House Budget Committee Releases FY 2018 Budget

House Budget Committee Chairman Diane Black (R-TN) today released the Chairman’s mark of the Fiscal Year (FY) 2018 House budget resolution. The budget proposes $4.3 trillion of policy savings ($5.4 trillion in spending reductions and $1.1 trillion of tax cuts from Obamacare repeal), which along with $1.5 trillion in claimed savings from increased economic growth would lead to $5.8 trillion of total savings, enough to balance the budget on paper by 2027. It also calls for deficit-neutral tax reform and at least $203 billion of mandatory savings through reconciliation instructions.

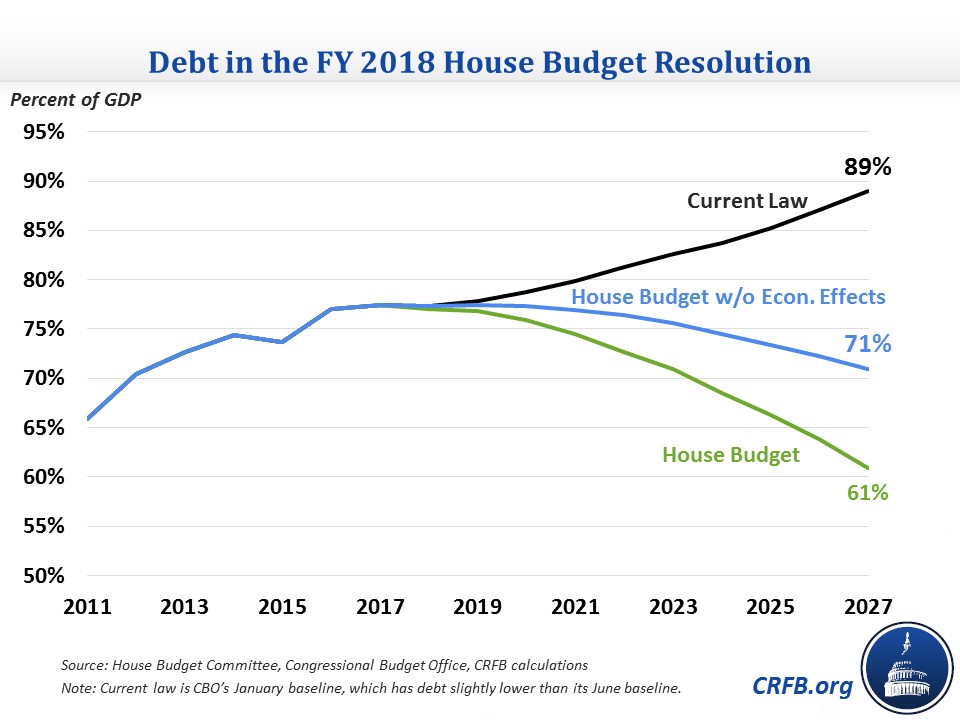

Based on the numbers provided by the Budget Committee, the budget would put the debt on a clear downward path, falling from 77 percent of GDP in 2017 to 61 percent by 2027. Excluding the budget's presumed increase in economic growth, which results in the economy in 2027 being 8 percent larger than the Congressional Budget Office (CBO) projects, debt would decline more gradually to 71 percent. Both results are much better than CBO's January projection for current law, which has debt reaching 89 percent of GDP by 2027 (CBO's June update projects debt rising to 91 percent of GDP under current law.)

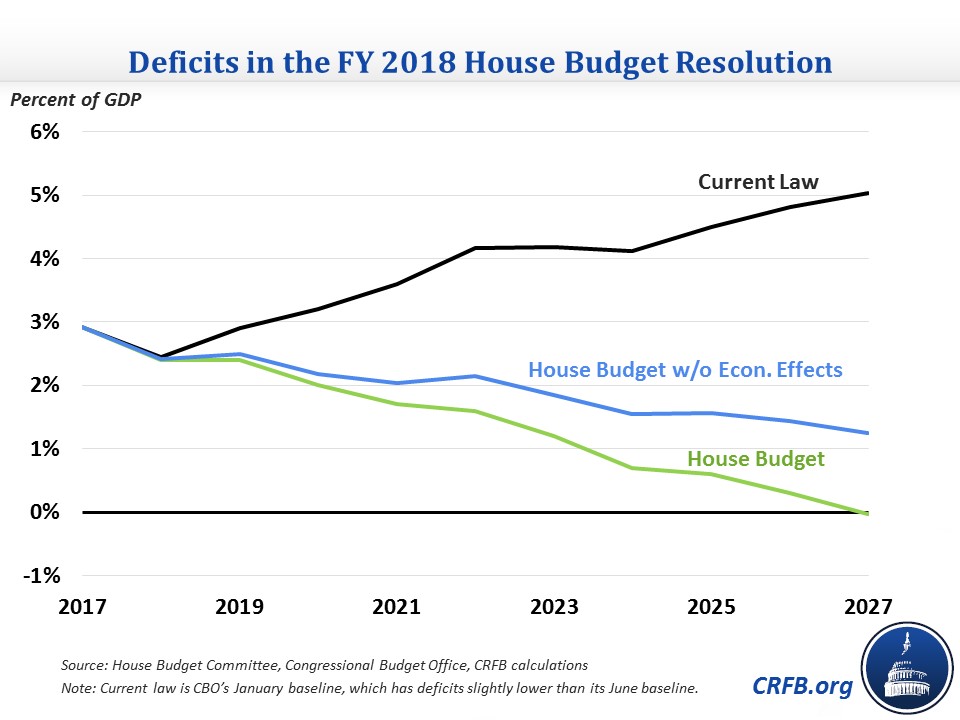

The budget would also reduce and then eliminate annual deficits if higher economic growth is counted. Deficits would fall from 2.9 percent of GDP (3.6 percent as of the June baseline) in 2017 to 0.3 percent by 2026, and there would be a $9 billion surplus in 2027. Excluding economic effects, the budget would not balance within ten years, but the deficit in 2027 would still be relatively small at about 1.3 percent of GDP ($350 billion). This path would represent a significant improvement over the 5.0 percent of GDP ($1.4 trillion) deficit projected for 2027 under CBO's January baseline.

The budget calls for the bulk of its savings from health care and other mandatory spending programs. This includes $1.5 trillion of spending cuts from Medicaid and other health programs, though much of this would be offset by the $1.1 trillion revenue loss from the House-passed repeal and replacement of the Affordable Care Act. The budget also saves $487 billion from Medicare by increasing means-tested premiums, reforming cost-sharing rules, and switching to a premium support system in 2024, among other changes.

Chairman Black’s budget also calls for $2.4 trillion of savings from other mandatory programs, citing policies such as block granting food stamps and reforming housing, education, and job training programs as ways to get there. However, the claimed savings may be unrealistically steep since they would reduce the entire category by more than half by 2027.

On discretionary (appropriated) spending, the budget would increase defense budget authority by $72 billion above sequester levels in FY 2018 and $929 billion over the next decade; this would amount to a 13 percent increase for next year and a 15 percent increase in 10-year discretionary spending, but only an 8 percent increase by 2027.

At the same time, the budget would decrease non-defense budget authority by $5 billion below sequester levels in FY 2018 and larger amounts in later years, totaling $1.3 trillion over the next decade. Many of the areas that would receive cuts are unspecified, but the reductions amount to nearly one-quarter of the category over ten years and more than one-third by 2027.

Finally, the budget increases war spending, or Overseas Contingency Operations (OCO), by $10 billion above President Trump's request for FY 2018, effectively using OCO as a gimmick to backfill normal defense spending needs. Lawmakers should not appropriate more than the Pentagon and President's request: $77 billion.

The budget claims $1.5 trillion of savings from the macroeconomic effects of the budget's policies, presumed to boost growth from an average of 1.9 percent in CBO's baseline projections to an average of 2.6 percent. That boost in growth would generate $1.8 trillion in economic effects, with $1.5 trillion devoted to deficit reduction and $300 billion used to offset tax reform. However, this amounts to, as CRFB President Maya MacGuineas said, "unrealistically high economic growth projections given the lack of details on how to achieve it." While 2.6 percent growth may be possible to achieve with an aggressive combination of pro-growth policies (and some luck), the budget should not rely on that growth to reach its target. As MacGuineas said, "You base budgets off the likely, not the hopeful."

Policy Changes in the Chairman's Mark of the FY 2018 House Budget

| Budget Category | 2018-2027 Savings |

|---|---|

| Medicaid and Other Health | $1,504 billion |

| Medicare (net) | $487 billion |

| Social Security | $4 billion |

| Other Mandatory | $2,446 billion |

| Discretionary and Highway | $458 billion |

| Revenue | -$1,125 billion |

| Interest | $541 billion |

| Subtotal, Policy Savings | $4,315 billion |

| Economic Effect of Budget | $1,500 billion |

| Subtotal, Claimed Savings with Economic Effects | $5,815 billion |

| Baseline Adjustments* | $731 billion |

| Total, Claimed Savings Compared to CBO January Baseline | $6,546 billion |

Source: House Budget Committee

*Includes drawdowns of war spending and short-term emergencies that were not included in CBO's January baseline.

The budget contains specific reconciliation instructions for 11 different committees to report legislation saving at least $203 billion over ten years. If the House budget resolution is intended to be a serious document intended to balance federal spending and revenue, the committees will hopefully go far beyond the $203 billion minimum, since this amount is only 5 percent of the total savings in the budget. Still, it is encouraging that these reconciliation instructions are there, and their inclusion represents, as MacGuineas put it, "an important action moment that could lead to real deficit reduction," as opposed to previous budget resolutions that assumed substantial savings but took no action to help enact them. Numerous mandatory spending options exist for the committees to meet or exceed these targets.

The resolution also calls for deficit-neutral tax reform, a very positive indication that Congress does not intend to use tax reform to enact large deficit-financed tax cuts. However, since the resolution talks about using part of the gains from economic growth to pay for tax reform, it seems tax reform may actually increase the deficit by $300 billion under conventional scoring. In order not to rely on positive economic feedback that may never materialize, lawmakers should instead ensure that tax reform is at least revenue-neutral under conventional scoring, with dynamic gains devoted to deficit reduction.

The FY 2018 House budget resolution sets a noteworthy fiscal goal and calls for substantial deficit reduction on paper. However, some of these savings are unspecified and many of them unrealistic. The reconciliation instructions that are the most likely to be acted upon only achieve a fraction of the budget's claimed savings. For FY 2018, the one year covered by the budget, its discretionary spending increases would increase deficits and are not contingent on offsetting deficit reduction being enacted.

While this budget is a step towards fiscal responsibility, lawmakers could improve upon it by pushing for more than the minimum $203 billion of savings while ensuring that any discretionary spending increases are offset and any tax reform is truly revenue-neutral.