Rigell Releases Sequester Replacement Plan

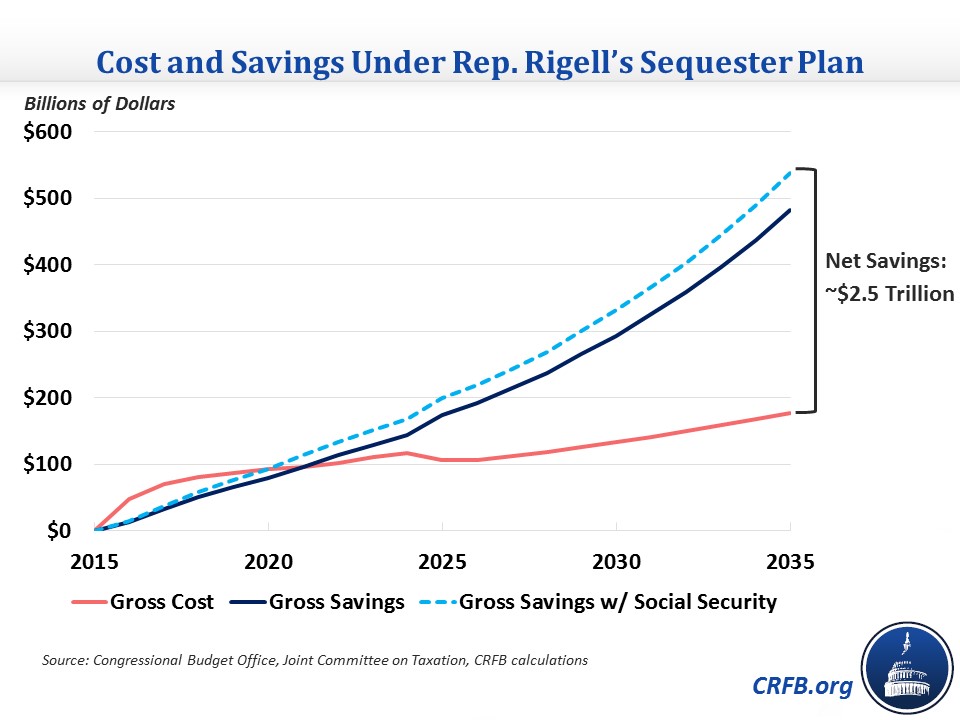

Congressman Scott Rigell (R-VA) released a plan today we might like even better than our own Sequester Offset Solutions (SOS) plan. Congressman Rigell's America First Act would permanently replace about three-quarters of the sequester-level cuts with a combination of mandatory spending cuts, Medicare reforms, limits on tax expenditures, and the savings and revenue from the adoption of the chained CPI. All told, it would reduce the debt by about $135 billion after a decade and according to our estimate nearly $2.5 trillion over twenty years.

Rigell's Plan would raise discretionary caps by about $630 billion over ten years and repeal $135 billion in mandatory sequester cuts, for a total cost of $765 billion. He would more than offset these costs with $820 billion of savings – including $620 billion from spending (and user fees) and $200 billion from tax revenue. He would also save $125 billion over ten years from Social Security, reducing the shortfall by approximately 15 percent.

To achieve these savings, Rigell's plan focusses largely on slowing the unsustainable growth of federal health spending. His plan includes over $450 billion of health savings. About one-third of this comes from beneficiary-oriented changes such as modernizing cost-sharing, restricting Medigap coverage, encouraging the use of generic drugs, and increasing means-tested Medicare premiums. Another half of the savings come from providers, where his plan would bundle payments for post-acute care, reduce hospital payments for medical education, equalize payments for services performed in different settings, reduce reimbursements for bad debts, and "rebase" nearly all payments to post-sequester levels.

The $165 billion of remaining spending reductions in the Rigell plan come from a variety of sources, many of which we recommend in our Sequester Offset Solutions (SOS) plan. For example, his plan would index various user fees to inflation, increase federal employee retirement contributions, increase PBGC premiums, and adopt the chained CPI for other spending, among other changes.

The plan also includes $200 billion of net tax revenue. About half of that comes from limiting the value of itemized deductions to the 35 percent bracket – a more modest version of what President Obama has proposed that would only impact families making over half a million dollars and would reduce the value of their charitable, mortgage, and state and local deductions by a small amount. The plan would raise an additional $150 billion by adopted the chained CPI as opposed to the CPI-U for indexing various parts of the tax code. $50 billion worth of tax revenue would be dedicated to repealing the medical device tax and extending the EITC expansions that expire after 2017.

| Budgetary Effect of Rep. Rigell's Sequester Plan | |

| Policy | Ten-Year Cost/Savings (-) |

| Repeal 75% of discretionary sequester | $630 billion |

| Repeal mandatory sequester | $135 billion |

| Sequester Relief | $765 billion |

| Switch to chained CPI for tax code | -$150 billion |

| Extend EITC expansions | $25 billion |

| Limit itemized deduction value to 35% | -$100 billion |

| Repeal medical device tax | $25 billion |

| Revenue | -$200 billion |

| Reform Medicare cost-sharing/restrict Medigap plans | -$110 billion |

| Expand and increase Medicare means-tested premiums | -$35 billion |

| Encourage use of generic drugs in Part D | -$20 billion |

| Reduce growth of post-acute care payments | -$65 billion |

| Reduce Medicare payments for bad debt | -$30 billion |

| Increase Medicare Advantage coding intensity adjustments | -$20 billion |

| Enact medical malpractice reform | -$15 billion |

| Equalize payments for services across settings | -$15 billion |

| Bundle payments for post-acute care | -$10 billion |

| Reduce Medicaid provider tax threshold | -$25 billion |

| Reduce Medicare payments for indirect medical education | -$10 billion |

| Rebase Medicare payments at sequester levels | -$100 billion |

| Health Care | -$455 billion |

| Apply Ryan-Murray pension change to pre-2014 workers | -$20 billion |

| Improve Pension Benefit Guaranty Corporation solvency | -$10 billion |

| Index customs, TSA, and other fees to inflation | -$10 billion |

| Policies That Build on Ryan-Murray | -$40 billion |

| Switch to chained CPI for non-Social Security spending | -$85 billion |

| Streamline student loan income-based repayment plans | -$15 billion |

| Reduce Federal Reserve dividend payments | -$15 billion |

| Reduce farm subsidies | -$10 billion |

| Other Savings | -$125 billion |

| Interest | $50 billion |

| Net Effect | -$10 billion |

| Net Effect w/ Social Security Savings | -$135 billion |

| Memo: Social Security savings dedicated to solvency | |

| Switch to chained CPI for cost-of-living adjustments | -$145 billion |

| Include old-age bump-up and low-income protections | $20 billion |

Source: Rep. Rigell's office

Adopting the chained CPI government-wide would also impact Social Security. Under Rigell's plan – as under the SOS Plan – those Social Security savings would be used to finance benefit increases for very old beneficiaries and to improve the solvency of Social Security.

In total, the plan would produce modest deficit reduction over the next decade – replacing somewhat haphazard discretionary cuts with more thoughtful savings. However, unlike the sequester, those savings would grow significantly over time. As a result, despite permanently repealing three quarters of the sequester, the plan would reduce the debt by nearly $2.5 trillion after twenty years, and the net savings would continue to grow beyond then.

As we noted when we released the SOS plan, the sequester was put in place because of the failure of Congress to enact the deficit reduction called for the by Budget Control Act, so legislation replacing the cuts under sequestration with smart deficit reduction in mandatory programs and the tax code is consistent with the original goals of the Budget Control Act.

Rep. Rigell's plan is a responsible way to roll back most of the sequester and replace it with smarter savings that will better correct the long-term trajectory of debt. As CRFB president Maya MacGuineas said about the bill, "This is what leadership looks like."