The IMF Looks at International Fiscal Rules

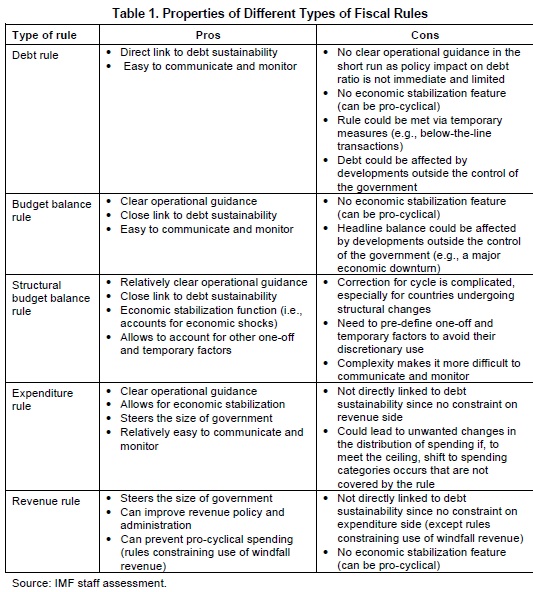

A new working paper by four authors at the International Monetary Fund takes a look at fiscal rules around the world. The Peterson-Pew Commission on Budget Reform put out a more general discussion of fiscal rules in December, but the IMF specifically looks at similiarities and differences between specific regimes. They note that rules have come in many varieties, both from different levels of government, with different levels of statutory authority, and with different budget variables involved. In general, they break down rules into five broad types:

- Debt rules

- Budget balance rules

- Structural budget balance rules

- Expenditure rules

- Revenue rules

Debt and budget balance rules are generally the most common, and the paper notes that they are often used in tandem. Expenditure rules and revenue rules--whether ceilings or floors--are less common, but expenditure rules are more frequently used. Structural budget balance rules, which adjust for changes in the economy, have become more popular lately, since they provide more flexibility for governments when a recession hits. Many countries use a combination of these rules.

The level of authority for each rule varies widely, and the IMF states that the proper authority that a rule has should be determined by circumstance. The highest level of authority are supranational rules, most notably the deficit and debt constraints in the European Union's Maastricht Treaty and Stability and Growth Pact. Below that are constitutional rules, which were quite uncommon in the countries studied. Statutory rules were the most common at the national level, while few rules were done through more informal means, such as coalition agreements.

Finally, the IMF looks at the "escape clauses" that a government can give a budget rule. Many governments allow violations of the budget rules if the economy enters a recession or a natural disaster strikes, as well as an "other" category. The authors argues that it is important that this "other" category be strictly limited to factors outside the government's control and that the definition of a disaster or recession is clearly stated as well.

How did these rules fare in the recession and current European crisis? Many countries, of course, went away from these limits in order to provide fiscal support, whether for the financial sector or for stimulus. However, these countries often specified a path back to normal or made their targets more flexible to account for fluctuations in economic output. It is this latter point the authors emphasize when they declare "these 'next-generation' fiscal rules explicitly combine the sustainability objective with more flexibility to accommodate economic shocks." There is an obvious upside to setting fiscal targets, but the last five years has taught that it is best to allow some room for countercylical policy, or otherwise make the goals unrealistic.

For a comparison of proposed fiscal rules in the US, click here.