The Long-Term Cost of Delaying Social Security Reform

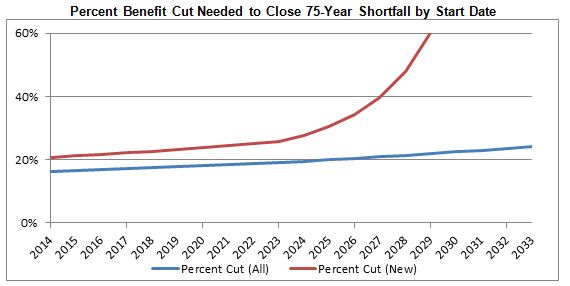

Last week, we noted that it was the 78th birthday of the Social Security program, but cautioned that reform was needed before we could count on another 78 years of sustainability. According to the latest Trustees Report, Social Security's trust fund is due to become insolvent by 2033, well within the lifetime of many of today's workers, and a 23 percent cut would need to be leveled on all beneficiaries for spending to match revenues. But compared to the decisions that need to be made on sequestration, the expiring government funding bill, and the debt ceiling, one might ask: Why is it important to do this now?

Today, CRFB has released a new report that shows the significant costs of waiting. While there are many options that could be combined to ensure 75-year solvency (try our Social Security Reformer to see), the longer policymakers wait to make reforms, the greater the costs. The report presents four main reasons why lawmakers cannot afford to wait with quantitative analysis for each.

- Waiting to Act Places a Greater Burden on Fewer People

- Waiting to Act Reduces the Accumulation of Interest in the Trust Fund:

- Waiting to Act Makes Cuts to Real Benefits Harder to Avoid

- Waiting to Act Gives Workers Less Time to Plan and Adjust

For instance, the percent benefit cut needed to close achive 75-year solvency is one of many examples that we use in the paper to show the advantages of starting early.

Achieving solvency for the program will require tough choices, which lawmakers may wish to avoid, but the challenge will only become more daunting the longer we delay. As we conclude in our paper: The right time to act to reform Social Security was two decades ago. The next best time is now.

Click here to read the full report.

Click here to try our Social Security Reformer.