President's Budget Would Add More to Debt With Tax Cut Extensions

President Joe Biden's Fiscal Year (FY) 2022 budget includes many significant changes that would add nearly $1.4 trillion to deficits through FY 2031. However, it stays largely silent on one important and potentially expensive decision point: whether or not to extend the individual tax cuts in the Tax Cuts and Jobs Act (TCJA) that expire at the end of calendar year 2025.

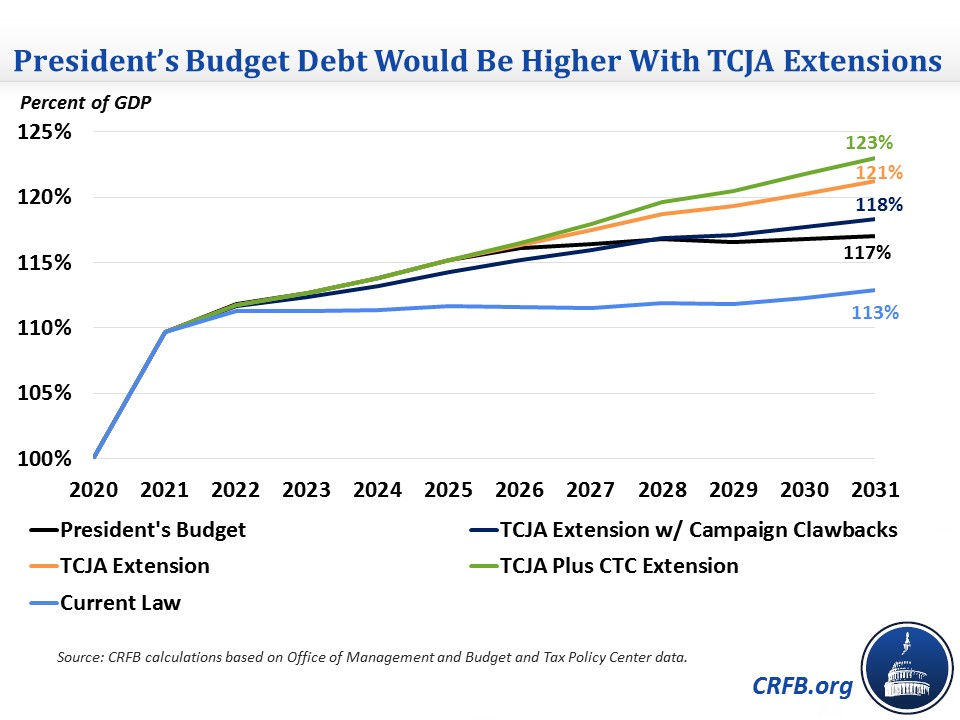

Outside of two policies, the budget does not indicate what would happen to the tax cuts. Apart from the policies the budget already addresses, we estimate that extending all of the expiring individual income tax cuts in the TCJA would add another $1.4 trillion to deficits through FY 2031 and cause debt to rise to 121 percent of Gross Domestic Product (GDP) by the end of FY 2031, instead of 117 percent as projected in the budget. An extension that also includes rollbacks of provisions President Biden proposed during the 2020 campaign would still cost $460 billion over a decade. On the other hand, a full extension that also extends the Child Tax Credit (CTC) increase beyond 2025 would cost $2 trillion (an extension that includes both the campaign policies and the Child Tax Credit extension would cost about $1.2 trillion).

Cost of Different Tax Cut Extensions

| Scenario | Cost Through 2031 | Cost Including Budget |

|---|---|---|

| Full TCJA extension excluding budget policies | $1.4 trillion | $2.8 trillion |

| Full TCJA extension excluding campaign policies | $460 billion | $1.8 trillion |

| Full TCJA and Child Tax Credit extension excluding budget policies | $2.0 trillion | $3.4 trillion |

Source: CRFB calculations based on Office of Management and Budget and Tax Policy Center data.

The TCJA included several changes to individual income taxes that are set to expire after 2025. Most of these provisions are tax cuts, including lower individual income tax rates and a higher standard deduction as well as an increase in the CTC, increasing the Alternative Minimum Tax (AMT) threshold, and the new pass-through business income deduction. However, a few policies are tax increases, including the $10,000 cap on the state and local tax (SALT) deduction, the elimination of personal exemptions, and the limit on active losses for pass-through businesses. Extending all of these policies would have a net cost of about $1.6 trillion through FY 2031. Importantly, this estimate does not include the cost of extending other temporary policies or repealing backloaded offsets from the TCJA like bonus depreciation and the amortization of research and experimentation expenses.

President Biden's budget does include an increase in the top individual income tax rate from 37 percent to 39.6 percent – as it was before the TCJA – as well as an extension of the TCJA's limit on pass-through business losses. Apart from these two provisions, however, the budget does not address any of the TCJA's expiring tax cuts, which leaves open many possibilities for what might happen to them after 2025. Extending all other provisions would cost $1.3 trillion through FY 2031, or $1.4 trillion including interest. This would cause debt to rise from 100 percent of GDP at the end of FY 2020 to 121 percent by 2031, four percentage points higher than the 117 percent of GDP projected by the Office of Management and Budget.

President Biden also proposed to roll back several TCJA policies during the 2020 campaign. He proposed to reinstate the "Pease Limitation" phaseout of itemized deductions for those earning $400,000 or more, phase out the pass-through business deduction for those earning $400,000 or more, and restore the estate tax to its less generous 2009 parameters. We estimate that incorporating these policies would reduce the cost of an extension to about $450 billion, or roughly $460 billion including interest, which would push debt to 118 percent of GDP by the end of FY 2031.

On the other hand, the budget proposes extending the increase in the Child Tax Credit from the American Rescue Plan Act only through 2025. If this increase were extended permanently and done in concert with a full extension of the TCJA (minus budget-proposed policies), the cost would reach $1.9 trillion, or $2 trillion including interest, and increase debt to 123 percent of GDP by 2031.

Of course, President Biden could ultimately choose any number of possible extensions or none at all. However, there is little room to reduce the cost of the extension beyond the campaign policies by rolling back tax cuts only for high-income taxpayers since most of the other provisions exclusively benefit lower-income taxpayers or have broad-based benefits that would be difficult to roll back for high earners only. As the 2025 expiration date approaches, lawmakers must ensure that any extension of the tax cuts is offset, or it will worsen an already bleak fiscal situation.