Potential ISIS Operation Shows the Value of Fiscal Space

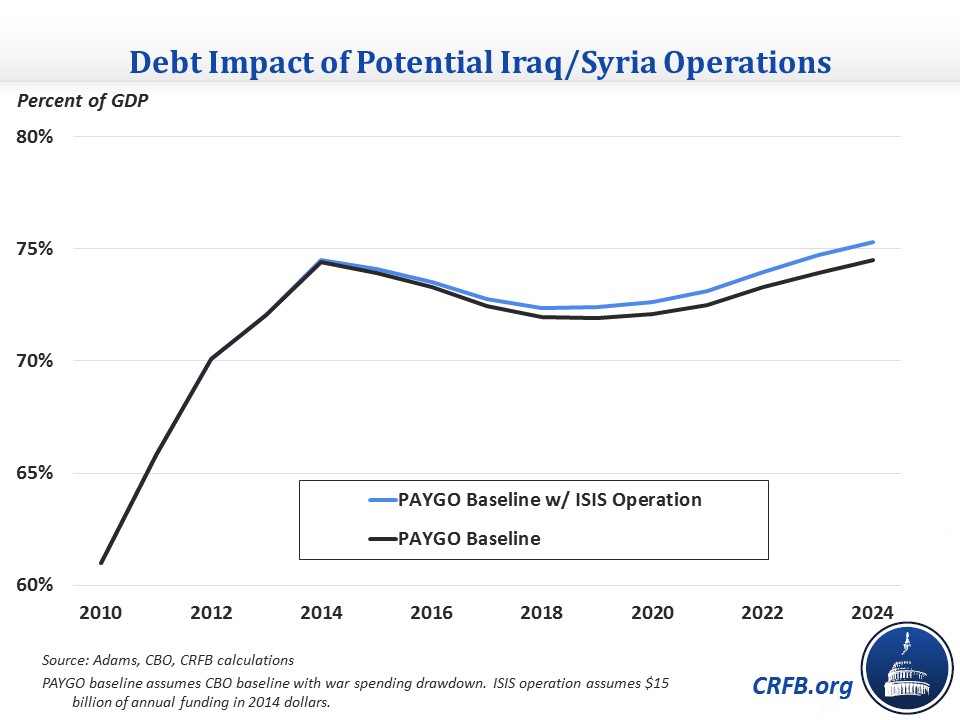

Recent events in Iraq and Syria have raised the prospect of expanding military operations in the region beyond airstrikes. Gordon Adams in a Fiscal Times article roughly estimated that $10 billion-$15 billion per year would be required to expand air operations and provide ground support for a campaign against ISIS, though the estimate is uncertain because it is not clear exactly how the U.S. would respond. Regardless of the exact number, it is clear that if the military is to expand its operations in Iraq and Syria, it would cost billions of dollars.

Given high and growing debt levels, lawmakers should avoid substantially adding to the debt to fund the operation.

Of course, the "path of least resistance" would be for Congress to fund these new costs by designating them as Overseas Contingency Operations (OCO), which are not subject to the same statutory caps that constrain most discretionary spending. And to be fair, the increased costs would indeed be used toward overseas operations in Iraq. Yet, every major budget assumes OCO spending will decline, and using the OCO designation as a slush fund for any new military operation could significantly worsen the debt situation.

A sensible solution to this concern might be to accompany any new funding for ISIS with a set of OCO caps, designed to limit total funds spent on military operations in Iraq and Afghanistan.

Any significant new funding for ISIS or other operations, beyond the allowed threshold, could then be funded by identifying offsetting spending cuts or new revenue sources, either in the same year or perhaps over several years. Putting caps in place is consistent with previous plans for a spending drawdown and would bring greater accountability to the process of allocating additional resources to military campaigns.

Importantly, the increasing trouble in Iraq demonstrates once again the importance of fiscal space, or having the economic headroom to borrow additional money. As we have seen this year with the Central American migrant crisis, the VA scandal, and other issues, new funds are often needed to address emergencies or new priorities. Our ability to respond is somewhat hampered by high levels of debt and will be further constrained if debt continues to grow as projected.

Putting the debt as a share of the economy on a clear downward path is the best way to provide policymakers with the "fiscal space" they will certainly need to respond to future challenges.