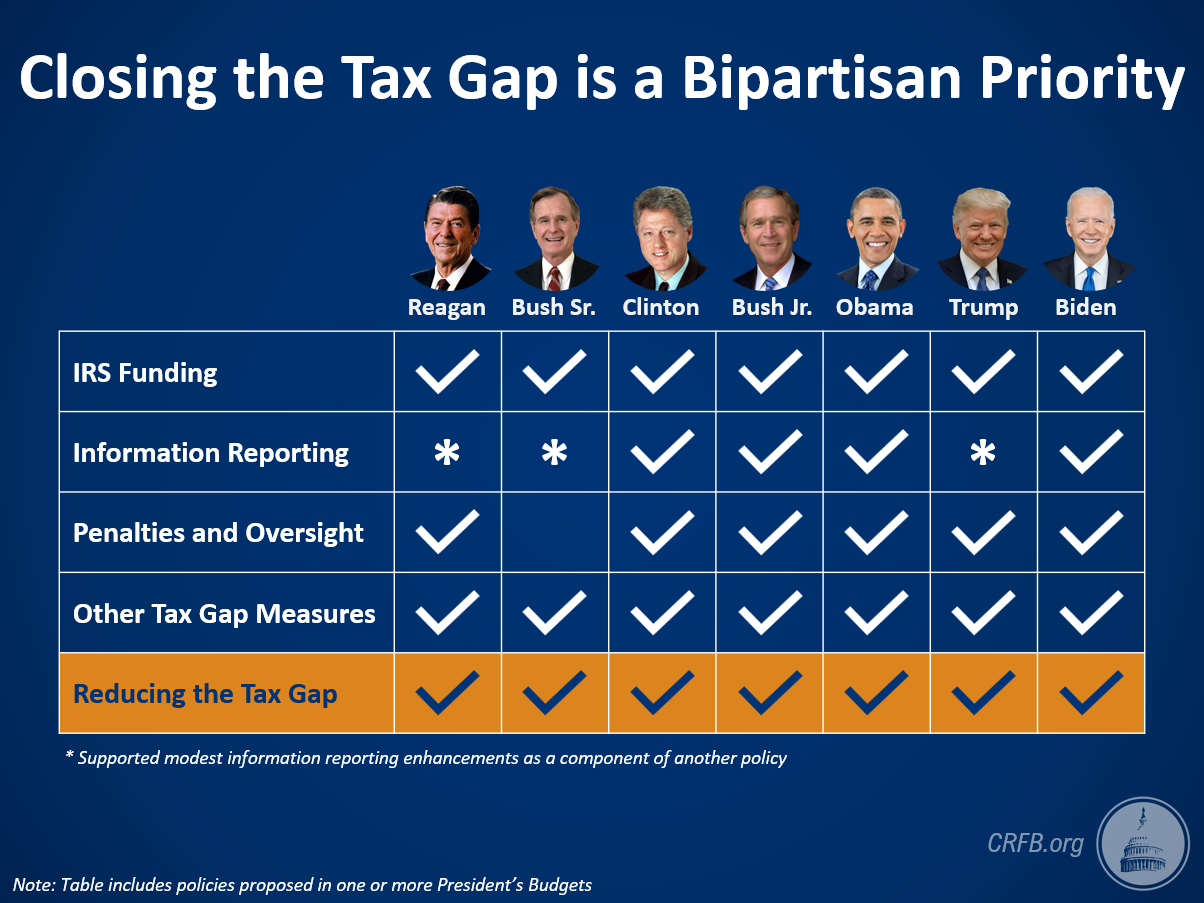

Republican and Democratic Presidents Support Reducing the Tax Gap

One of the most fair and efficient ways for policymakers to raise revenue would be to close some portion of the “tax gap," or the difference between the total amount of taxes owed to the federal government each year and the amount it actually collects (see our primer here).

Recently, proposals to reduce the tax gap have been put forward by President Biden and included in the Bipartisan Infrastructure Framework. However, these efforts are hardly the first to focus on narrowing the tax gap. In fact, measures to improve tax compliance have a long history of bipartisan support.

Prior to President Biden, proposals to reduce the tax gap have been included in budgets put forward by former Presidents Reagan, Bush, Clinton, Bush, Obama, and Trump.

In fact, former President Trump included proposals to narrow the tax gap in all four of his annual budget proposals. His last two budgets included between $60 billion and $90 billion of additional revenue from improved tax compliance.

Tax Gap Proposals from President Trump’s Fiscal Year (FY) 2020 and FY 2021 Budgets

| OMB Ten-Year Savings | CBO Ten-Year Savings | |

|---|---|---|

| Increase IRS tax enforcement funding | $64 billion' | $56 billion' |

| Give IRS more flexibility to address correctable errors | $17 billion | $0.3 billion |

| Strengthen enforcement of law requiring valid SSN to collect most tax credits* | $3 billion | not scored separately |

| Improve clarity for worker classification and reporting requirements* | $2 billion | $1 billion |

| Increase oversight of paid tax return preparers | $0.5 billion | $0.2 billion |

| Expand mandatory electronic filings of W-2s* | $0.3 billion | <$0.1 billion |

| Total | ~$87 billion | ~$60 billion |

'Net revenue, subtracting higher funding levels. *Relies on estimates from President Trump’s FY 2020 budget proposal. OMB = Office of Managemetn and Budget; CBO = Congressional Budget Office.

Most significantly, and like many of his predecessors, President Trump proposed substantial new funding for the Internal Revenue Service (IRS), which is also part of the bipartisan infrastructure agreement. Funding the IRS is one of the few policies that will truly pay for itself, as each dollar spent on tax enforcement or taxpayer assistance produces several dollars of revenue for the federal government.

President Trump also supported other measures that would have adjusted policy in order to improve tax compliance – for example, by clarifying worker classification rules, expanding the IRS’s authority to fix correctable errors on tax returns, and strengthening oversight of paid tax preparers.

While policymakers should rightfully debate every policy on its merits, there is simply nothing partisan about ensuring people pay the taxes they already owe.

The federal government loses over $500 billion per year in unpaid or underpaid taxes – due both to honest mistakes and to outright fraud. Policymakers from both sides should work together to narrow that gap so that everyone is paying the taxes they owe under the law.

Twitter

Twitter