How a Fed Rate Increase Could Affect the Budget

Today, the Federal Open Market Committee, the Fed's interest rate setting and deliberative body that meets eight times a year, could announce that they will raise the federal funds rate to be above near-zero for the first time in seven years. There has been much debate about the appropriateness of a rate increase for the economy, but the decision also has budgetary consequences, which we discuss in an updated analysis Interest Rates and the Debt.

With interest rates likely to return to more normal levels at some point, spending on interest on the debt will increase significantly as a result. If debt rises as it is projected to do in the future, we risk further increases in interest rates that will put greater pressure on the budget. Ultimately, the best way to guard against interest rate risks is to put debt on a downward path to lessen the negative effect of interest rate increases.

Our analysis shows that because of interest rates returning to normal levels and debt rising, interest spending will be the fastest growing part of the budget this decade. Under the CBO's August baseline, interest payments are projected to more than triple from $223 billion in 2015 to $755 billion in 2025. Rising interest spending is problematic for a few reasons, namely that it reduces resources available for other important priorities and is difficult to reverse quickly.

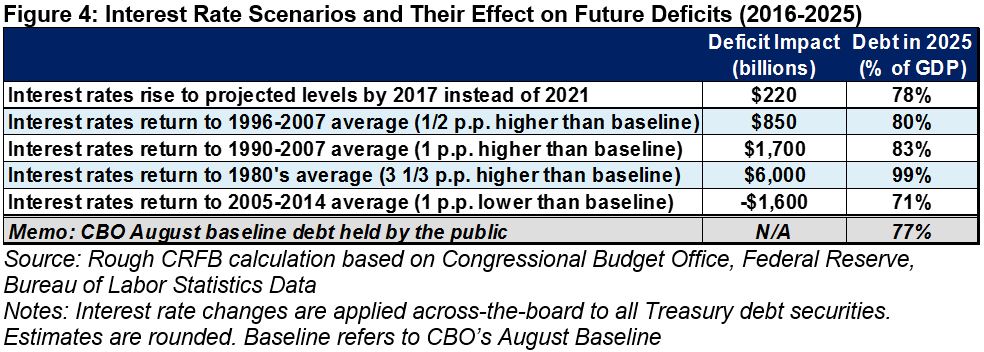

More concerning is the risk that interest rates could be higher than CBO expects. The agency projects that even when interest rates rise to more normal levels, they will still be below recent historical trends. If this is not the case, it would mean worse news for the federal budget. For example, if interest rates were 1 percentage point higher than expected, debt would rise by $1.7 trillion over ten years.

Our analysis shows how our currently high debt leaves the federal budget exposed to explosive growth in interest spending. Reining in the growth of long-term debt will help free up spending for other priorities and protect against unexpected interest rate increases.