IRS Estimates a $606 Billion Tax Gap for 2022

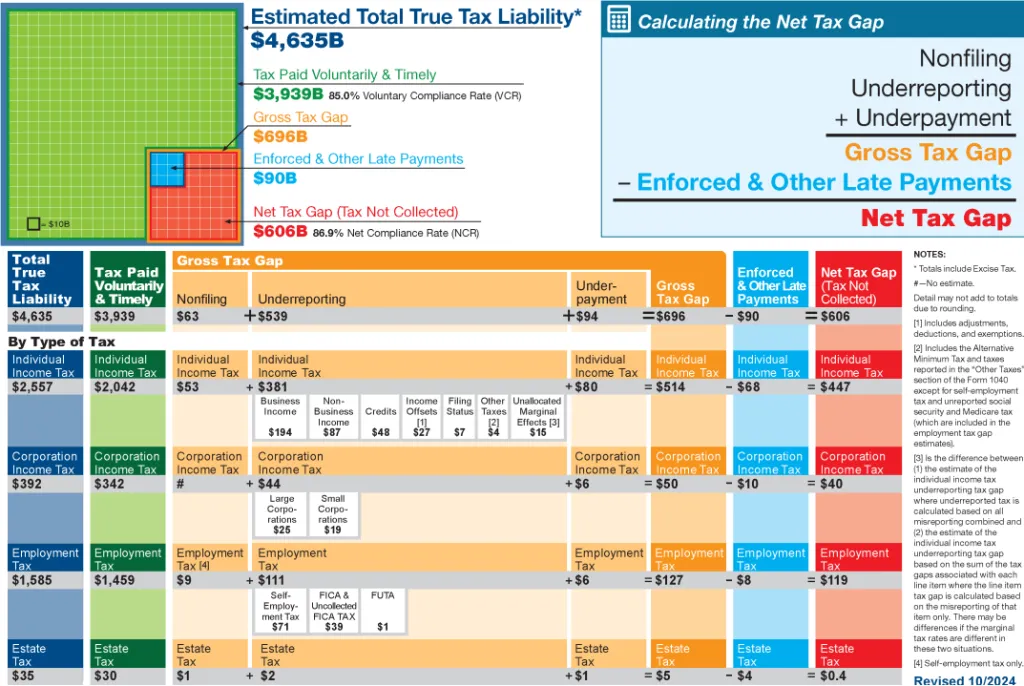

The Internal Revenue Service (IRS) recently published its projections of the “tax gap” – the difference between taxes owed to and collected by the federal government annually – for tax year 2022, as well as updated projections for tax years 2017-2019, 2020, and 2021. The report finds that the net tax gap after enforcement actions fell from $617 billion in 2021 to $606 billion in 2022.

In its new report, the IRS estimates that:

- The gross tax gap was $708 billion for 2021 and $696 billion in 2022; after enforcement and late payments, those figures fell to $617 billion and $606 billion, respectively.

- Gross tax gap projections have increased by $200 billion since 2014-2016, but that is largely reflective of a larger economy and inflation – voluntary compliance rates have held steady at around 85 percent.

- Nearly three-quarters ($447 billion) of the net tax gap comes from individual income taxes, while the remaining quarter comes from corporate income taxes, employment taxes, and estate taxes.

While the IRS projects that taxpayers owed $4.6 trillion in total tax liability in 2022, only about $3.9 trillion of that was paid on time and without penalty. Enforcement actions and late payments led to an additional $90 billion being collected.

Most of the tax gap comes from individual income taxes, which accounted for 74 percent ($514 billion) of the gross tax gap in 2022. Of this amount, underreporting of income accounted for 74 percent, most of which came from underreported business income ($194 billion) and non-business income ($87 billion).

The IRS notes that voluntary compliance rates have remained roughly steady over the past decade at around 85 percent, and net compliance rates – which account for enforcement actions and late payments – have similarly held steady at about 87 percent, meaning enforcement actions and late payments reliably yielded an additional2 percent of total tax liability. While compliance rates have been consistent for the last decade, they could increase in future years due to additional enforcement dollars appropriated to the agency by the Inflation Reduction Act (IRA).

A large portion of the tax gap comes from income subject to little or no information reporting requirements, such as business income from sole proprietorships. Of the $381 billion projected individual income tax underreporting gap in 2022, $179 billion – or 47 percent – comes from this category, including $117 billion from “non-farm proprietor income.” Other forms of income that are subject to more reporting requirements contribute much less to the tax gap.

Over the past decade, the gross and net tax gaps have risen by about 40 percent in nominal dollars, though most of this growth is likely due to the growing economy and inflation. For the first time in many years, the IRS projects that both the gross and net tax gaps for 2022 shrank in nominal terms from the year prior. While the decline is modest – less than 2 percent – it is worth noting that it took place before the vast majority of IRS funding from the IRA has been spent.

While it is likely impossible to fully close the tax gap, efforts to narrow it are among the best ways to raise revenue and have been promoted on a bipartisan basis. Simply enforcing the tax laws in a more consistent manner increases tax revenue without raising tax rates. As we wait to see the impact of the IRA’s tax gap measures, policymakers should continue to support policies and actions that allow the government to collect the revenue it is owed.