President's Budget Would Add More to Debt With Policy Extensions

Last month, the Biden Administration released its Fiscal Year (FY) 2023 budget proposal that includes many policy changes that would reduce deficits by $1.05 trillion through FY 2032. However, the budget remains mostly silent on one important and potentially costly decision point: whether or not to extend the individual tax cuts in the Tax Cuts and Jobs Act (TCJA) set to expire at the end of calendar year 2025. Moreover, after a large upfront discretionary spending increase, the budget assumes slow nominal discretionary spending growth thereafter, particularly for defense. More realistic policy assumptions would erase the deficit reduction in the President's budget and could add up to $2.75 trillion to budget deficits through FY 2032.

Besides proposing to increase the top individual income tax rate from 37 percent to 39.6 percent (the top rate prior to the TCJA), the President's budget is silent over what would happen after all other individual income tax provisions in the TCJA expire at the end of 2025. Depending on the precise details, we estimate that extending all of the expiring provisions in the TCJA other than the top rate - including both the tax cuts and tax increases - would cost $2.1 trillion with interest over the FY 2022 to 2032 period. Extending the individual income tax provisions in the TCJA minus the top rate while incorporating rollbacks President Biden proposed during the 2020 presidential campaign - such as limiting the TCJA's 20 percent pass-through deduction for high earners and restoring the "Pease Limitation" that indirectly reduces the value of itemized deductions - would cost $1.1 trillion including interest through FY 2032. Meanwhile, increasing out-year defense spending in the President's budget by maintaining at least inflation growth would cost roughly $400 billion with interest, while growing all discretionary spending at the rate of economic growth after 2023 would cost $1.7 trillion with interest through FY 2032.

Assuming only the extension of the individual tax cuts after the campaign clawbacks, the President's budget would go from reducing budget deficits by $1.05 trillion to not reducing them at all. With all tax cuts extended, it would increase deficits by $1.05 trillion. And with all tax cuts plus faster discretionary spending growth, it could increase deficits by up to $2.75 trillion.

Cost of Different Policy Extensions

| Scenario | Full TCJA Extension | Partial TCJA Extension |

|---|---|---|

| President's Budget with no modifications | -$1.05 trillion | |

| President's Budget with TCJA extension | $1.05 trillion | $0 |

| President's Budget with TCJA extension and higher defense spending | $1.45 trillion | $0.40 trillion |

| President's Budget with TCJA extension and higher discretionary spending | $2.75 trillion | $1.70 trillion |

Source: Committee for a Responsible Federal Budget estimates based on Congressional Budget Office, Office of Management and Budget, and Tax Policy Center data. Costs include interest and are rounded to the nearest $50 billion.

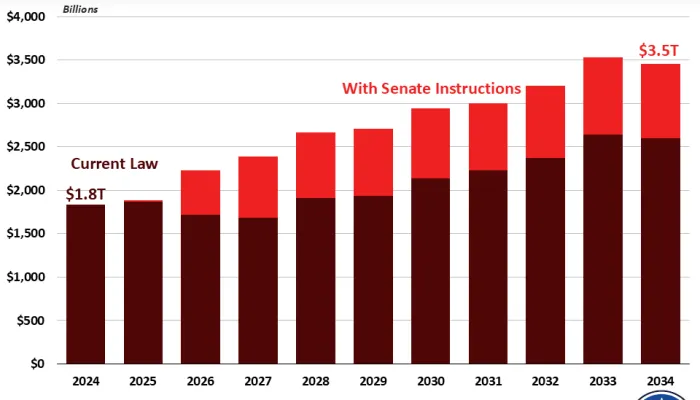

These higher costs would, of course, lead to higher debt. Based on the Administration's own estimates, debt under the President's budget would rise to a record 107 percent of Gross Domestic Product (GDP) by the end of FY 2032. Even with a partial extension of the TCJA's tax cuts, debt would still rise to 110 percent of GDP by the end of FY 2032; with a full extension of the TCJA, debt would grow to 112 percent of GDP. Assuming discretionary spending grows with GDP would push debt up further to 117 percent of GDP by the end of FY 2032. We discuss the individual scenarios in more detail below.

The TCJA includes several individual income tax changes that are set to expire at the end of 2025, most of which are tax cuts. These include lower individual income tax rates, a higher standard deduction, an increased Child Tax Credit, higher Alternative Minimum Tax thresholds, and a new pass-through deduction for business income. However, a few of the TCJA's policies are tax increases, including the $10,000 cap on the State and Local Tax deduction, the elimination of personal exemptions, and the limit on active losses for pass-through businesses. The TCJA also includes bonus depreciation that allows businesses to deduct some investments immediately rather than over time and requires business to amortize research and experimental expenses beginning this tax year. Extending all of the TCJA's individual income tax provisions, other than the top income tax rate, and bonus depreciation, as well as repealing the amortization of research and experimental expenses would cost $2.1 trillion including interest. As a result, debt would grow to 112 percent of GDP by the end of FY 2032.

During the 2020 presidential campaign, President Biden proposed to roll back several TCJA policies. He proposed reinstating the "Pease Limitation" phaseout of itemized deductions for those earning over $400,000, phasing out the pass-through business deduction for those earning $400,000 or more, and restoring the estate tax to its less generous 2009 parameters. We estimate that incorporating these policies would reduce the cost of extending the TCJA's individual income tax provisions (minus the top rate) to $1.1 trillion including interest and debt would total 110 percent of GDP by the end of FY 2032.

Under the President's budget, total defense and nondefense discretionary spending would increase by $750 billion relative to the Administration's baseline through FY 2032, but defense spending would grow slower than inflation after 2024. If defense spending instead were to grow with inflation after FY 2024, total discretionary spending would be $365 billion higher through 2032. If this were done in concert with a full extension of the TCJA (minus the budget's proposed top individual income tax rate increase), it would cost $2.5 trillion including interest. Under this scenario, debt would grow to 113 percent of GDP by the end of FY 2032. With a partial TCJA extension, it would cost $1.4 trillion including interest and debt would total 111 percent of GDP by the end of FY 2032.

If total defense and nondefense discretionary spending were to grow at the rate of economic growth beginning in FY 2024, total discretionary spending would be $1.6 trillion higher through 2032 than under the President's budget. If this was done in tandem with a full extension of the TCJA, it would cost $3.8 trillion including interest and debt would grow to 117 percent of GDP by the end of FY 2032. If done in concert with a partial extension of the TCJA, it would cost $2.7 trillion including interest and debt would total 114 percent of GDP by the end of FY 2032.

Ultimately, President Biden could choose any number of possible extensions or forgo them entirely. However, there is little room to reduce the cost of extension beyond the President's 2020 campaign proposals by rolling back tax cuts only for high-earning taxpayers. As the 2025 expiration for the TCJA's individual income tax provisions nears, lawmakers must ensure any extension of the TCJA's policies is offset. Otherwise, an already bleak fiscal outlook will become even more grim.