No, President Biden Has Not Implemented Historic Deficit Reduction

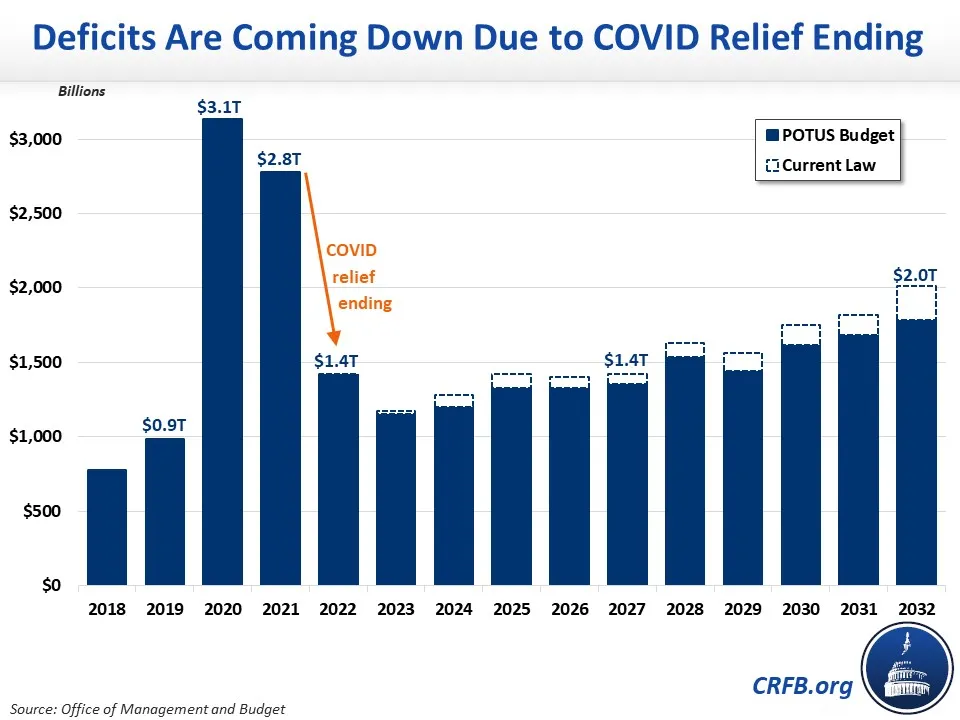

While President Biden’s Fiscal Year (FY) 2023 budget calls for $1.05 trillion of welcomed deficit reduction, the Administration has largely been focused on taking credit for the expected $1.3 trillion fall in the deficit between FY 2021 and 2022. The Administration touting this victory is highly misleading; deficits are falling mainly because COVID relief is ending, and deficits will remain high even after this decline.

In President Biden’s State of the Union address, a White House fact sheet and press release, and several Twitter posts, the Administration has taken credit for what it calls “historic deficit reduction.” In a tweet in late March, President Biden declared, “my Administration is on track to cut the deficit by more than $1.3 trillion.”

While deficits are projected to decline from $2.8 trillion in 2021 to $1.4 trillion in 2022, this is mainly because Congress and the Administration increased deficits in 2021 (by $1.2 trillion), not because they reduced deficits in 2022.

Indeed, the main source of falling deficits is the expiration of most COVID relief such as enhanced unemployment benefits and recovery rebates. The remaining decrease is largely the result of strong income growth and high inflation.

Prior to the passage of the American Rescue Plan, the Congressional Budget Office (CBO) estimated the 2022 deficit would total $1.06 trillion, meaning the White House’s latest estimates of the 2022 deficit is $365 billion higher than projected when the President took office. Meanwhile, annual deficits will remain above pre-pandemic levels over the next decade and reach a whopping $1.8 trillion by 2032 under the President’s budget.

The President’s actions to date have not reduced deficits but instead increased them. Between the American Rescue Plan, the bipartisan infrastructure law, and various executive orders, we estimate at least $2.5 trillion has been added to deficits through 2031 over the President’s term so far. This excludes the recent omnibus spending bill, which may have added as much as $500 billion more over a decade, but due to high inflation, it largely represented a continuation of current services.

Deficit Increases During President Biden's Term So Far

| Enacted Policy | 2021-2031 Fiscal Cost |

|---|---|

| American Rescue Plan | $1,850 billion |

| Bipartisan Infrastructure Law | $400 billion |

| Expansion of SNAP Benefits (EO) | $180 billion |

| Extension of Student Debt Forbearance (EO) | $70 billion |

| Total, Deficit Increases | $2.5 trillion |

Source: Congressional Budget Office, Committee for a Responsible Federal Budget.

Note: Estimates exclude the effect of the FY 2022 omnibus appropriations bill, which increased the deficit by roughly $500 billion relative to CBO’s July 2021 baseline but would be roughly budget neutral relative to inflation. EO = Executive Order

We are pleased to see the Administration stress the importance of fiscal responsibility and put forward over $1 trillion of concrete deficit reduction proposals. We believe this could represent an important first step toward meaningful action to improve the nation’s fiscal outlook.

But the hard work to enact these policies is still ahead. Inappropriately taking credit for “historic” deficit declines that still leave borrowing too high does little to advance deficit reduction.