Nine Social Security Myths You Shouldn’t Believe

Social Security is a vital program for tens of millions of seniors, dependents, and workers with disabilities, and it has been a hot topic of conversation in the 2016 election campaign as well as discussions in and outside of Washington. Unfortunately, the program is currently on a financially unsustainable path toward insolvency. Already, Social Security pays more in benefits than it is raises from payroll taxes, a trend that is projected to worsen as the baby boom generation continues to retire and life expectancy grows.

The Social Security Trustees project that the trust funds will run out of reserves in just 18 years, and the Congressional Budget Office (CBO) projects they will run out in 13 years. Little time remains to enact sensible changes that would avoid deep cuts for nearly all seniors and workers with disabilities.

Yet too little of the discussion in Washington and on the campaign trail is about the types of solutions necessary to fix Social Security, and too much is focused on perpetuating myths that cloud the discussion. In this paper, we identify and debunk nine such myths:

Myth #1: We don’t need to worry about Social Security for many years.

Myth #2: Social Security faces only a small funding shortfall.

Myth #3: Social Security solvency can be achieved solely by making the rich pay the same as everyone else.

Myth #4: Today’s workers will not receive Social Security benefits.

Myth #5: Social Security would be fine if we hadn’t “raided the trust fund.”

Myth #6: Social Security cannot run a deficit.

Myth #7: Social Security has nothing to do with the rest of the budget.

Myth #8: Social Security can be saved by ending waste, fraud, and abuse.

Myth #9: Raising the retirement age hits low-income seniors the hardest.

Below, we debunk these myths in the hopes that an honest discussion of the facts will lead the next President and Congress to come together and put Social Security on sound financial footing.

Read the short version as a printer-friendly PDF.

Myth #1: We don’t need to worry about Social Security for many years

Fact: There is a high cost of waiting to reform Social Security.

According to estimates from CBO and the Social Security Trustees, the Social Security trust funds have sufficient reserves to pay full benefits through 2029 or 2034. This has led some to claim Social Security reform can be put off well into the future; they are wrong.

Although 2034 seems to be far away, many of today’s newest retirees would likely still be on the program – turning 80 – and today’s 49-year-olds would be reaching the normal retirement age. At that point, all beneficiaries would face an immediate across-the-board benefit cut of about one-fifth.

The cost of waiting to avoid this cut is high. The longer lawmakers wait to enact Social Security reform, the more abrupt and less targeted changes will have to be, the less time workers will have to plan and adjust, and the fewer the options policymakers will have. Perhaps more importantly, the size of the problem literally grows over time.

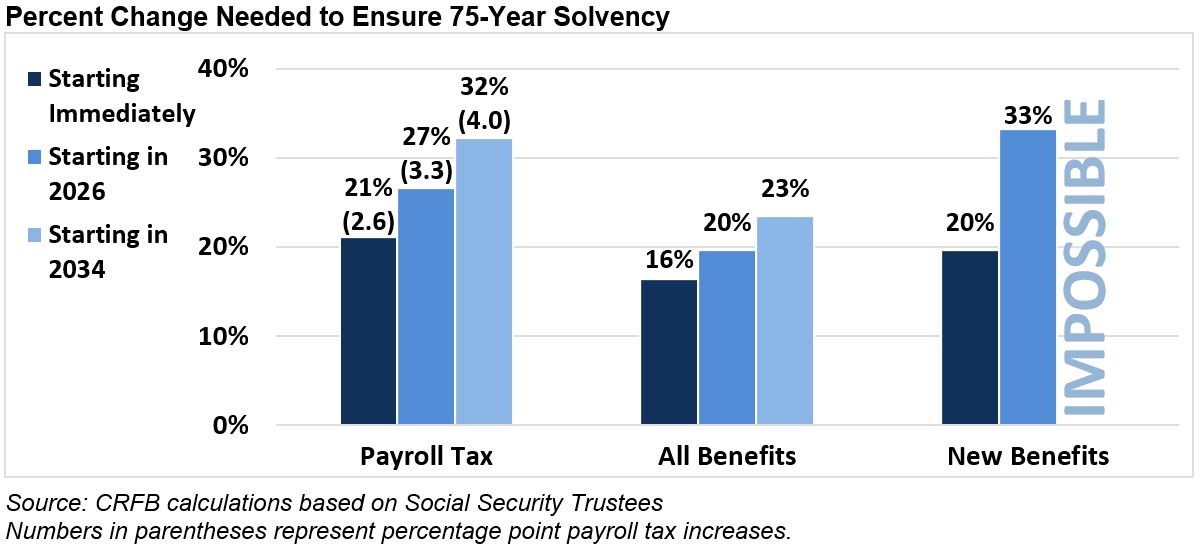

For example, based on projections from the Trustees, the payroll tax would need to rise 21 percent (2.6 points) today to make Social Security solvent but by 32 percent (4.0 points) if lawmakers wait until 2034 to act.

The size of the necessary across-the-board benefit cut would similarly grow from 16 percent today to 20 percent in a decade and 23 percent by 2034. If lawmakers exempted existing beneficiaries, that cut would be 20 percent today, 33 percent in a decade, and literally could not solve the problem by 2034.

Prompt action is the best way to keep the program solvent. For this reason, “the Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them… [and] allow more generations to share in the needed revenue increases or reductions in scheduled benefits.”

Read more about the cost of waiting here.

Myth #2: Social Security faces only a small funding shortfall.

Fact: Social Security faces a large but manageable financing gap.

Although many have claimed Social Security’s shortfall is small, the reality is that significant adjustments will be needed to bring spending and revenue in line. In 2016, Social Security will spend about $70 billion more on benefits than it will generate in tax revenue. As the population ages, that gap will only widen.

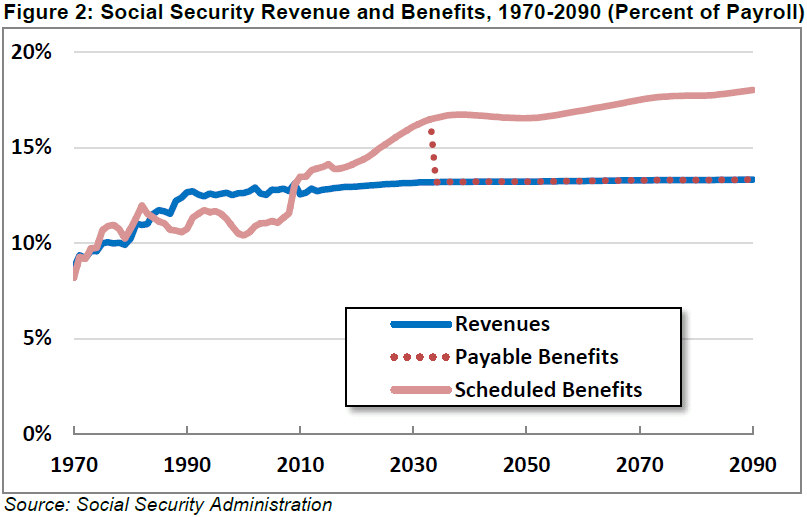

Social Security spending has already risen from 10.4 percent of payroll in 2000 to 13.9 percent of payroll this year. The Trustees project the cost of scheduled benefits to further grow to 16.7 percent of payroll by 2040 and 18 percent by 2090. Meanwhile, revenue will remain relatively constant at about 13 percent of payroll.

Addressing this large and growing gap will require significant adjustments. Even acting immediately to make Social Security solvent for the next 75 years would require the equivalent of an immediate 21 percent (2.6 point) payroll tax increase or 16 percent across-the-board benefit cut, according to the Trustees. CBO estimates that a much larger 35 percent (4.4 point) tax increase or 26 percent benefit cut would be necessary. Closing the program’s structural gap permanently will require a much larger tax increase of 38 to 52 percent, or a spending cut of 27 to 32 percent.

These shortfalls are much larger than the shortfall closed in the 1983 Social Security reforms.

Myth #3: Social Security solvency can be achieved solely by making the rich pay the same as everyone else.

Fact: Eliminating the payroll tax cap would still leave a shortfall.

Currently, Social Security’s 12.4 percent payroll tax applies to a worker’s first $118,500 of wage income, and benefits are calculated based on that income. Though this “taxable maximum” is indexed to wage growth, it currently only covers about 83 percent of all wages – meaning 17 percent remain tax free.

One common suggestion for solving the Social Security shortfall is to lift or eliminate the taxable maximum so more income is subject to the 12.4 percent payroll tax. This change would significantly improve Social Security’s finances, but it would not by itself make the program sustainably solvent – and thus other actions would be necessary.

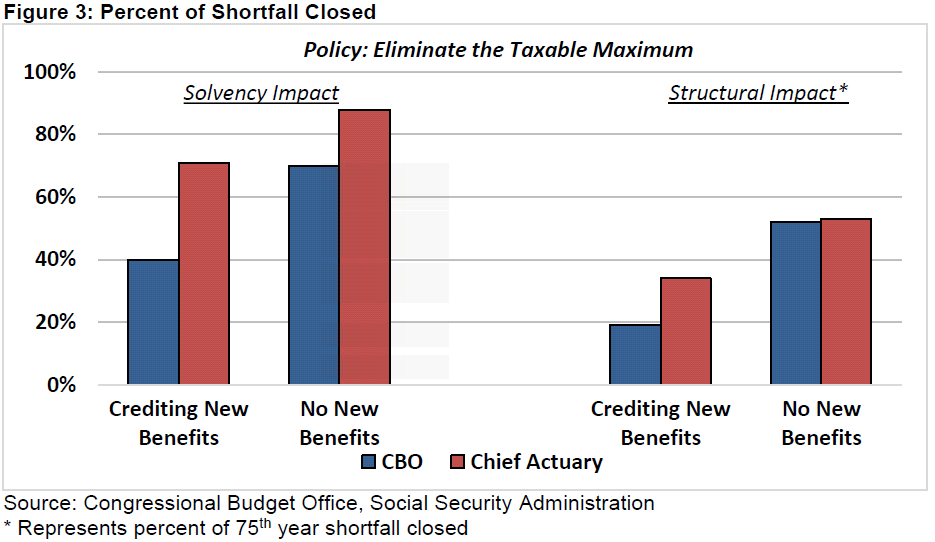

According to the Chief Actuary of the Social Security Administration, eliminating the taxable maximum would extend the life of the trust fund by 32 years, close 71 percent of the program’s 75-year gap, and close 34 percent of the structural gap by the end of the projection window. CBO estimates the same policy would extend the life of the trust fund by 10 years, close about 40 percent of the program’s 75-year gap, and close 19 percent of the structural gap.

One reason this policy does so little in the longer term is that the current Social Security structure pays benefits based on the amount of income being taxed, so eliminating the taxable maximum would significantly increase future benefits for higher earners. Breaking this link between taxes and contributions so that higher earners pay more taxes but do not receive more benefits would allow policymakers to close 71 to 88 percent of the 75-year gap and slightly more than half of the structural gap.

Even in this case, more would need to be done to fully ensure solvency. Working within the confines of the current system, such a policy would likely need to be accompanied by changes that slow the growth of benefits and/or increase taxes on income below the taxable maximum.

Myth #4: Today’s workers will not receive Social Security benefits.

Fact: Even if policymakers do nothing (which they shouldn’t), the program will still be able to pay about three-quarters of benefits.

Social Security has been around since 1935, and there is no indication that anyone intends to eliminate the program. Although Social Security faces serious financial challenges, benefits would not disappear unless lawmakers acted to eliminate them.

While the Trustees expect the combined trust fund reserves to be depleted in 2034, payroll tax revenue will continue to flow into the trust funds. This revenue would initially be sufficient to pay 79 percent of scheduled benefits and would ultimately decline to 73 percent by 2090.

Rather than causing benefits to “disappear,” the absence of legislation would probably either lead monthly checks to be reduced by about one-fifth (more in later years) or to be issued on a delayed basis, resulting in equivalent annual benefit cuts. This cut would apply to all current beneficiaries regardless of age or income as well as to future beneficiaries.

An immediate cut of that magnitude – particularly for older and lower income retirees – could be devastating. For that reason, most observers agree that Congress should take action to avoid such an abrupt cut.

Myth #5: Social Security would be fine if we hadn’t “raided the trust fund.”

Fact: The program’s financial shortfall stems primarily from a growing mismatch between benefits paid and incoming revenue.

In the 1990s and 2000s, Social Security ran $1.1 trillion in primary surpluses, and including interest, it has accumulated $2.8 trillion of trust fund assets. Those assets are invested in special U.S. Treasury bonds and effectively loaned to the rest of the government. Many argue that these Social Security surpluses masked other deficits in the rest of the government and thus allowed policymakers to enact more deficit-financed tax cuts or spending increases than they otherwise would have. In that sense, it could be argued that Congress and the President “raided the trust fund.”

However, regardless of how that money was used, the full $2.8 trillion is still owed to the Social Security trust fund under current law, and nearly all measures of Social Security’s long-term projections assume the $2.8 trillion will be repaid. Redeeming these bonds will require the non-Social Security parts of government to tax more, spend less, and/or borrow more than would have otherwise been necessary. In nominal dollars, the Trustees project paying trust fund principle and interest will cost the rest of the government about $4.4 trillion through 2034.

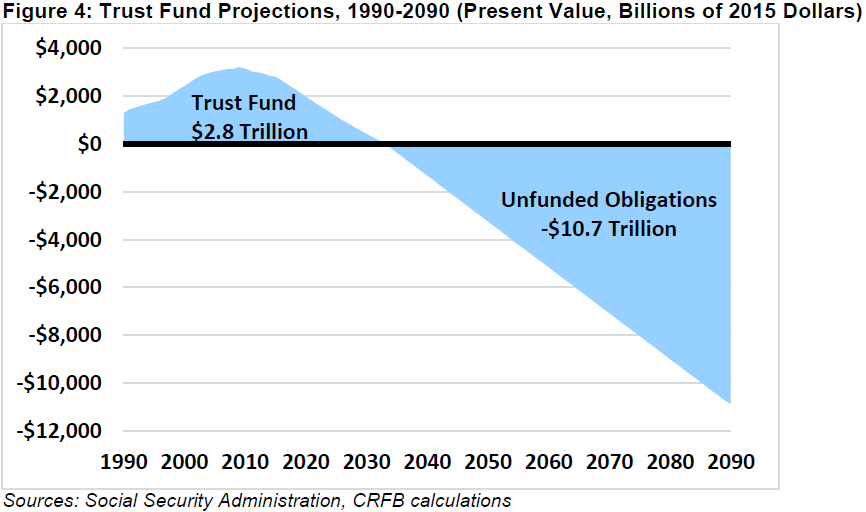

The reality is that Social Security doesn’t face financial problems because those funds will not be repaid (they will) but rather because the trust fund is dwarfed by the system’s projected shortfall over time. On a present-value basis, the program is projected to spend $13.5 trillion more than it raises in revenue over the next 75 years – far more than the $2.8 trillion held in the trust fund. In other words, policymakers must identify $10.7 trillion, or about 2.7 percent of payroll, to make Social Security solvent even after the trust fund’s holdings are paid back.

Myth #6: Social Security cannot run a deficit.

Fact: Social Security is running a cash deficit today, and it will keep running deficits until its trust funds run out.

Social Security is legally barred from going into debt; in other words, it cannot spend more than it takes in (or has transferred in) over the life of the program. However, the program can (and does) run annual deficits. In 2016, for example, Social Security will run a cash-flow deficit of about $70 billion. Over the next decade, the Trustees project cash-flow deficits of $1.5 trillion, and CBO projects deficits of $2.2 trillion. Even including interest income, the program is projected to begin running deficits by 2018 or 2020.

Because the Social Security trust funds currently hold $2.8 trillion in reserves, the program is projected by the Trustees to continue to run “annual deficits for every year of the projection period” until the trust funds are depleted in 2034. At that point, current law bars Social Security from paying benefits beyond what is collected in revenue.

Myth #7: Social Security has nothing to do with the rest of the budget.

Fact: Regardless of how Social Security is viewed, it interacts in many ways with the broader federal budget.

There are two different ways to look at Social Security: as its own isolated “off-budget” program or as part of the broader “unified” budget. We discuss these two frameworks in detail in our 2011 paper, “Social Security and the Budget.” Both of these frameworks are valid, and both show the program to have a financial problem. If treated in isolation, Social Security is on the road towards insolvency. If treated as part of the unified budget, Social Security is adding to the deficit, and this effect will increase over time.

If viewed as an off-budget program, Social Security does not directly add to the “on-budget deficit.” However, it indirectly contributes to the on-budget deficit because the interest payments it receives from the general fund are on-budget. It also receives funding from income tax revenue on Social Security benefits, which is technically on-budget, and has at times received general revenue transfers to compensate for policies that would reduce Social Security revenue (such as when lawmakers cut payroll taxes in 2011 and 2012).

Viewing Social Security as a self-financed program is not a reason to exclude it from fiscal constraints. In fact, this view highlights the need to make the program solvent for its own sake without relying on general revenue transfers or borrowing. To be self-sufficient, the program would need changes to bring spending in line with revenues.

Although Social Security is excluded from on-budget calculations, most economists consider the unified budget deficit to be a more meaningful measure of the government’s fiscal health because it better measures the budget’s impact on the economy. The Social Security system has been contributing to unified budget deficits on a cash-flow basis since 2010 and will continue to do so indefinitely. The federal government will have to borrow more, cut other spending, or raise taxes to make up for the Social Security system’s cash-flow deficit.

The Trustees noted the impact of the Social Security program on the federal budget in their recent report:

The trust fund perspective does not encompass the interrelationship between the Medicare and Social Security trust funds and the overall federal budget ... From a budget perspective, however, general fund transfers, interest payments to the trust funds, and asset redemptions represent a draw on other federal resources for which there is no earmarked source of revenue from the public. In the past, general fund and interest payments for Medicare and Social Security were relatively small. These amounts have increased substantially over the last two decades, however, and the expected rapid growth of Medicare and Social Security will make their interaction with the Federal budget increasingly important.

Myth #8: Social Security can be saved by ending waste, fraud, and abuse.

Fact: Even eliminating Social Security fraud would close only a tiny portion of the shortfall.

One popular idea to reduce Social Security spending is to eliminate improper and fraudulent payments made by the program. Certainly, some beneficiaries are fraudulently collecting Social Security retirement and (perhaps more frequently) disability benefits, and policymakers should do whatever they can to prevent this. However, even eliminating all fraud would not significantly improve the solvency of the program.

Simply put, there is not nearly enough waste, fraud, and abuse in the system to significantly impact its costs. The Social Security Administration estimates that improper payments – or payments made to the wrong person, for the wrong amount, or with insufficient documentation – total about $3 billion per year. By comparison, benefits would need to be cut by about $150 billion per year to make the program solvent.

This means that even assuming that the government could fully eliminate improper payments and do so with no additional spending on anti-fraud efforts – an impossible task – it would only close 2 percent of the program’s solvency gap. More realistic anti-fraud efforts would save only a fraction of that.

Myth #9: Raising the retirement age hits low-income seniors the hardest.

Fact: Raising the normal retirement age has roughly a proportional effect on benefits that actually affects the benefits higher earners slightly more.

One common proposal to improve Social Security’s finances – raising the normal retirement age – has been criticized as disproportionally affecting lower-income seniors. This claim makes intuitive sense, since workers with higher incomes tend to live significantly longer than those with lower incomes. However, the claim is based on a misunderstanding of how the retirement age works.

Social Security actually has several retirement ages, including an earliest eligibility age (62), a normal retirement age (headed to 67), and a delayed retirement age (70). Raising the normal retirement age – the only policy of the three that would significantly improve solvency – does not change eligibility but rather reduces the benefits one can receive at any age. In other words, raising the normal retirement age does not affect when people can claim benefits; it only affects when people can claim full benefits or how much they are penalized for claiming early.

Thus, an increase in the normal retirement age would result in a roughly proportional cut in scheduled benefits (both annual and lifetime) for all beneficiaries regardless of how old they are when they retire and when they pass on. The fact that higher earners are living relatively longer over time reduces the overall progressivity of the Social Security program but has virtually no impact on the progressivity of changing the normal retirement age.

Social Security experts from the left and the right agree on this fact. Former Social Security Administration Deputy Commissioners Andrew Biggs of the American Enterprise Institute has explained multiple times that raising the normal retirement age does not impact lower-income beneficiaries any more than higher income seniors. Social Security Advisory Board Chairman Henry Aaron of the Brookings Institution recently made a similar point, noting that “’raising the full benefit age from 67 to 70’ is simply a 24 percent across-the-board cut in benefits for all new claimants, whatever their incomes and whatever their life-expectancies.”

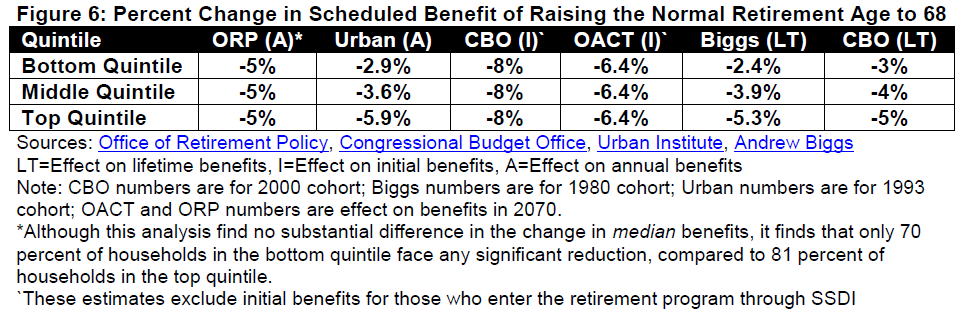

Indeed, actual analysis of raising the normal retirement age shows it is actually likely to be somewhat progressive relative to benefit levels. For example, CBO finds raising the retirement age by one year would reduce lifetime benefits for the highest earners by 5 percent but only reduce benefits by 3 percent for the lowest earners. Similarly, the Urban Institute finds annual benefits would fall 5.9 percent for the top quintile of earners compared to 2.9 percent for the bottom quintile. The main reason for this progressivity is that workers on the Social Security Disability Insurance (SSDI) program – who are disproportionally lower income – are unaffected by changes in the retirement age even after they enter the old-age program. Studies that find the policy to be literally across-the-board generally exclude these workers.

One caveat is that some proposals to raise the normal retirement age would also increase the earliest eligibility age. Enacting these policies together leads to complicated distributional outcomes that could be viewed as progressive or regressive depending in part on which measure of distribution one views as most important (annual, initial, or lifetime benefits), how one accounts for behavior, and whether one takes into account non-Social Security benefits.

In any case, it would be a mistake to look at the distributional impact of only one aspect of a comprehensive Social Security plan in insolation. Many plans that raise the retirement age would make the system much more progressive overall.

Read a summary of the new myths relelvant to the 2016 Campaign as a printer-friendly PDF. (2 pp.)

Read the full document as a printer-friendly PDF. (10 pp.)