Reinhart and Rogoff Release Errata

Economists Carmen Reinhart and Kenneth Rogoff of Harvard University have issued an erratum to their 2010 paper, “Growth in a Time of Debt.” Their original paper found some evidence of a possible tipping point at which higher debt levels would significantly restrict economic growth, with median growth rates falling from 2.9 percent among countries with debt levels between 60 percent and 90 percent of GDP to 1.5 percent among countries with debt levels greater than 90 percent. However, a paper by Thomas Herndon, Michael Ash, and Robert Pollin of the University of Massachusetts-Amherst raised three methodological concerns: an Excel coding error, possible exclusion of relevant data, and questions over the weighting methodology. R&R correct for errors and other concerns, resulting in a median growth rate of 2.5 percent of GDP for high debt countries, compared to the original findings of a -0.1 percent mean growth rate and a 1.6 percent median growth rate, and 2.2 percent mean growth rate in the HAP analysis.

R&R have made several changes to their 2010 paper after re-examining the data. First, they correct the Excel coding error, which includes the missing countries of Australia, Austria, Belgium, Canada, and Denmark in the study for all debt levels, though the most notable change is to increase the median economic growth rate for 90 percent countries by +0.3%. In addition to this coding change, they also found several blank cells containing non-zero entries that were affecting the results by a magnitude of 0.1%-0.2% in either direction.

R&R also make two other revisions based on data that has since been acquired. First is the addition of Spain from 1959 – 1980, a low debt nation with high growth during that time which would not affect the 90 percent threshold. The other is a revision of the New Zealand data. Two years (1948 and 1949) are added (a coding correction), and the data for GDP growth rate was changed to reflect a better source. Official GDP data does not exist for New Zealand prior to 1955, so the authors used data from the work of Angus Maddison in the original paper. However, GDP data from the The New Zealand Historical Statistics seems to better fit the economic history of the country, so R&R replace the Maddison data with the other series.

Source: Reinhart and Rogoff

While the differential in growth rates after 90 percent threshold becomes weaker after the R&R erratum, there is still a negative correlation between debt and growth. After adjustments, R&R’s more recent paper, using a their full data set instead of just post WWII data, found median growth rates of 2.3 percent among high debt countries compared to 2.6 percent for countries between 60 percent and 90 percent. Beyond R&R, many other studies using more sophisticated econometric techniques stand as evidence of a negative relationship between high debt and economic growth.

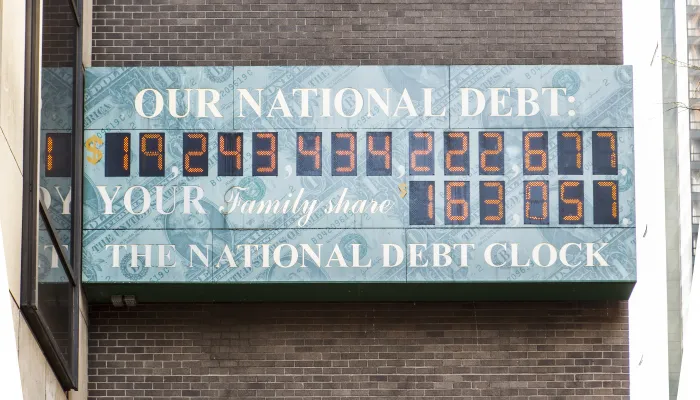

International comparisons are always problematic as each country and time period have unique circumstances, and it is difficult to isolate two dynamic variables such as economic growth and debt. But projections of the U.S. fiscal outlook appear to be unsustainable. It would be irresponsibly to wait for a crisis to resolve this problem and run the risk of serious economic slowdown, especially with the many benefits of deficit reduction done in a smart, thoughtful way.