Policymakers Shouldn't Attach More Borrowing to a Debt Ceiling Increase

The debt ceiling, or the statutory limit on the total amount of debt the federal government can accrue, is set to come back on August 1 after being suspended for the last two years. It is imperative that lawmakers raise or suspend it again soon; in fact, it already should have been done well in advance of its July 31 expiration.

Nevertheless, the deadline to raise it before it expires will likely be missed, at which point the debt ceiling will automatically be raised to the amount of debt we have incurred up to that date – around $28.5 trillion. Using its cash balances and so-called "extraordinary measures," the Treasury Department should be able to delay the actual date when the debt limit would be breached to October or November, according to the Congressional Budget Office.

It should not be a question of whether or not we should raise the debt ceiling – simply put, we must. The debt ceiling signifies our past commitments to borrow in order to pay for our obligations, and it cannot be questioned that we will honor our payments and make good on our promises. Concerns about excessive borrowing should be raised at the time the laws are passed, not just when the bill comes due. It is reckless to have supported borrowing and then force us to default on that debt.

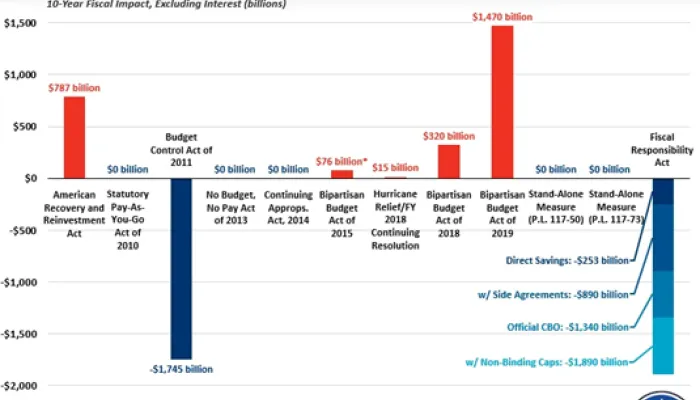

At the same time, lawmakers should look towards past debt ceiling increases and suspensions as a guide to increasing the debt ceiling while simultaneously setting up options to deal with the debt. Up until six years ago, Congress often coupled debt limit increases with budget reforms to reduce deficits or set up a process to address excessive borrowing. Viewing the debt limit as an opportunity to take stock of and adjust our fiscal outlook, without threatening to breach the limit, is a fiscally responsible approach.

Since 2015, however, debt ceiling suspensions have been tied to deficit-increasing legislation – an approach that should not appeal to anyone concerned about the financial health of the nation. This included the Bipartisan Budget Act of 2015 and the Bipartisan Budget Acts of 2018 and 2019. Those three bills boosted borrowing by nearly $80 billion, $420 billion, and $1.7 trillion, respectively.

Reforms Have Often Advanced with the Debt Ceiling

| Year | Title of Bill/Package | Debt Ceiling Change | Notable Attachments | Bipartisan | |

|---|---|---|---|---|---|

| 1985 | Gramm-Rudman-Hollings Act | Increased $175 billion | Set targets for balanced budget by 1991, enforced by sequestration | Yes | |

| 1987 | Gramm-Rudman-Hollings Act Part II | Increased to $2.8 trillion | Built on GRH with additional deficit reduction enforced by sequestration | Yes | |

| 1990 | Omnibus Budget Reconciliation Act of 1990 | Increased $915 billion | Nearly $500 billion in deficit reduction over five years, statutory PAYGO, and spending caps | Yes | |

| 1993 | Omnibus Budget Reconciliation Act of 1993 | Increased $600 billion | Reduced deficits nearly $500 billion in five years, extended 1990 spending caps, raised taxes on high earners | No | |

| 1996 | Contract with America Advancement Act of 1996 | Increased $600 billion | Passed in tandem with giving the President line-item veto power to strike programs and tax benefits that affect fewer than 100 people | Yes | |

| 1997 | Balanced Budget Act of 1997 | Increased $450 billion | Called for ~$125 billion of net deficit reduction over five years and $425 billion over ten years | Yes | |

| 2010 | Statutory PAYGO Act of 2010 | Increased $1.9 trillion | Reinstated statutory PAYGO, informally led to Simpson-Bowles | No | |

| 2011 | Budget Control Act of 2011 | Let the President increase by $2.1 trillion in tranches, subject to Congressional disapproval resolutions | $917 billion in deficit reduction over ten years, mostly with discretionary spending caps, established the “Super Committee” to save at least $1.2 trillion | Yes | |

| 2013 | No Budget, No Pay Act of 2013 | Effectively suspended through 5/19/13 | Required each chamber to pass a budget, or else the compensation of Members of Congress would be withheld | Yes | |

| 2013 | Default Prevention Act of 2013 | Suspended through 2/7/14 | Set up a bicameral budget conference to reconcile budgets for FY 2014 and ended a 16-day government shutdown | Yes | |

| 2015 | Bipartisan Budget Act of 2015 | Suspended through 3/15/17 | Cost ~$76 billion, increased BCA caps for FY 2016 and 2017 | Yes | |

| 2018 | Bipartisan Budget Act of 2018 | Suspended through 3/1/19 | Cost $420 billion, increased BCA caps for FY 2018 and 2019 | Yes | |

| 2019 | Bipartisan Budget Act of 2019 | Suspended through 7/31/21 | Cost $1.7 trillion ($360 billion directly), by increasing caps for FY 2020 and 2021, with increases then built into the baseline | Yes |

Lawmakers and the President must work together to increase or suspend the debt ceiling as soon as possible. It would be beneficial to the fiscal situation if they were to pass reforms to improve our budget process or underlying finances. Certainly, a debt limit increase should not be used to worsen our debt, which is already headed to record levels.