Five Fiscal Plans for Consideration

Today, the Peter G. Peterson Foundation held a follow-up event to its 2011 Solutions Initiative, in which policy organizations presented plans to deal with the debt. Many of those same organizations updated their plans for this year to deal with replacing the fiscal cliff with a comprehensive plan.

There was a wide range of policy perspective from the fix organizations, with American Action Forum, the Bipartisan Policy Center, the Center for American Progress, the Economic Policy Institute, and the Heritage Foundation all presenting their own take on how to both reduce the deficit in the long term and protect the economy in the near term.

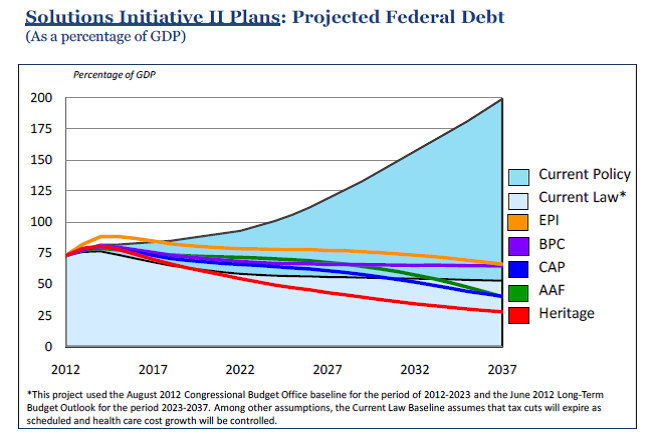

But what they have in common is an aggressive approach to reducing the federal debt. All of the plans put debt on a clear downward path to below 70 percent of GDP by 2037 and with the exception of EPI (who put a greater emphasis on short-term stimulus), all of the plans reduce debt to below 75 percent of GDP by 2022. It is clear that there are many ways to make the budget sustainable in both the medium and the long term.

Source: Peterson Foundation

On revenues, the plans take much different approaches in terms of their policies and the total level of revenue. EPI relies the most on revenue, with revenues at 23 percent of GDP in 2022, while Heritage Foundation proposes the lowest levels of revenue of 18.5 percent of GDP. All would engage in some kind of tax reform, though this takes different forms. The AAF would institute a progressive consumption tax as part of its plan, while CAP would change many deductions to credits to further enhance the progressivity of the code. Three out of the five plans would eliminate the Alternative Minimum Tax as part of tax reform.

On spending, Heritage Foundation has the lowest levels of spending at 17.6 of GDP by 2022, while EPI has the highest at 25.3 percent of GDP. However, all of the plans mention rising health care costs in their need to address spending. The AAF, BPC, and Heritage Foundation would all change Medicare to a form of premium support, with the BPC retaining traditional Medicare as an option. CAP and EPI give greater authority to IPAB to make changes needed to control costs.

Earlier in the summit, Erskine Bowles asked a great question: Why should we go over the fiscal cliff when there are so many plans out there that would be better than the alternatives? The best compromise may take ideas from each of these plans to reduce the debt, protect the most vulnerable, and promote economic growth. But this problem cannot be solved unless both parties reach across the aisle and put everything on the table.

All five plans and comparison tables can be found here and video of the event here.