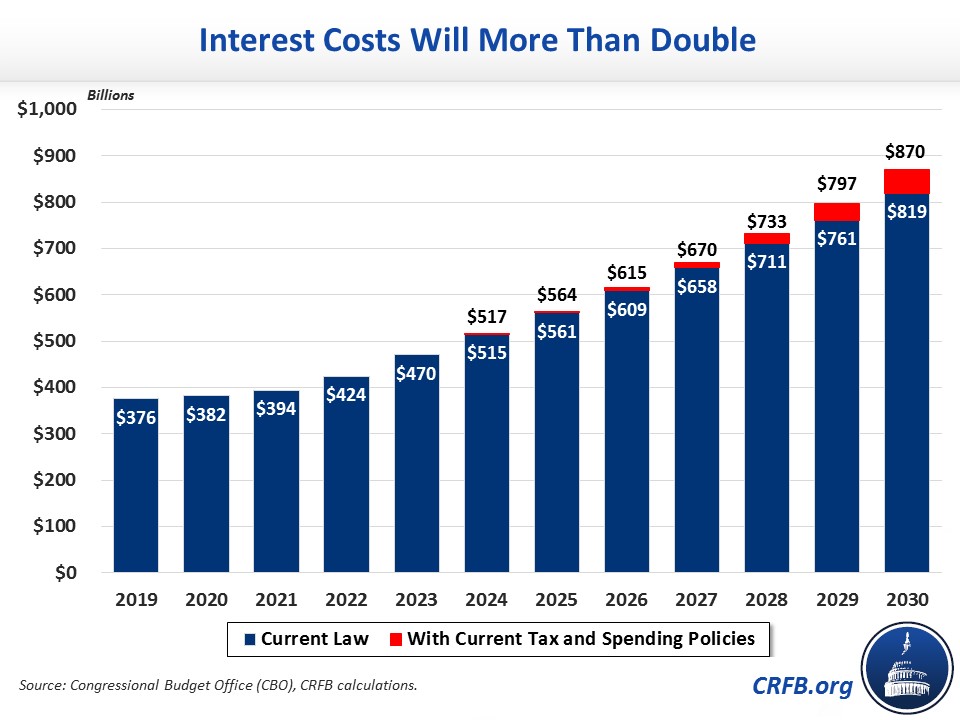

Interest Costs Will More Than Double Over the Next Decade

The Congressional Budget Office's (CBO) latest budget projections show interest on the national debt remains the fastest growing category of the federal budget. Under current law, net interest payments are projected to more than double over the next decade, from $376 billion in 2019 to $819 billion by 2030 – a 118 percent increase. If lawmakers extend expiring tax cuts and grow discretionary spending with the economy, as in CBO's Alternative Fiscal Scenario (AFS), we estimate interest payments will grow by 132 percent to reach $870 billion by 2030.

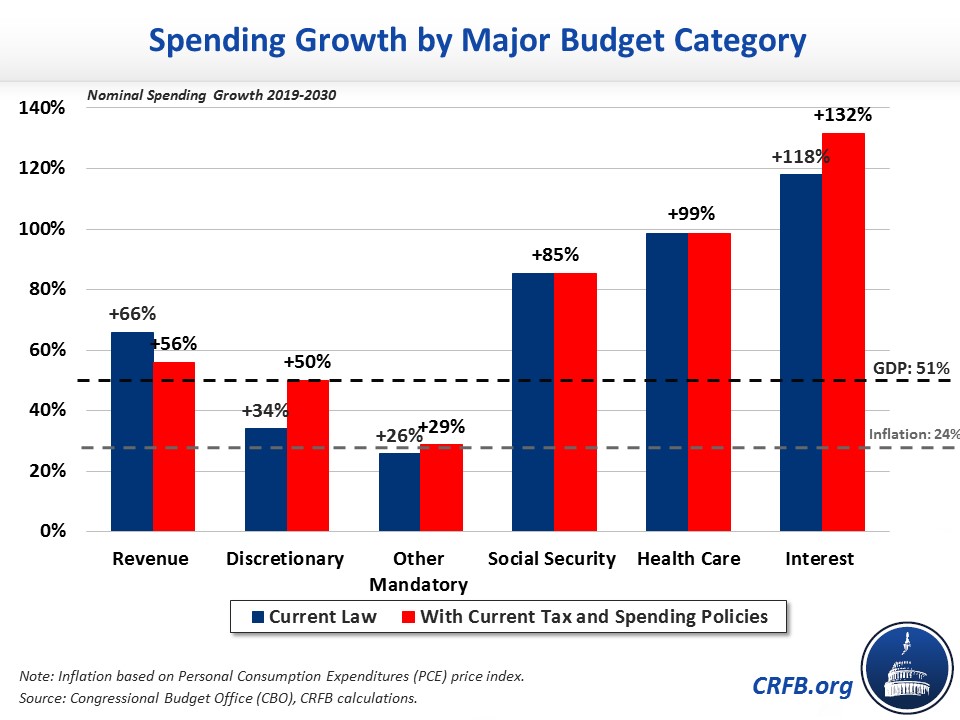

The 118 percent projected growth in interest payments through 2030 is far larger than the projected 24 percent increase in price levels or the 51 percent projected growth in Gross Domestic Product. As a result, net interest will grow from 1.8 percent of GDP in 2019 to 2.6 percent by 2030 – a nearly 50 percent increase.

As in previous baseline projections, interest payments will grow faster than any other category of spending over the next decade. CBO expects spending on Social Security to grow by 85 percent, outlays for the major federal health care programs (Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the exchanges) to increase by 99 percent, while most other categories of spending will grow by roughly 30 percent. Interest costs will also outpace projected revenue growth of 66 percent under current law.

As a result of rapid spending growth and mostly stagnant revenues, net interest payments will consume a larger share of total federal spending than today over the next ten years. CBO projects net interest will rise from 8 percent of spending in 2019 to 11 percent in 2030.

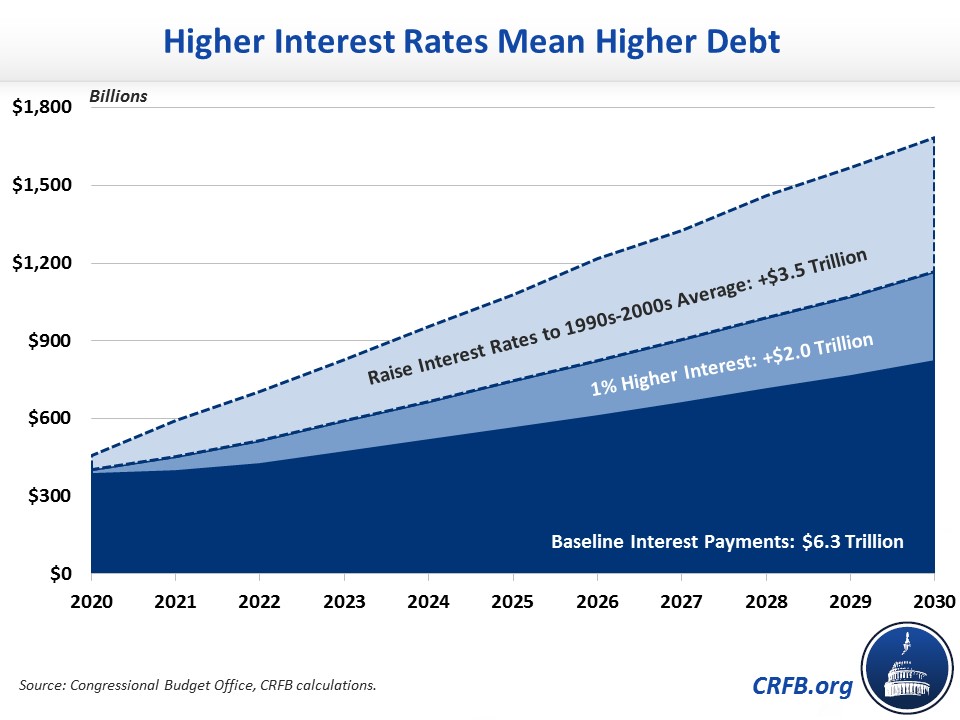

That growth is the result both of rising debt and of eventual rising interest rates for that debt. Of the 118 percent increase in interest costs projected over the next decade under current law, CBO estimates roughly three-fifths of the projected increase is due to rising debt levels, while the other two-fifths is the result of the projected increase in interest rates.

If interest rates rise faster than projected, interest costs would grow even further. CBO projects interest costs will total $6.3 trillion over the next decade with the rate on ten-year Treasuries averaging 2.7 percent. If interest rates increase by one percentage point to an average of 3.7 percent, total interest costs would be roughly $2 trillion higher over the next decade. If interest rates increase to 5.6 percent – their average over the 1990s and 2000s – total interest costs would be $3.5 trillion higher than the 3.7 percent level and $5.5 trillion higher in total. These scenarios would push projected debt as a share of the economy in 2030 from 98 percent of GDP under current law to 104 percent and 115 percent, respectively.

As our national debt continues to grow and interest rates on Treasury bills rise in response to a strong economy, the federal government's interest payments on its debt are poised to grow rapidly over the next decade. In turn, interest will comprise a larger and larger share of federal spending, increasing deficits and crowding out important priorities. There's simply no precedent for deficits this large at a time when the economy is this strong. Policymakers should work to put debt on a sustainable path through a combination of entitlement reforms, wasteful spending reductions, and tax revenue increases to put debt and deficits on a more sustainable path.