Options to Replace the ACA Cadillac Tax

As policymakers debate repealing and replacing the Affordable Care Act (ACA or "Obamacare"), disagreement remains over how to address the ACA's "Cadillac tax." Rather than repealing the 40 percent tax on high-cost insurance plans outright, many advocates of "repeal and replace" have proposed replacing it with a limit on the tax exclusion for employer-sponsored health insurance (ESI). Doing so would be a wise choice, and limiting the ESI exclusion would both generate significant revenue to pay for an ACA replacement and help to limit the overall growth of health care spending. In this piece, we discuss some of the options available for replacement. (Click here to jump to replacement options)

The Case for Limiting the ESI Exclusion

The ACA's Cadillac tax is scheduled to go into effect in 2020 and projected to raise about $100 billion through 2027. The purpose of the tax is to indirectly chip away at the ESI exclusion, which itself is projected to lose $2 trillion of income tax revenue (and $1.6 trillion of payroll tax revenue) over the next decade. At first, the Cadillac tax will only affect high-cost health insurance plans – generally those which cost over $11,000 ($29,000 for families) per year – and would likely lead employers to offer cheaper plans in their place. Because the threshold for the tax is indexed to inflation, however, it will affect an increasing number of plans over time.

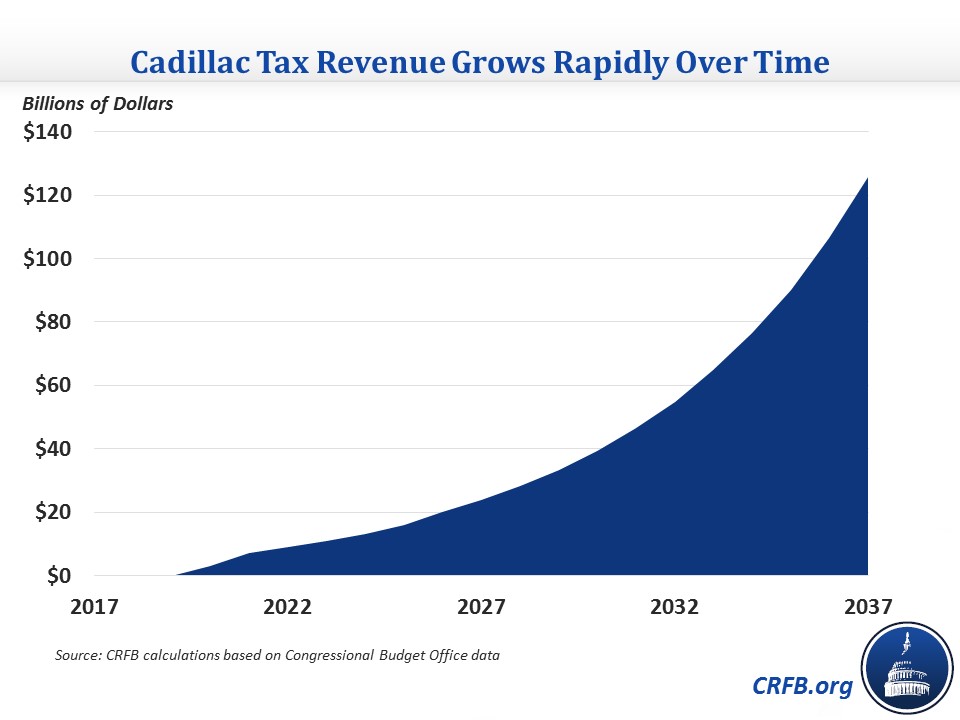

Though the Cadillac tax is apparently unpopular among politicians, it has broad support among economists on both the left and right. They tend to point to three major advantages of the tax. First and most importantly, by offsetting the uncapped tax benefit for health insurance the tax is believed to be one of the government's strongest tools to slow the unsustainable growth of health care spending. Second, the tax will increase wages and salaries by limiting the incentive of employers to expand tax-free health insurance benefits instead of paying their workers in higher taxable wages. And finally, the tax is likely to generate substantial tax revenue over time and thus reduce future deficits. While the Congressional Budget Office (CBO) estimates it will raise about $100 billion over the next decade, we estimate it will raise roughly $700 billion in the following decade and more in the years after that.

Importantly, the Cadillac tax is not the only, or even necessarily, the best way to achieve these three important objectives. A more direct limit to the ESI tax exclusion would also slow health care cost growth, increase wages, and reduce future deficits. In fact, recent analysis suggests a direct limit to the ESI exclusion could achieve these goals in a more progressive and efficient way and would have the further benefit of better equalizing the tax treatment of wage- and non-wage income.

Options to Replace the Cadillac Tax

Repealing the Cadillac tax would cost about $100 billion over the next decade. In addition, repealing the ACA's employer mandate would cost about $200 billion, repealing its Medicare surtax would cost another $150 billion, and repealing the other taxes in the ACA would cost an additional $550 billion.

To ensure new "replacement" coverage provisions are enacted in a fiscally responsible way, lawmakers will either need to retain some of the taxes described above, cover fewer people than under current law, spend far less per person covered than under current law, identify new spending cuts, identify new revenue sources, or some combination.

Changes to the ESI tax exclusion can help to cover these costs. Capping the income tax inclusion at the 75th percentile of plan costs beginning in 2020 would raise $200 billion – enough to fund the revenue loss from repealing the Cadillac tax twice over. Under this policy, companies could offer insurance plans of any size, but employees would pay income tax on any cost above $9,500 ($23,900 for families) just as they would on cash wages. A similar cap set at the 50th percentile level would raise $400 billion over a decade.

Options for Replacing the Cadillac Tax with a Health Exclusion Limit in 2020

| Option | Rough 2018-2027 Savings/Cost (-) | |

|---|---|---|

| Repeal Cadillac Tax | -$100 billion | |

| Repeal the Employer Mandate | -$200 billion | |

| Repeal the 0.9% Medicare Surtax | -$150 billion | |

| Repeal the Other ACA Tax Increases | -$550 billion | |

| Cap the Income Tax Exclusion | ||

| Cap at the 75th Percentile, Indexed to CPI | $200 billion | |

| Cap at the 50th Percentile, Indexed to CPI | $400 billion | |

| Eliminate the Income Tax Exclusion | $1.3 trillion | |

| Cap the Payroll Tax Exclusion | ||

| Cap at the 75th Percentile, Indexed to CPI | $100 billion | |

| Cap at the 50th Percentile, Indexed to CPI | $200 billion | |

| Eliminate the Payroll Tax Exclusion | $1.1 trillion | |

| Eliminate the Medicare Payroll Tax Exclusion | $250 billion | |

| Replace the Income Tax Exclusion w/ Fixed-Dollar Credit/Deduction | ||

| Index the Credit or Deduction to CPI | $200 billion | |

| Index the Credit or Deduction to GDP | $100 billion | |

| Other Changes | ||

| Limit the Value of the Exclusion to the 28% Bracket | $50 billion | |

| Phase Out the Exclusion Above $250K of Income | $200 billion | |

| Eliminate the Deduction for Employee-Paid Premiums | $250 billion |

Sources: Congressional Budget Office, Joint Committee on Taxation, CRFB calculations

Note: All savings estimates are rounded to the nearest $50 billion since they are very rough.

Of course, policymakers have a number of other options at their disposal. For example, by our very rough estimates, fully eliminating the income tax exclusion beginning in 2020 would save $1.3 trillion through 2027, more than enough to replace all the revenue loss from repealing the ACA's taxes and its mandates. Policymakers could also replace the income tax exclusion with a fixed tax credit or deduction, which would retain the incentive to provide insurance but end the incentive to hold the most costly insurance and generate $100 to $200 billion of revenue, depending on how fast they indexed the new tax benefit.

A few other options include limiting the value of the exclusion to the 28 percent bracket (saving $50 billion) so the value of the tax benefit does not rise with income beyond about $250,000; phasing out the exclusion entirely for people making above $250,000 (which would save $200 billion); and eliminating the ability of employers to deduct employee-paid premiums through "cafeteria plans" (saving $250 billion).

Most of the changes to the income tax exclusion described above could be applied to the Social Security and Medicare payroll taxes as well given that the value of employer-sponsored health insurance is also excluded from the payroll tax. The caps in particularly would generate about 50 percent more if also applied to payroll taxes. For example, capping the payroll tax exclusion at the cost of the median plan would save $200 billion, on top of the $400 billion that could be saved by applying that cap to the income tax exclusion. Completely eliminating the exclusion just for the 2.9 percent Medicare payroll tax would generate $250 billion, enough to pay for repeal of the ACA's Medicare surtax and generate another $100 billion to extend Medicare solvency.

Importantly, though, budget estimates of changes to the payroll tax exclusion should be viewed with caution. For one, the same money cannot be used twice, so any funds that are used to strengthen the Social Security or Medicare trust funds should not also be used to pay for new insurance subsidies or tax cuts. In addition, since Social Security benefits are calculated based on taxed wages, most increases in Social Security revenue will ultimately be eaten up by future increases in Social Security costs.

Still, it is worth considering changes to the ESI exclusion on both on the income and payroll tax side (so long as there is there is no double-counting) in order to pay for "replace" legislation, strengthen trust funds, increase wages, slow health care cost growth, and ultimately reduce future debt levels.

Policymakers should certainly not repeal the Cadillac tax unless they are willing to address the ESI health exclusion or identify other ways to both replace the revenue and slow health care cost growth. The cost to the budget and the health care system would simply be too large.