JCT's Latest Analysis Confirms Tax Bills Will Produce Modest Growth, Won't Pay For Themselves

The Joint Committee on Taxation (JCT) released its dynamic analysis of the House's version of the Tax Cuts and Jobs Act (TCJA) yesterday. JCT's analysis suggests the House bill would increase economic growth by roughly 0.1 percentage points per year over the next decade, which is similar to their estimate of the Senate bill. Even after accounting for this growth, JCT finds the tax bill would still cost over $1 trillion over a decade. These estimates are in line with those from outside organizations and in stark contrast to the 0.7 percentage point growth boost claimed by the Treasury Department.

JCT's latest projections find the House bill would increase ten-year Gross Domestic Product (GDP) by 0.7 percent on average, compared to 0.8 percent from the Senate bill. Though the average increase is smaller in the House bill than the Senate bill, GDP in 2027 appears to be higher under the House bill and thus the average growth rate is likely higher as well. JCT does not specify a year-by-year path, but we believe average GDP growth will be somewhere between 0.06 and 0.12 percentage points higher under JCT's analysis (which we round to 0.1 percentage point). By comparison, the Senate bill would likely increase the growth rate by less than 0.08 percentage points – or perhaps significantly less – over the next decade.

These estimates are consistent with others modeled by Moody's, Tax Policy Center (TPC), and Penn Wharton Budget Model (PWBM). In fact, new analyses of the Senate bill from TPC and PWBM estimate the bill would improve annual growth by 0.004 percentage points and 0.05 to 0.1 percentage points, respectively. Estimates from the Tax Foundation and Heritage Foundation, which ignore the economic effect of higher debt, show somewhat faster growth but still fall well short of a 0.4 percentage point growth boost.

The estimates above help to highlight the fantastical nature of recent claims from the Treasury Department that average growth would improve by 0.7 percentage points per year mostly as a result of the tax bill. The 0.35 percentage point boost they claim from the corporate side alone is far higher than any existing estimate for the entire bill. As CRFB president Maya MacGuineas explained, "the Treasury Department appears to have drawn a favorable conclusion first and worked backwards from there."

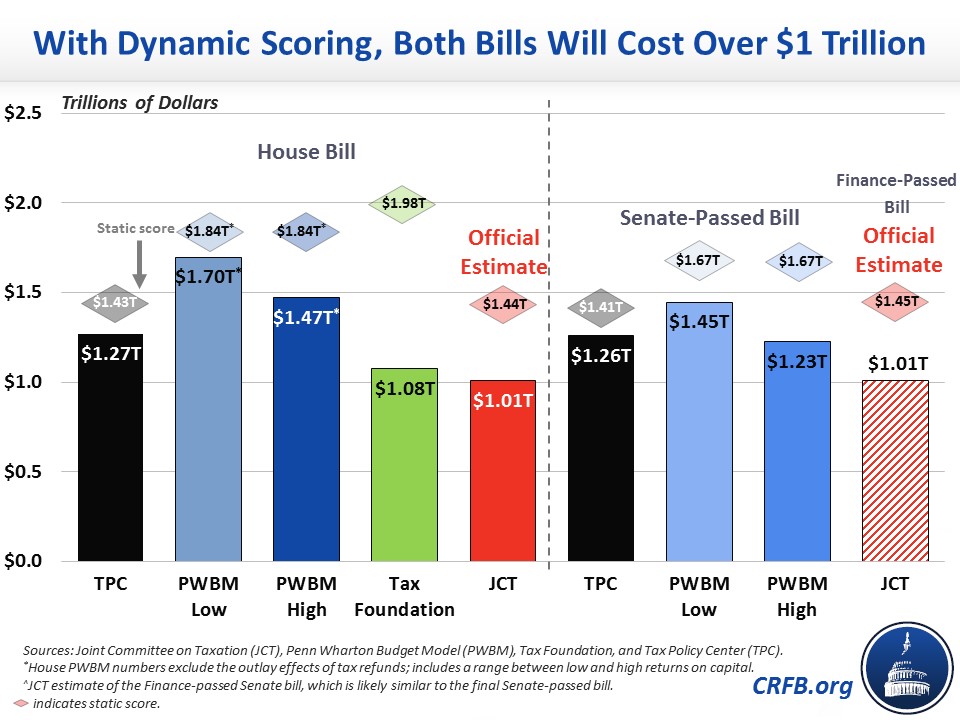

This is also true when it comes to the claim that the tax bill would be largely or fully self-financing. JCT's analysis of the House-passed bill finds it would cost $1.01 trillion over a decade when the economic growth effects are included. Specifically, JCT estimates $428 billion of dynamic feedback, offsetting about 30 percent of the $1.44 trillion of conventional costs (before accounting for gimmicks). This is very much in line with JCT's estimate of the Senate bill and actually shows a lower cost than what has been estimated by TPC and PWBM.

These estimates continue to show that the current tax bills will not be deficit-neutral when factoring in economic effects. To achieve this goal, policymakers must make adjustments to the bill in conference. Here are several options to do so.