Health Package Sets Stage For Nearly $600 Billion of Costs

Ways and Means Committee Republicans have offered a package of health legislation that would delay several Affordable Care Act (ACA or "Obamacare") taxes. The package reportedly may also include extensions of other health spending policies. We estimate that this package could cost as much as $95 billion over ten years depending on what is included, but if these policies continue to be extended, the ultimate cost would be roughly $580 billion.

Given the fact that there is $2.2 trillion worth of potential deficit-increasing legislation to be taken up before the end of the year, Congress should set a precedent of offsetting these delays and extensions with other health or tax policies to prevent a bad debt situation from getting worse.

The package includes:

- A five-year delay of the medical device tax, which would otherwise come back into effect next year.

- A two-year delay of the health insurer tax, which would also come back into effect next year.

- A one-year delay of the "Cadillac tax" on high-cost health insurance plans, which is set to go into effect in 2020.

- A one-year moratorium and three-year retroactive relief on employer mandate penalties.

- A two-year policy to allow people to use Health Savings Accounts (HSAs) for over-the-counter (OTC) drugs.

In addition, it is reported (paywall) that lawmakers would add several health spending extenders to the bill, mostly holdovers from the 2015 doc fix. This would mark the second time that the medical device, health insurer, and Cadillac taxes are delayed, which is a strong signal that lawmakers intend to repeal those taxes but don't want to be charged the full cost of doing so. If lawmakers continue this disappointing trend, the $95 billion on-paper cost of the year-end health legislation could turn into a much larger $580 billion cost once extended.

Ten-Year Cost of Reported Health Extenders Deal

| Provision | Temporary Cost | Permanent Cost |

|---|---|---|

| Five-year delay of medical device tax | $10 billion | $20 billion |

| Two-year delay of health insurer tax | $30 billion | $185 billion |

| One-year delay of Cadillac tax | $10 billion | $105 billion |

| One-year moratorium and three-year retroactive relief of employer mandate penalty | $35 billion | $225 billion* |

| Two-year policy allowing use of HSAs for OTC drugs | $1 billion | $5 billion |

| Possible two-year health extenders | $10 billion | $40 billion |

| Total | $95 billion | $580 billion |

Source: Rough CRFB calculations based on Congressional Budget Office and Joint Committee on Taxation data.

*This is estimate is based on a stand-alone score of employer mandate repeal. This could change some based on what happens with the individual mandate and the Affordable Care Act more broadly.

If lawmakers want to enact these policies, there is little reason to make them perpetual temporary extensions. Instead, they should make permanent and pay for any policies they value.

In particular, since most of the cost is from repealing ACA taxes, Congress could adopt various policies to reduce ACA spending as proposed during the repeal and replacement debate. For example, policymakers could lower the income eligibility threshold for exchange subsidies, more frequently evaluate eligibility for Medicaid, or otherwise scale back Medicaid and exchange subsidy costs.

Alternatively (or additionally), Congress could replace the last revenue with other taxes. For example, they could limit or reform of the exclusion for employer-sponsored health insurance, which would both raise revenue and help to slow health care cost growth. Whichever offsets lawmakers identify should focus on policies that will save more over the long term given the large amount of revenue the Cadillac tax is expected to bring in over time.

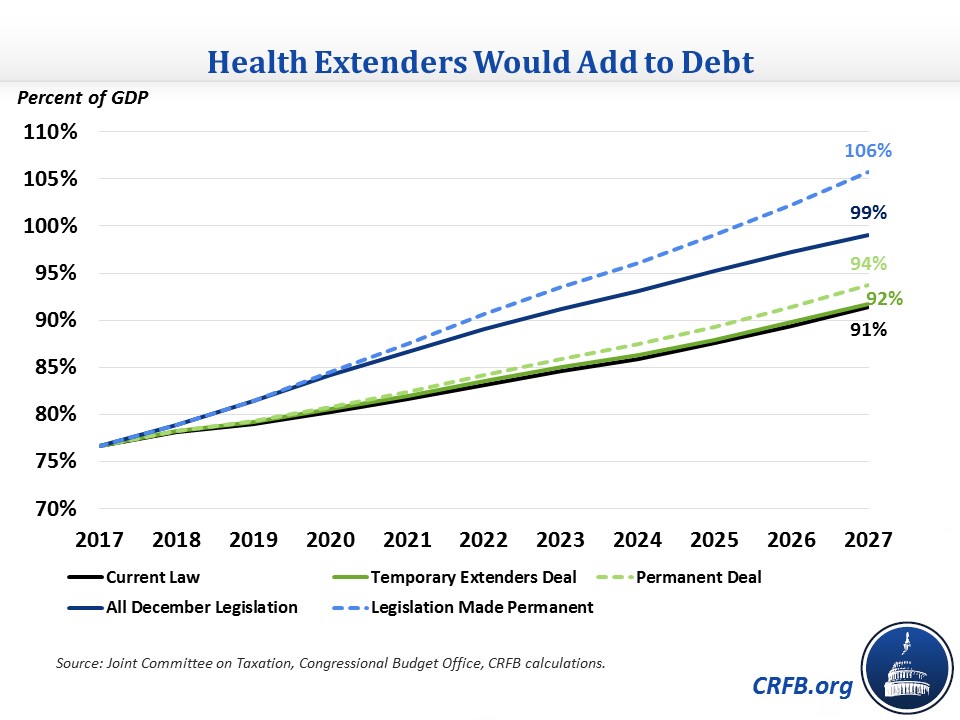

If this package is not offset, debt would increase to 92 percent of Gross Domestic Product (GDP) in 2027, compared to 91 percent under current law. The permanent version of these policies would result in debt of 94 percent of GDP. This deal would be just one part of possible year-end legislation that could increase debt to 99 percent of GDP (mostly due to the tax bill), or 106 percent if those policies were made permanent.

This package is one of several with fiscal implications that could happen at the end of the year. All of this legislation has the potential to add $2.2 trillion to the debt over ten years. Like the health package, costs would increase dramatically to $4.1 trillion if the temporary elements were made permanent. Lawmakers could start bringing down that price tag by offsetting this package.

Potential Budgetary Effect of Year-End Legislation

| Policy | Potential Ten-Year Deficit Effect |

|---|---|

| Tax Bill | $1.4 trillion |

| Sequester Relief | up to $200 billion |

| Disaster Relief | $45 billion or more |

| Obamacare Tax Delays | $55 billion for two years |

| Tax Extenders | $20 billion for two years |

| CHIP and Health Spending Extenders | Up to $20 billion |

| Potential Interest Costs | Up to $370 billion |

| Total | Up to $2.2 trillion |

| Memo: | |

| Additional cost from permanent extension of temporary provisions above (including interest) | +$1.9 trillion |

| Total, cost if temporary provisions above are permanently extended (including interest) | up to $4.1 trillion |

Sources: Congressional Budget Office, Joint Committee on Taxation.

The tax bill certainly has the largest fiscal implications of the year-end legislation, but the health extenders package may also be very costly. It represents an opportunity for lawmakers to take a stand for fiscal responsibility and ideally to put in place policies to help contain the growth of health spending.