Marc Goldwein: Candidates, Stop Perpetuating Social Security Myths. Start Offering Solutions.

Marc Goldwein is the Senior Vice President and Senior Policy Director of the Committee for a Responsible Federal Budget. He wrote a guest post that appeared on the RealClearPolicy blog. It is reposted here.

There’s an old saying that Social Security is the third rail of American politics — touch it and you die. That’s unfortunate, given that Social Security is on a path towards insolvency; failure to touch it will result in an abrupt, 21 percent across-the-board cut in benefits for everyone who relies on the program, according to the 2015 Social Security Trustees’ report.

Far too little attention on the campaign trail has been given to the types of solutions necessary to fix Social Security and too much to perpetuating myths that cloud the discussion. In addition to an interactive online tool, “The Reformer,” that allows ordinary citizens to choose various policy options and come up with their own Social Security plan, we at the Committee for a Responsible Federal Budget have released a paper identifying and debunking some of the myths that we’ve heard in the 2016 campaign.

One of the most common myths is the idea that we don’t need to worry about Social Security for many years since estimates from the Social Security trustees show that the trust funds have sufficient reserves to pay full benefits through 2034. The fact is there is a high cost to waiting.

The longer we wait to address the program’s long-term fiscal challenges, the bigger the problem gets and the more painful the policy choices will be. If lawmakers wait until 2034, what could be solved by raising taxes or reducing benefits for new beneficiaries by about one-fifth today would require a one-third tax increase or a benefit cut larger than all new benefits. We can either make thoughtful and gradual changes now, in advance of when the trust funds run out of money, or we will be forced to make more drastic ones later, once they do.

Another myth accepts that we have a problem, but insists that it only came about because we “raided the trust fund” in the 1990s and 2000s. But for that, Social Security would be fine.

While it is true that Social Security ran $1.1 trillion of primary surpluses over that time period — and there is some evidence that this allowed policymakers to enact more spending increases and deficit-financed tax cuts than they would have otherwise — this has little to do with Social Security’s projected insolvency. Currently, the Social Security trust fund holds $2.8 trillion in bonds — meaning the program can run the equivalent of nearly $3 trillion worth of deficits going forward before the trust fund runs out. But Social Security is projected to run closer to $13.5 trillion of deficits (on a present-value basis) over the next 75 years, only a very small portion of which can be covered by the supposedly raided funds.

Many of the other myths wrongly suggest that there are easy solutions to Social Security’s insolvency. Examples include the idea that we can fix the program’s financial problems simply by getting rid of “waste, fraud and abuse” or by increasing the amount of income subject to Social Security’s 12.4 percent payroll tax.

“Waste, fraud, and abuse” is largely a red herring. The Social Security Administration estimates that improper payments total about $5 billion per year, and even if SSA could somehow eliminate all improper payments that would only cover 3 percent of the $150 billion needed each year to make Social Security solvent.

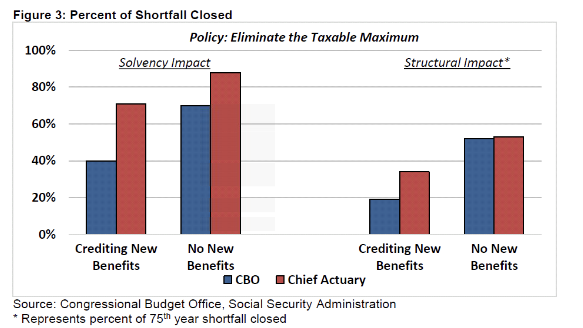

Increasing the amount of income subject to the payroll tax (and used to calculate benefits) — currently $118,500 — really could make a difference. But, by itself, it won’t be enough to close the gap. Even fully eliminating the taxable maximum — raising the top federal tax rate to 56 percent — would close only two-fifths to three-quarters of the program’s funding gap and one-fifth to one-third of its long-term structure gap.

Here are the simple facts that should be driving the conversation: doing nothing about Social Security means a massive benefit cut in the not-so-distant future; waiting means that the needed changes will be much more painful.