How Big is the Tax Gap?

The Senate Finance Committee will hold a hearing on September 12 on tax avoidance and how it relates to the upcoming debate on extending the expiring Tax Cuts and Jobs Act. Part of this conversation will likely be around the “tax gap,” or the difference between taxes owed and taxes actually paid to the government.

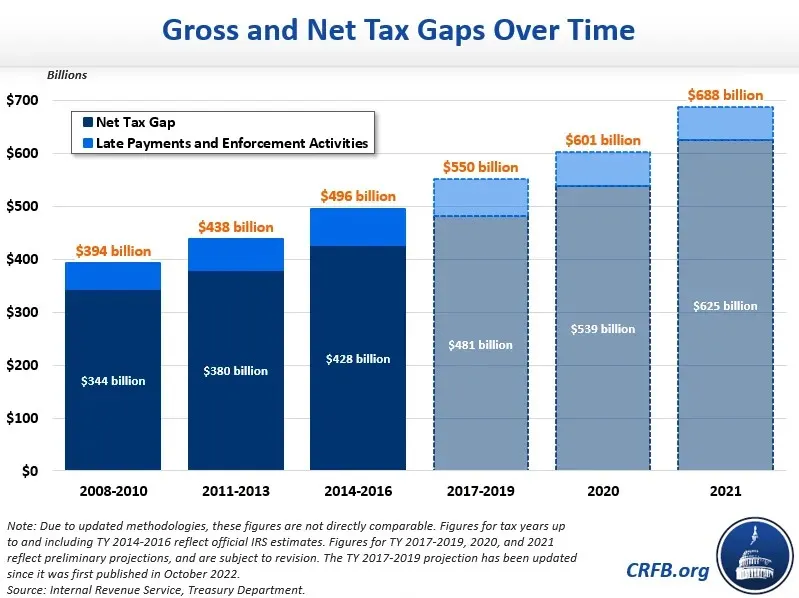

The gross tax gap totaled $688 billion in 2021, while the net tax gap was $625 billion after payments were collected late or through IRS enforcement. The $625 billion figure is more than all current spending on Medicaid and more than half of all corporate tax collection.

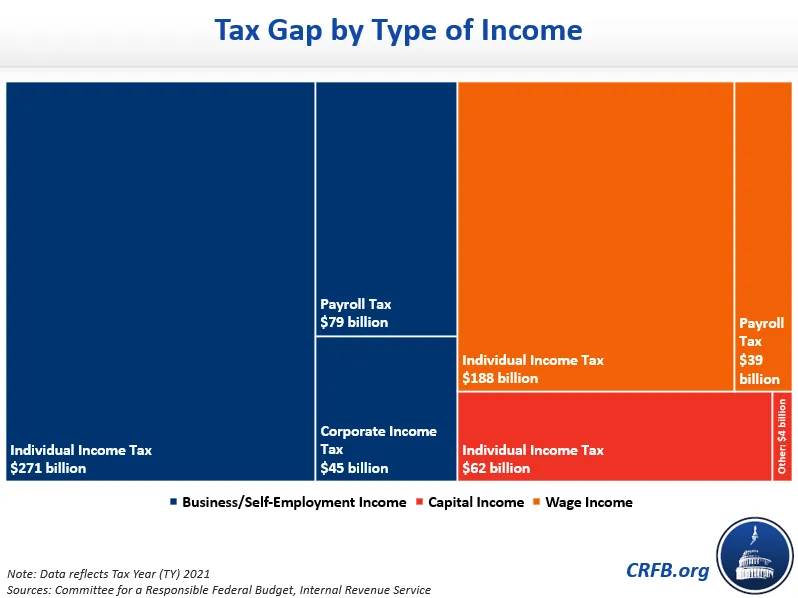

Most of the tax gap – about 60 percent – is from business income, and particularly pass-through businesses (including self-employment), where it is harder to track compliance. We’ve broken the tax gap in more detail here.

Reducing the tax gap is one of the easiest ways to raise revenue without increasing anyone’s taxes. Lawmakers should consider further efforts to narrow the tax gap. Read more about the tax gap and bipartisan efforts to reduce it here.