, he has to make up $4.6 trillion in lost revenues through 2022 to make his proposal revenue-neutral.

- Medicare: Ryan proposes to slow Medicare spending growth from current projections, resulting in five percent less spending in 2022, about 25 percent less in 2035, and larger reductions thereafter. Chairman Ryan instructed CBO to assume a gradual increase in the Medicare eligibility age, from 65 to 67, phased in from 2023 to 2037, although this increase is not mentioned in his published budget. Without it, annual Medicare spending would cost about another 0.1 percent of GDP by 2030, another 0.2 percent by 2036, and another 0.25 percent by 2045 above CBO’s forecasts for Chairman Ryan’s targets. Chairman Ryan’s reforms would establish a competitive bidding process for Medicare, with federal premium payments fixed at growth rates slower than projected for national health spending (GDP plus 0.5 percent per beneficiary).

- Other Health Spending: Chairman Ryan’s plan would repeal the 2010 Affordable Care Act, but would keep the Medicare cuts in the law, besides IPAB. Also, he would block grant Medicaid and CHIP spending while limiting their growth to inflation plus population growth, a much lower rate than currently projected.

- Other Mandatory and Discretionary Spending: All remaining mandatory, defense, and other discretionary spending would grow at the rate of inflation over the long-term, which differs from CBO's long-term assumption of GDP growth. As a result, combined spending on these budget categories would decline from 12.0 percent of GDP in 2011, to 8.9 percent in 2014, 6.6 percent in 2022, 5.0 percent in 2035, and 3.7 percent in 2050. By contrast, since 1970, the lowest combined spending for these categories was 8.5 percent in 1999.

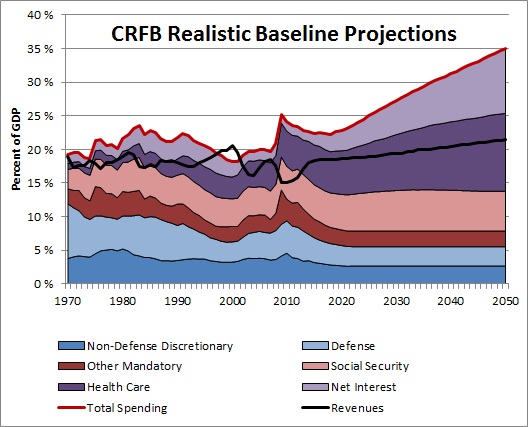

Below is our projection of the composition of spending under the Ryan budget. The one striking difference, not surprisingly, is that health care spending would grow only slightly as a percent of GDP, rather than growing dramatically as expected under current projections. Also, with much lower debt, interest payments stay subdued and start falling as debt shrinks.

Also, here are our extrapolations of the debt projections under the budget (CBO only gives debt numbers for every ten years). As you can see, assuming the numbers in the budget hold up, debt would fall to low levels by mid-century, likely to be paid off sometime in the 2050s.

Note that these debt numbers do not incorporate the adjustments we mentioned yesterday for the rest of the sequester or doc fix or the revenue-neutrality assumption.