IRS Estimates a $625 Billion Tax Gap

The Internal Revenue Service (IRS) recently released a new analysis of the “tax gap” – the difference between taxes owed to the federal government each year and the amount actually collected – featuring preliminary projections for tax years 2020 and 2021, as well as an updated preliminary projection for tax years 2017 through 2019. See our prior tax gap analyses here.

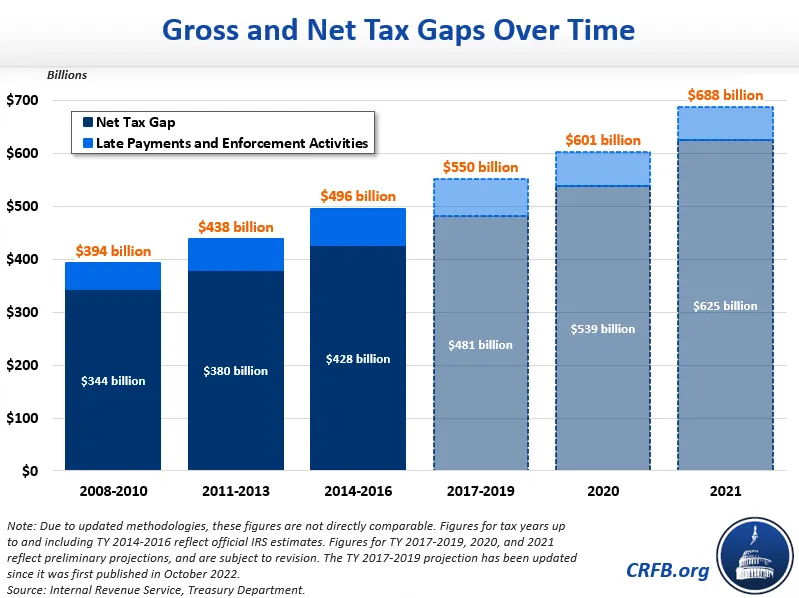

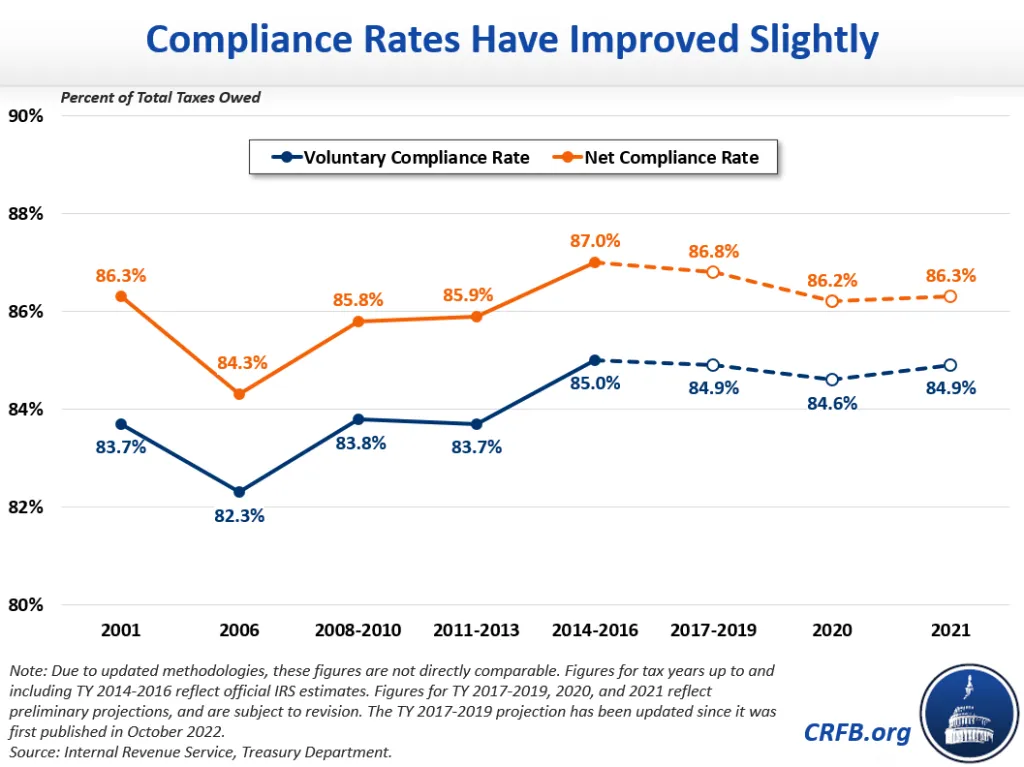

The analysis projects that the gross tax gap was $601 billion for tax year 2020 and $688 billion for tax year 2021, while the net tax gap after enforcement and late payments was $539 billion in 2020 and $625 billion in 2021. That means that less than 85 percent of taxes owed were paid on time and only about 86 percent were paid ever.

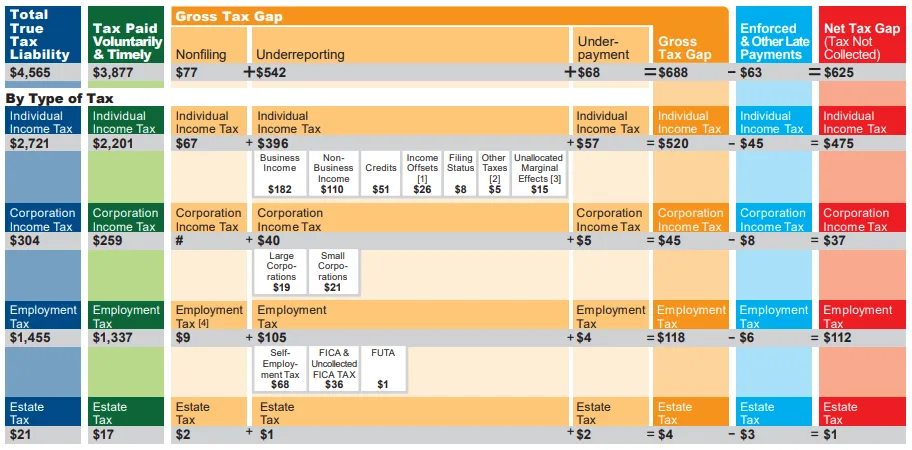

Of the $688 billion gross tax gap from tax year 2021, the IRS estimates about four-fifths ($542 billion) came from underreporting of income, while 11 percent ($77 billion) came from non-filing and 10 percent ($68 billion) from underpayments.

Source: Internal Revenue Service

* Totals include excise tax

# No estimate

Detail may not add to totals due to rounding.

[1] Includes adjustments, deductions, and exemptions.

[2] Includes the Alternative Minimum Tax and taxes reported in the “Other Taxes” section of the Form 1040 except for self-employment tax and unreported Social Security and Medicare taxes (which are included in the employment tax gap estimates).

[3] Is the difference between (1) the estimate of the individual income tax underreporting tax gap where underreported tax is calculated based on all misreporting combined and (2) the estimate of the individual income tax underreporting tax gap based on the sum of the tax gaps associated with each line item where the line item tax gap is calculated based on the misreporting of that item only. There may be differences if the marginal tax rates are different in these two situations.

[4] Self-employment tax only.

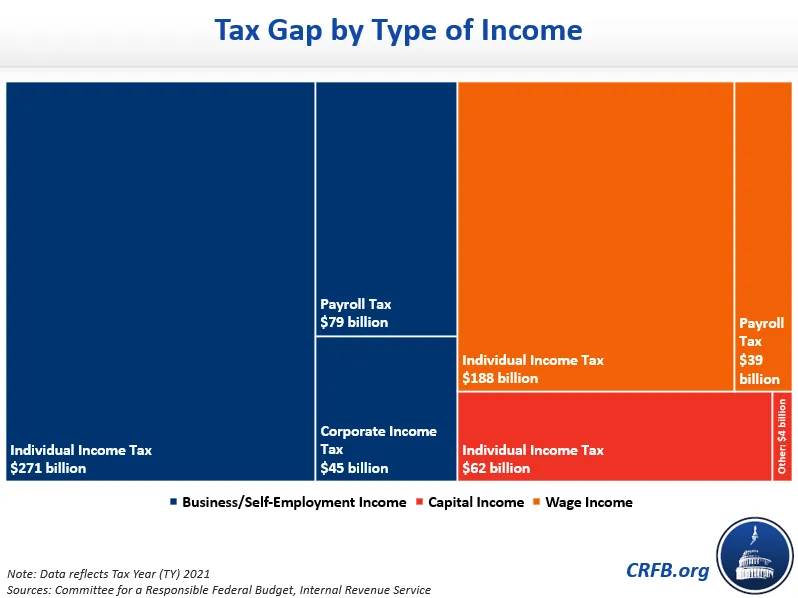

Three-quarters of the net tax gap in 2021 ($475 billion) comes from the individual income tax, while one-sixth ($112 billion) comes from payroll taxes, 6 percent ($37 billion) from corporate income taxes, and a very small amount ($1 billion) from estate taxes. About three-fifths of the gross tax gap can be attributed to business income – mostly from smaller businesses – including $182 billion from underreported pass-through income and $68 billion from underreported self-employment taxes.

Based on the latest IRS numbers, the nominal gross tax gap has grown by 75 percent since the 2008-2010 period, by almost 40 percent since the 2014-2016 period, and by 25 percent since 2017-2019. In dollars, the net tax gap grew from $344 billion in 2008-2010 to $481 billion in 2017-2019 and $625 billion in 2021.

In large part, this growth is driven by a growing tax base. As a percentage of total taxes owed, the tax gap has remained relatively steady. Since 2001, taxpayers have generally initially paid 82 to 85 percent of the taxes they owe, and ultimately paid 84 to 87 percent. Importantly, the 2021 numbers pre-date the recent increase in IRS funding, which is projected to reduce the tax gap somewhat.

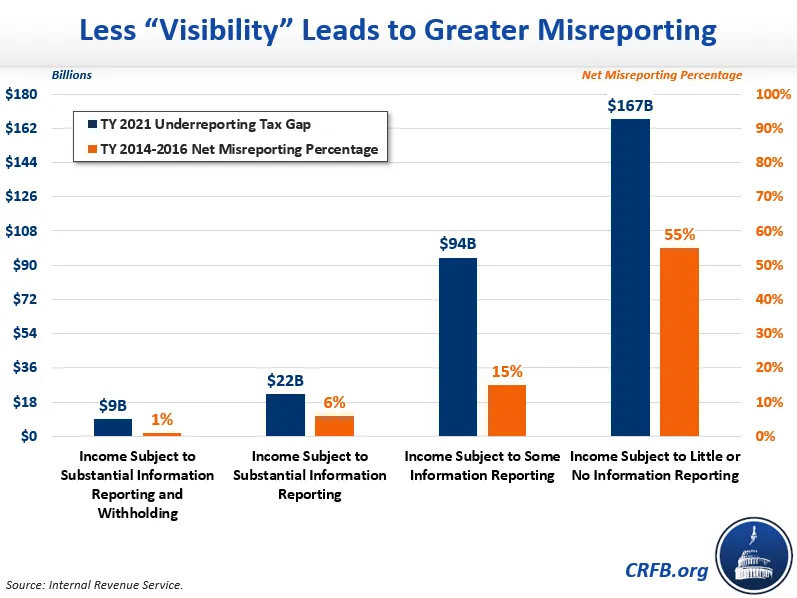

Consistent with previous analyses, the IRS’s latest tax gap analysis continues to demonstrate a strong, negative correlation between the degree of “visibility” into certain types of income and the amount of misreporting that occurs.1 Income subject to substantial information reporting and withholding, such as wages and salaries, had a net misreporting percentage (NMP) of only 1 percent in the 2014-2016 period, whereas income subject to little or no information reporting, such as small business income and income from rents and royalties, had an NMP of 55 percent.2

Shrinking the tax gap is one of the most efficient ways of raising revenue, and it does so without raising anyone’s owed taxes. It also has a long history of bipartisan support, including from every president since Ronald Reagan. Policymakers would be wise to enact additional measures to help reduce the tax gap and close tax loopholes that make it easy for taxpayers to avoid paying what they owe.

1 “Visibility” refers to the degree to which income is subject to tax withholding or reported to the IRS by a third party.

2 The net misreporting percentage (NMP) is the ratio of the total amount of misreported income in a given category to the sum of the amount that should have been reported, expressed as a percentage.