The Feldstein-Feenberg-MacGuineas Cap Could Be Useful for Tax Reform

As lawmakers gear up for tax reform, they will need options to broaden the tax base and ensure that tax reform doesn’t add to debt. The traditional approach is to remove or reform specific tax expenditures, but it can be politically challenging to single out specific provisions for elimination. In 2011, Martin Feldstein, Daniel Feenberg, and Committee for a Responsible Federal Budget president Maya MacGuineas proposed a way around the impasse: a broad-based cap on tax expenditures that could broadly limit them without singling any out.

The universal cap that Feldstein, Feenberg, and MacGuineas proposed would limit the value of certain tax expenditures to 2 percent of adjusted gross income (AGI) per year. The cap would specifically limit all itemized deductions, the exclusion for employer-sponsored health insurance, and the child tax credit. It would have the political advantage of not singling out a specific tax break while still generating significant amounts of revenue and reducing the distortions in the tax code.

We have written on the 5 Reasons Tax Reform Shouldn't Add to the Debt, and a cap on tax expenditures could be an important tool to ensure that it doesn't.

In 2011, the original paper estimated that the cap would raise $278 billion in 2011, which is 1.8 percent of Gross Domestic Product (GDP) or about $350 billion in 2017.

We used the Open Source Policy Center's Tax Brain model to provide updated estimates. Unfortunately, their model doesn't allow us to estimate the revenue from the broad cap that covers the health exclusion. But we were able to estimate the effects of a cap applied only to itemized deductions: limiting itemized deductions to 2 percent of AGI would save $1.1 trillion* over ten years, while a 3 percent cap would save $708 billion. The Tax Policy Center has also estimated that a 3 percent cap on itemized deductions could raise $1 trillion over ten years on top of repealing the Alternative Minimum Tax (AMT) and Pease limitation on deductions, two policies that may be included in tax reform.

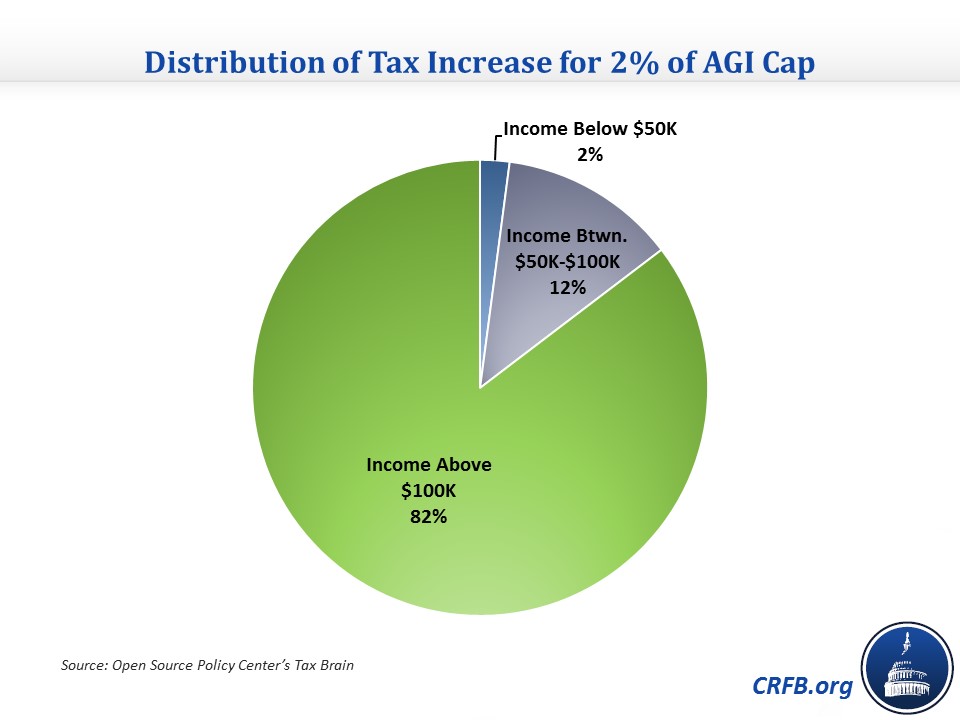

In both cases, three-quarters to four-fifths of the revenue raised would come from people making more than $100,000 per year, so the cap would also help to make the tax code more progressive.

Policymakers also have the option to make the cap apply a broader set of tax expenditures than just itemized deductions, just as the original cap was designed to do.

The Tax Policy Center estimates a 2 percent cap similar to the original Feldstein-Feenberg-MacGuineas proposal that also covered the municipal bond exclusion and education tax breaks would have saved $204.7 billion in 2016 on top of the cost of repealing the AMT and Pease limitation on deductions. These savings are equal to 1.1 percent of GDP, or the equivalent of $2.6 trillion over ten years. Another estimate shows that a 3.5 percent of AGI limit on itemized deductions, the municipal bond exclusion, and the exclusion for employer health insurance premiums above the 75th percentile would raise $1 trillion over ten years on top of the cost of AMT and Pease repeal.

Comprehensive tax reform should be used to improve our fiscal future, not to worsen it with unpaid-for tax cuts. The Feldstein-Feenberg-MacGuineas cap offers an innovative way to offset the potential revenue loss of other elements of tax reform and increase the progressivity of the tax code without targeting specific tax provisions individually, so it can be a very useful policy in constructing fiscally responsible tax reform. If lawmakers want other options for specific tax expenditures, we have written about many of them.

*Update 9/28/2017: The scores in this analysis represent the potential savings of implementing the Feldstein-Feenberg-MacGuineas cap on top of the existing income tax. Savings would be dramatically different if the cap were instead added to a plan like the House GOP "Better Way" or the framework announced on September 27 by the "Big 6." Those plans shrink itemized deductions, as well as dramatically increase the number of taxpayers expected to use the standard deduction. The amount of savings that could be achieved from this cap would be much smaller if added to a plan that already shrank the deductions this cap is intended to limit.