NYT Gets It Wrong on the Chained CPI

The New York Times has an editorial criticizing switching to the chained CPI for Social Security cost-of-living adjustments (COLAs). Recall that the chained CPI is widely regarded as a more accurate measure of inflation because it better accounts for consumer substitution between different categories of related goods as relative prices rise or fall. As a technical matter, the chained CPI is the best available price index for accomplishing the goal in many spending programs and in the tax code of accurately accounting for inflation in determining various benefits.

The NYT's arguments are flawed for a number of reasons. Their main arguments against the chained CPI are:

- Deficit reduction should be held off until the economy has fully recovered.

- Social Security is not driving the deficit. It will not be able to pay full benefits in 20 years, but that is a separate issue which should not be dealt with in the context of deficit reduction.

- The chained CPI may be a more accurate measure of inflation for the working age population but it is not for the elderly population. Instead, the Bureau of Labor Statistics should develop a retiree-specific price index.

On the first point, the issue of when deficit reduction occurs is actually a strong point for the chained CPI. Because the savings compound over time, the deficit reduction associated with the chained CPI starts off small and is very backloaded. Of the $390 billion in total savings over the next decade from switching to chained CPI, only a miniscule $12 billion would arise in the first two years. Based on CBO's report on the macroeconomic effects of deficit reduction, that means an economic effect of 0.03 percent of GDP in 2015, essentially a rounding error.

Source: CBO

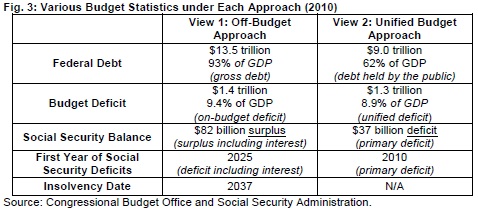

On the second point, we have said before that whether one views Social Security as a stand-alone program or part of the federal budget, it leads to the conclusion that changes should be enacted sooner rather than later. The editorial appears to take the off-budget view of Social Security, but that view shows that small gradual changes made now can avoid abrupt and harmful changes later. Switching to the chained CPI would close about one-fifth of Social Security's 75-year funding gap. By the unified-budget approach, Social Security is the single largest government program currently. Although it isn't expected to grow as fast as Medicare and Medicaid, it is growing faster than eveything else, certainly much faster than the areas of the budget we have addressed in the spirit of deficit reduction so far.

Note: Numbers in the chart are out of date and should not be cited. This chart is being used as an example of the two views.

On the third issue, the Times to their credit does call for a "statistically rigorous" index for elderly-specific inflation, rather than calling for using the Experimental Consumer Price Index for the Elderly (CPI-E). The CPI-E is not a fully developed price index (hence, the "experimental") and suffers from a number of methodological flaws, including its small sample size, its failure to account for senior discounts and other purchasing habits, and the question of whether the CPI actually measures health care inflation correctly. Still, even a robust version of the CPI-E would represent a policy change rather than a technical correction, since the current COLA, as with most other government programs and provisions, is based on overall inflation. If policymakers were to use a retiree-specific price index for Social Security, this would represent a benefit expansion that should only be done in the context of a plan to make the program solvent. And to be technically accurate, that retiree-specific price index would still need to be "chained."

Finally, it is worth pointing out that while The New York Times editorial is only about Social Security, switching to the chained CPI would actually result in savings throughout government. Indeed, while it would generate savings on the entitlement side it (as Republicans have called for), it would also generate new revenue (as Democrats have called for).

In total, Social Security only accounts for about one-third ($127 billion) of the ten-year deficit reduction ($390 billion), with revenue counting for another one-third and the rest from other spending programs and interest. Indeed, if accompanied with protections for the poor and very old as most chained CPI proposals would, an even smaller portion of the net package would come from Social Security. Maintaining overly generous COLAs for everyone makes little sense when protections can be targeted to the specific vulnerable populations.

Experts from across the spectrum agree that the chained CPI is the best available measure for overall changes in the cost of living. Improved accuracy of inflation measurement should be a goal even absent budgetary impact, but especially given the many tough tax and entitlement choices policymakers will be facing to put the debt on a clear downward path. That is why every serious bipartisan budget plan -- from Simpson-Bowles, to Domenici-Rivlin, to the forming Obama-Boehner plans -- has recommended it. We hope the President's budget follows suit.

Click here to read our full analysis of the chained CPI, "Measuring Up: The Case for the Chained CPI."