House SGR Bill Increases Long-Term Deficits

While the relevant congressional committees recently reached agreement on a bipartisan plan to replace the Sustainable Growth Rate (SGR) formula with a payment structure to better incentivize high-quality, higher-value care, the question of how to pay for that reform remains unresolved. Today, though, the first legislative proposal to offset the costs of the SGR fix was introduced in the form of an amendment to the House bill (H.R. 4015). This amendment, introduced by Ways and Means Chairman Dave Camp (R-MI), would delay the Affordable Care Act's (ACA) individual mandate for five years. And although this bill would reduce deficits over the first decade, paying for permanent costs with temporary savings would inevitably increase debt over the long run.

The Congressional Budget Office estimates that the amendment would save $159 billion through 2024, enough to offset the $138 billion cost of the replacement physician system. And because of its front-loaded savings, interest savings to service our debt would also accrue, resulting in total savings of $45 billion through 2024. Unfortunately, though, not only does the amendment miss a critical opportunity to enact structural reforms to help bend the health care cost curve, but by relying on very front-loaded savings, the bill would increase deficits in the second decade likely by over $200 billion (and potentially significantly more).

The $159 billion of direct savings over the first ten years accrues from delaying the implementation of the individual mandate until 2019. Recall that eliminating or delaying the individual mandate has a number of cross-cutting effects. Of course, the government would forgo collecting the revenue from the penalty, projected at about $15 billion through FY 2018. More importantly, though, many fewer people would obtain coverage through Medicaid, the health exchanges, or their employer. Fewer people enrolling in Medicaid and the health exchanges would save the federal government significant money, and fewer people receiving coverage through their employer would increase revenue as those employees received compensation in the form of taxable wages rather than non-taxable health insurance benefits. In addition, employer mandate penalties would increase while small business tax credits would decrease.

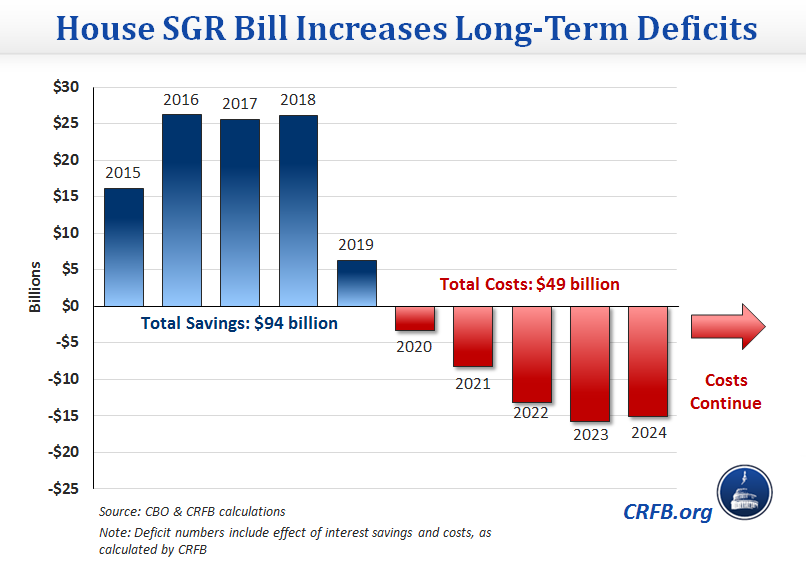

Because the mandate delay is temporary, while the measure as a whole would save $94 billion through 2019, with interest, it would actually increase deficits by $49 billion from 2020-2024. The bill would likely start adding to the debt in 2027, and by increasing amounts thereafter. Offsetting permanent costs with temporary savings, as this bill does, is one of the budget gimmicks we recently warned against.

The proposed offset is most disappointing because health reforms should be focused on saving significant money over the longer term, when those savings are most needed. Instead, this bill would only reduce deficits in the short term and be a long-term debt increaser.