Mid-Session Review Shows How Much Worse the Deficit Has Gotten in the Past Year

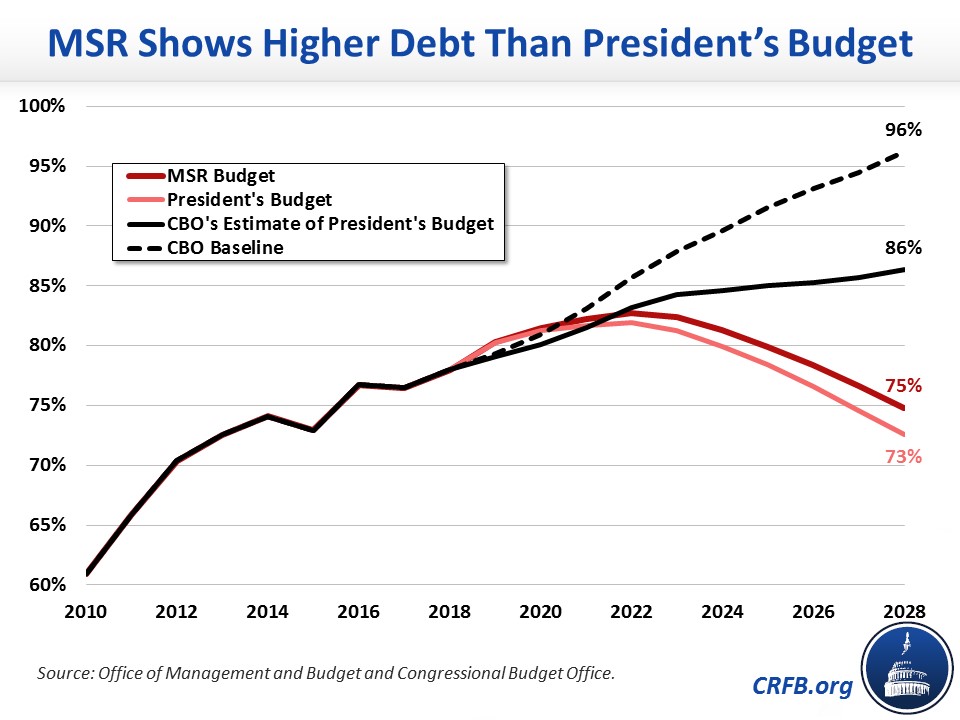

The Office of Management and Budget (OMB) released the Mid-Session Review (MSR) last week, updating the President's FY 2019 budget projections with legislation enacted since its release (and just prior to it). Even under OMB's rosy economic projections and aggressive deficit reduction, next year's deficit would reach nearly $1.1 trillion under the President's budget before gradually falling to just under half a trillion dollars by 2028. Debt held by the public as a share of the economy would rise from around 77 percent today to about 83 percent by 2022 before falling to 75 percent by 2028. The MSR shows just how much further our fiscal situation has deteriorated.

As we noted in a statement, the MSR projects the 2019 deficit will be twice as large as the one estimated in the Administration's FY 2018 budget, owing largely to the unpaid-for tax cuts and spending increases of the past year.

The MSR tells a similar story to the original President's 2019 budget, albeit with higher deficits. According to OMB, ten-year deficits would be $926 billion higher over the 2019-2028 window. All of this change is due to the enactment of legislation and resulting policy changes and debt service. Economic and technical reestimates show higher revenues than originally anticipated but almost equally higher mandatory outlays (mostly in the form of debt service). As a result, the 2019 deficit under the President's budget would be $1,085 billion – $101 billion more than estimated back in February.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2019-2028 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Deficits (Billions) | |||||||||||

| MSR | $1,085 | $1,076 | $1,011 | $952 | $875 | $749 | $659 | $608 | $549 | $458 | $8,021 |

| President's Budget | $984 | $987 | $916 | $852 | $774 | $672 | $579 | $517 | $450 | $363 | $7,177 |

| CBO Estimate of President's Budget | $955 | $866 | $945 | $1,039 | $971 | $859 | $895 | $893 | $965 | $1,087 | $9,474 |

| CBO Baseline | $973 | $1,003 | $1,118 | $1,275 | $1,273 | $1,245 | $1,352 | $1,321 | $1,314 | $1,527 | $12,401 |

| Deficits (% of GDP) | |||||||||||

| MSR | 5.1% | 4.8% | 4.3% | 3.9% | 3.4% | 2.8% | 2.3% | 2.0% | 1.7% | 1.4% | 3.2% |

| President's Budget | 4.7% | 4.5% | 3.9% | 3.7% | 3.0% | 2.3% | 2.1% | 1.7% | 1.4% | 1.4% | 2.9% |

| CBO Estimate of the President's Budget | 4.5% | 3.9% | 4.1% | 4.4% | 3.9% | 3.4% | 3.4% | 3.2% | 3.4% | 3.6% | 3.7% |

| CBO Baseline | 4.6% | 4.6% | 4.9% | 5.4% | 5.2% | 4.9% | 5.1% | 4.8% | 4.6% | 5.1% | 4.9% |

Sources: Office of Management and Budget and Congressional Budget Office.

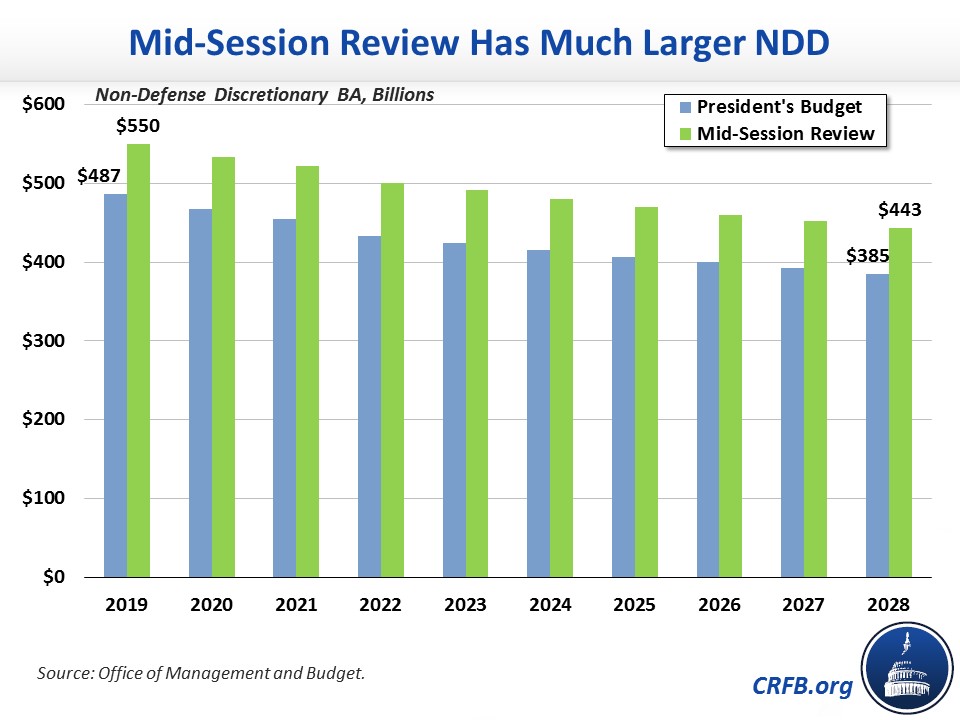

The biggest policy difference between the MSR and the President's budget comes from how they deal with discretionary spending. The President's budget, which didn't incorporate the Bipartisan Budget Act (BBA) of 2018 that increased spending caps for 2018 and 2019, had proposed to increase 2019 defense budget authority (BA) $54 billion above the Budget Control Act (BCA) caps and decrease non-defense discretionary BA $54 billion below the caps. The BBA increased the 2019 defense BA cap by $85 billion to $647 billion and the non-defense BA cap by $67 billion to $597 billion. The MSR accepts the BBA's cap for defense but requests a $57 billion BA cut for non-defense, rolling back most of the BBA increase but rejecting the larger cut the original budget called for. This results in the MSR's overall defense BA (including Overseas Contingency Operations) being about even with the President's budget, but non-defense BA ends up being $63 billion higher in 2019 than the President's budget.

Because the budget's proposal for a "two-penny plan" (two percent annual) reduction in non-defense levels depends on the starting level of non-defense BA, the MSR ends up increasing ten-year non-defense BA nearly $700 billion above the President's budget. Ten-year defense BA is roughly the same in the MSR as in the President's budget, though with almost all defense funding moved to the base budget rather than the sizeable portion that was in OCO.

Importantly, the MSR would also extend two additional individual tax provisions from the December 2017 tax law that the budget did not originally extend related to pass-through business income, which are responsible for about three-quarters of the $285 billion individual revenue loss in the updated estimates. Additionally, the MSR continues to assume extremely rosy economic growth that is higher than every other estimator.

While the MSR (and President's budget) contains important deficit reduction proposals that lawmakers should consider, it also continues to demonstrate how the past year's reckless legislation has made our fiscal situation even worse. Policymakers should come together to enact long-term deficit reduction – in the form of entitlement reforms, revenue increases, and spending decreases – that puts our debt on a downward trajectory as a share of the economy.