A Quick Take on the 2016 Social Security Trustees Report

The Social Security and Medicare Trustees have released their reports on the financial state of their respective programs. With regards to Social Security, the Trustees continue to show that the program is headed towards insolvency and faces a large and growing shortfall. They project that the Social Security Disability Insurance (SSDI) trust fund, whose insolvency was delayed due to the budget agreement passed last year, will run out in 2023, and the combined Social Security trust fund will run out in 2034. The report shows basically the same outlook as last year's report and thus still makes the case for immediate action to close the program's shortfall.

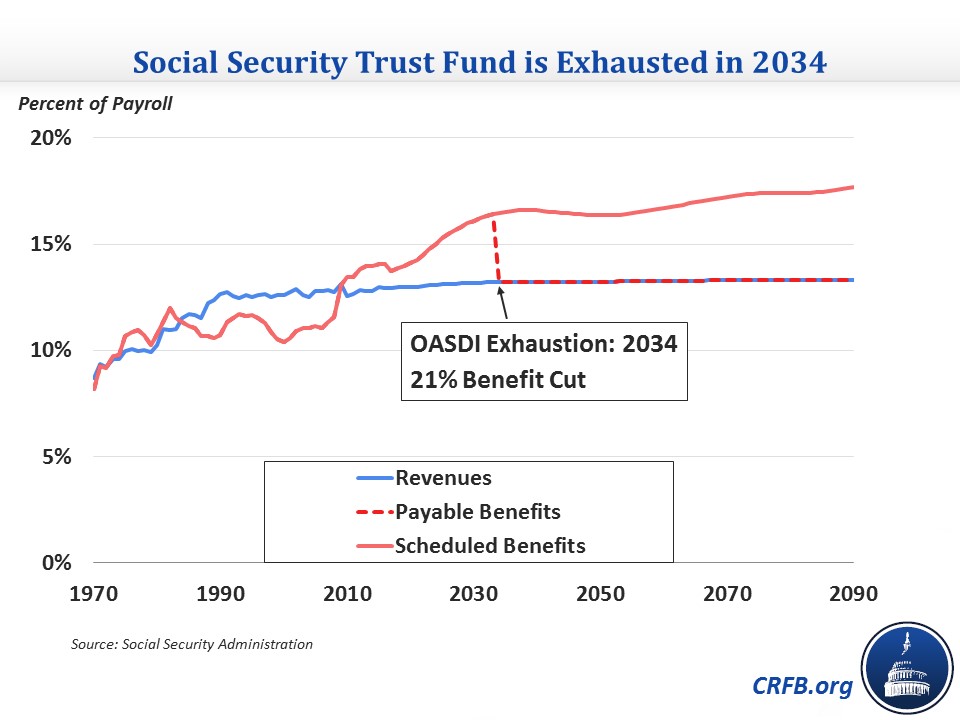

According to the Trustees, Social Security faces a 75-year shortfall of 2.66 percent of payroll (0.95 percent of GDP), at which point all beneficiaries would face a 21 percent across-the-board benefit cut. This shortfall means the payroll tax would have to be raised immediately from 12.4 to about 15 percent to ensure 75-year solvency. Annual deficits would grow over time so that by 2090, the payroll tax would need to rise further to nearly 17 percent. Alternatively, policymakers could reduce benefits by about 16 percent today, with the needed reduction growing to 26 percent to eliminate the 2090 deficit.

These deficits are the result of growing spending on benefits and flat revenue. Benefits will grow from 14.1 percent of payroll in 2016 to 16.6 percent by 2037, then level off for the next two decades before rising thereafter to 17.7 percent by 2090. Revenue will rise only slightly over the next 75 years from 12.9 percent of payroll in 2016 to 13.3 percent by 2090.

Compared to the 2015 report, this year's report shows a 75-year shortfall that is basically the same (2.66 percent of payroll versus 2.68 percent). This similar outlook is the net result of shifting the 75-year window from 2015-2089 to 2016-2090, which increases the shortfall by 0.06 percent, and other changes that reduce the shortfall by 0.08 percent. 0.03 percent of the 0.08 percent total is due to small legislative changes enacted in last year's budget agreement, while the remaining amount is due to net effect of incorporating new economic and demographic data and changes in projection methods.

| Change in 75-Year Balance Since Last Year (Percent of Payroll) | |

| Effect on 75-Year Shortfall | |

| 2015 Report's 75-Year Shortfall | -2.68% |

| Legislation/Regulation | +0.03% |

| Change in Valuation Period | -0.06% |

| Demographic Data and Assumptions | 0.00% |

| Economic Data and Assumptions | -0.07% |

| Disability Data and Assumptions | 0.00% |

| Methods and Program Data | +0.11% |

| 2016 Report's 75-Year Shortfall | -2.66% |

Source: Social Security Administration

The Medicare Trustees' report estimates that the Hospital Insurance (Part A) trust fund will be exhausted in 2028, two years earlier than projected last year. Most of the changes between last year's report and this year's come in the short term, so the 75-year shortfall has increased only slightly from 0.68 percent of payroll to 0.73 percent of payroll. Still, the change in the exhaustion date means that lawmakers only have a little more than a decade to deal with Part A's shortfall. We will have more on the Medicare Trustees' report in the coming days.

The latest Social Security Trustees' report makes the case for lawmakers moving quickly to enact Social Security changes that ensure the program's solvency for the next 75 years and beyond. This is especially important in light of recent calls for benefits to be expanded. Instead of enacting broad-based benefit expansions that will confer significant benefits on many beneficiaries who don't need them, lawmakers should focus on making the program secure for future generations.