The Kamala Harris Proposal to Raise the Corporate Tax Rate to 28%

The campaign for Democratic presidential nominee Vice President Kamala Harris told NBC News today that if elected President, she would seek to raise the corporate income tax rate to 28 percent. We estimate this change would reduce the deficit by $1 trillion over a decade.

US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Throughout the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.

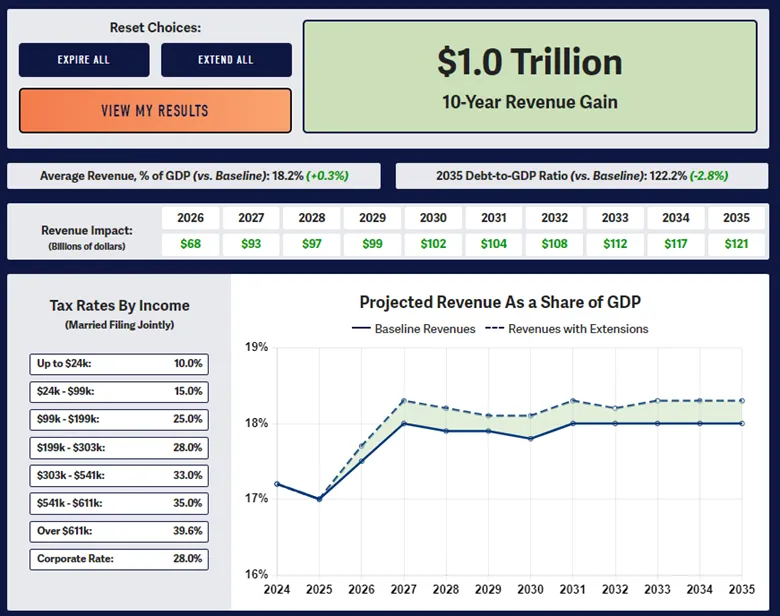

The current corporate income tax rate was set at 21 percent by the 2017 Tax Cuts and Jobs Act (TCJA), reduced from 35 percent before. Unlike the individual income portions and other business tax policies in the TCJA, the corporate income tax rate cut will not expire. Using our Build Your Own Tax Extensions tool, which allows users to design their own plan for tax reform in advance of the 2025 tax debate, we estimate that raising the rate to 28 percent would reduce the deficit by $1 trillion by raising significant revenue between Fiscal Years (FY) 2026 and 2035.

A similar proposal in the President’s FY 2025 budget was estimated to raise the same magnitude of revenues by other independent estimators as well. The Tax Foundation, for instance, estimates that the President’s proposal would raise $1 trillion from FY 2024-2034 while Penn Wharton Budget Model estimates that the President’s proposal would raise $1.2 trillion over the same time period – both on a conventional basis. Also similar to our tool, the Yale Budget Lab estimates that raising the corporate rate to 28 percent would raise about $1 trillion of revenue over a decade. On the other hand, the White House’s Office of Management and Budget estimated in the President’s FY 2025 budget that their proposal would raise $1.4 trillion from FY 2024 through 2034.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.