One Month to Go for Highway Funding

In a newly released ticker, the Department of Transportation has shown that there is one month left for lawmakers to decide on funding for the Highway Trust Fund before cash flows to transportation projects are affected. After extending the highway authorization for two months at the end of May, lawmakers will have to come up with a new authorization and find a way to fund that spending to close the gap that has persisted since 2008.

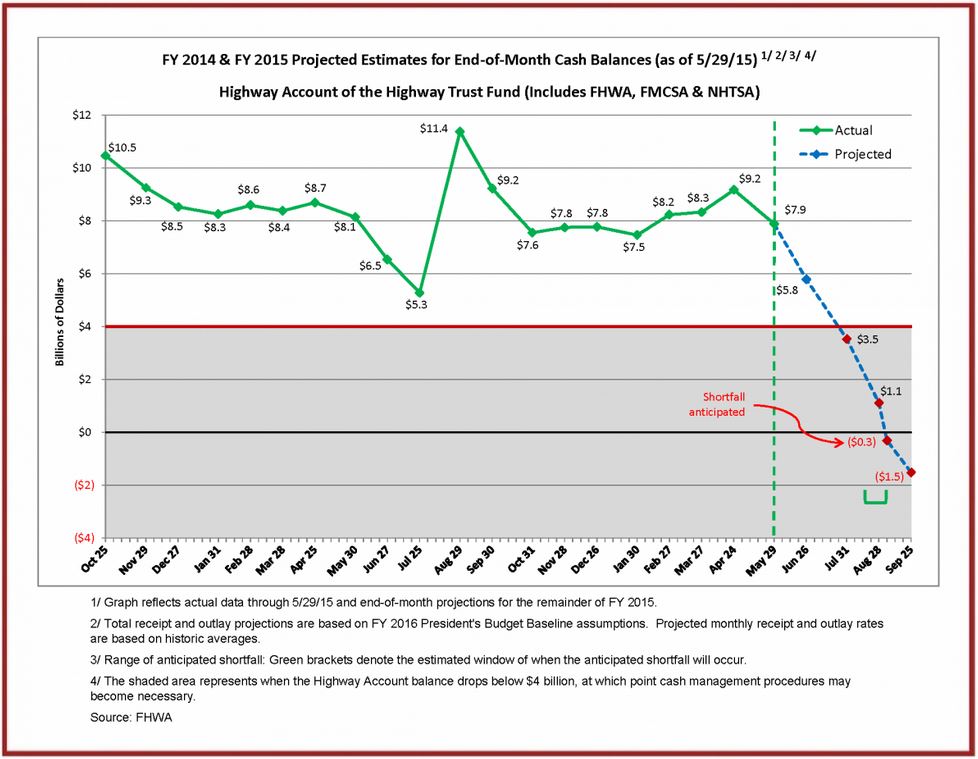

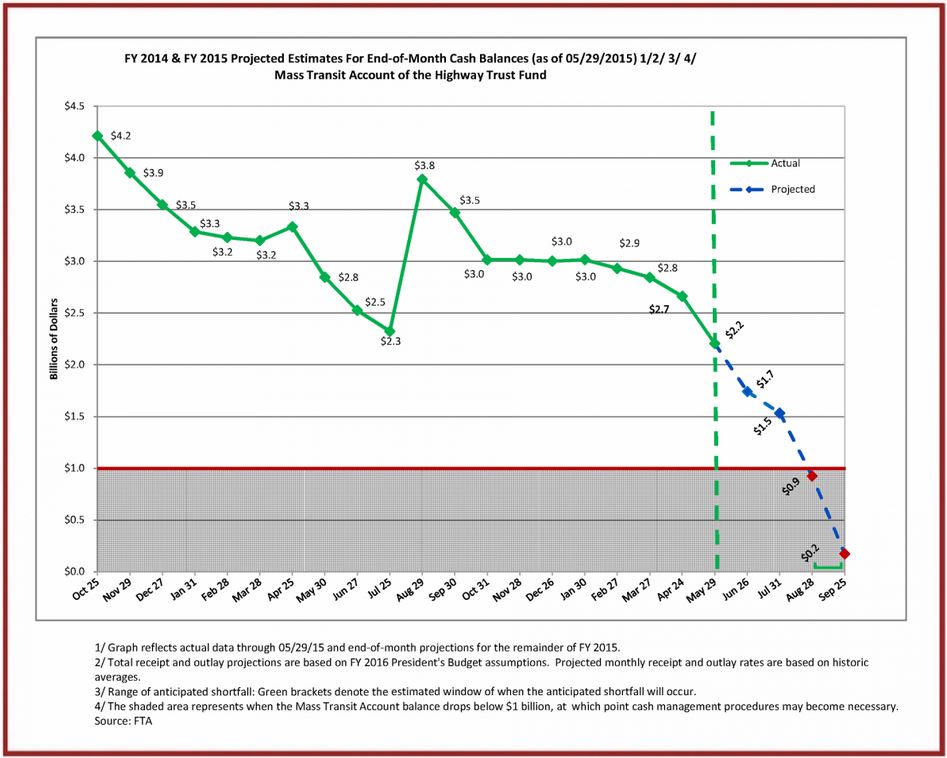

The DOT shows the balance of the highway account of the trust fund dropping from $8 billion at the end of May to $3.5 billion by the end of July, below the $4 billion cushion DOT says it needs to be able to make timely reimbursements of projects. The smaller mass transit account will have a little more time, falling below its $1 billion cushion by the end of August, but lawmakers consider these accounts together since they have the same funding source, so the true deadline is the end of July.

In the meantime, there has been some movement as the Senate Environment and Public Works Committee released a bipartisan six-year, $275 billion reauthorization of the highway portion of surface transportation. The bill would spend at about current law levels overall, meaning that it would need to close the $90 billion shortfall projected over that time (a shortfall that grows to $175 billion over ten years). Since the EPW bill doesn't change spending levels, other committees would have to either raise fuel taxes or otherwise increases taxes or cut spending to make up the difference. In other words, this bill does the politically easier part of determining spending levels, leaving how to pay for it to the rest of Congress.

Congress held two hearings related to highway financing last week: one in the Senate Finance Committee on using the private sector and one in the House Ways and Means Committee on using repatriation revenue to close the shortfall. At the Senate Finance Committee, witnesses and Senators generally agreed that public-private partnerships (P3s) were part of the solution but not a silver bullet for highway financing. The EPW bill funds the Transportation Infrastructure Finance and Innovation Program, which provides credit to private projects, at $675 million per year, below the current level of $1 billion. The Ways and Means Subcommittee on Select Revenue Measures discussed various ways to fund the trust fund with repatriation, either via the mandatory deemed repatriation proposed by President Obama and former Chairman Dave Camp (R-MI) or a voluntary repatriation holiday (which doesn't actually work as an offset). These policies got mixed support, but most agreed that repatriation had limited ability to solve the immediate financing issue, since it would usually be done in the context of tax reform that would take more time than they had.

Our "Road to Sustainable Highway Spending" plan prescribes a different way to bring spending and revenue in line. It includes an upfront transfer offset with real savings to pay for legacy costs, and then provides a fast-track process for tax reform to fund highway spending. The default plan if lawmakers do nothing would increase the gas tax by 9 cents and then limit spending to the previous year's trust fund income, meaning $100 billion of revenue increases and $50 billion of spending cuts. However, lawmakers could stay within the framework while keeping current law spending as long as they raise the gas tax to pay for it or find alternate financing sources. Ultimately, the plan more closely links spending and revenue in contrast to the patchwork financing that's been used since 2008.

Whichever way they go, Congress bought itself two months of time specifically so it could solve the Highway Trust Fund's financing issues. They now have the month of July to get that done.