Explaining Donald Trump's Penny Plan for Non-Defense Spending

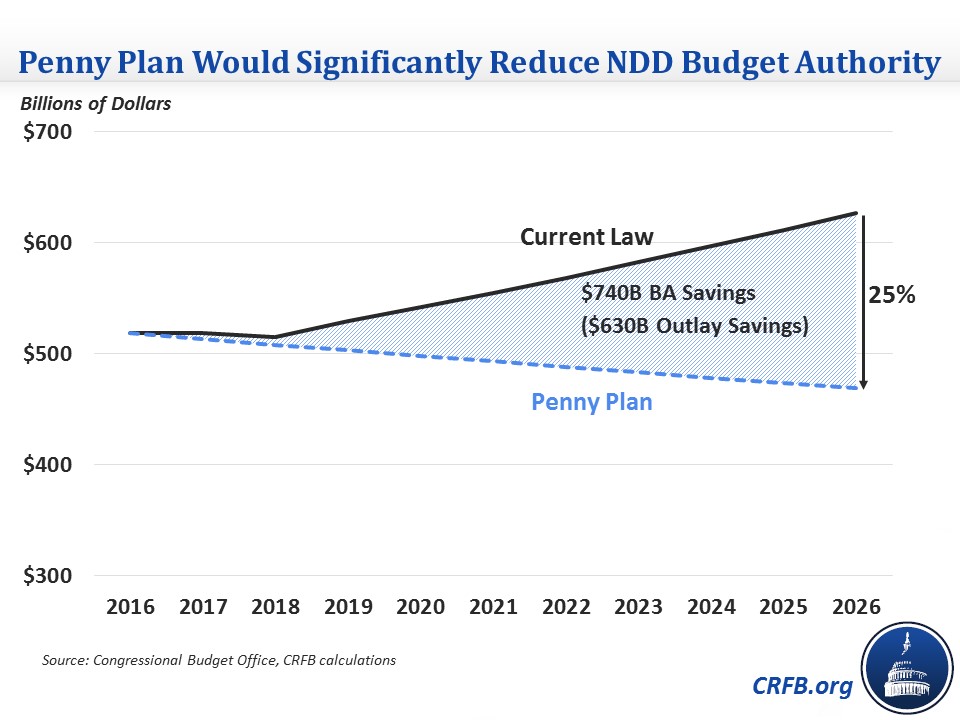

Much of the attention in Thursday's remarks by Republican presidential candidate Donald Trump has focused on his revised tax plan, but another new policy could have significant effects on the budget: applying the "Penny Plan" to certain domestic spending. This plan would gradually reduce the caps on non-defense discretionary (NDD) spending by shrinking them 1 percent per year (as opposed to allowing them to grow roughly with inflation) and doing the same to certain other mandatory non-defense spending. By our estimates, applying the Penny Plan to the NDD caps alone would save roughly $630 billion but would shrink the NDD budget by roughly one-quarter within a decade.

The Penny Plan has been proposed before, including by Representative Connie Mack (R-FL), Senate Budget Committee Chair Mike Enzi (R-WY) and Congressman Mark Sanford (R-SC) in Congress and by former presidential candidates Ben Carson and Senator Rand Paul (R-KY) during the Republican presidential primary. The basic idea behind the Penny Plan is straightforward: it would reduce spending by 1 percent per year in nominal dollars, so that, for example, $100 billion of spending would decline to $99 billion the next year, then $98.01 billion the following year, and so on. Over time, a 1 percent reduction would represent a significant reduction in spending relative to current law, where average spending is projected to grow by over 4 percent per year. Indeed, the traditional version of the Penny Plan would lead to potentially drastic cuts since it would be working against rising health costs and an aging population.

Unlike the traditional version, Trump's Penny Plan would only apply cuts to a subset of the budget, most of which is already capped and not growing particularly rapidly. Specifically, he would apply the Penny Plan to the NDD caps and select non-defense, non-entitlement, and non-safety net spending. The campaign claims this could save $1 trillion over ten years – a bit higher than our estimates, but not dramatically so.

This year, NDD budget authority (the amount of new obligations federal agencies can make) was capped at $518 billion, and under current law, this cap is scheduled to remain roughly flat for the next two years then increase roughly with inflation each year after that, reaching $627 billion in 2026. Under Trump's plan, spending would instead decline one percent each year to $469 billion by 2026 for total ten-year BA savings of nearly $740 billion. Since the plan affects growth rates, the cuts would grow larger over time so that by 2026, non-defense discretionary spending would be cut by one-quarter relative to current law. It would be cut by somewhat more than one-quarter compared to current spending adjusted for inflation.

As a result of these cuts, the caps would be about $740 billion lower over the next decade than under current law, which would translate into $630 billion of outlay savings over a decade. Scheduling these savings to occur would be relatively easy: it would simply require lowering and extending the existing NDD caps. Meeting those caps, however, would require lawmakers to make tough choices and identify significant cuts to many areas of government spending each year.

Trump's Penny Plan would also apply to some mandatory spending, though it's not exactly clear to which programs. He specifically mentions that he would exempt Social Security, Medicare, Medicaid, and veterans' programs but otherwise states he would exempt "entitlement" and/or "safety net" programs. The majority of the remaining spending comes from federal retirement programs, but it is not clear whether those would count as entitlement programs or not. Either way, it does not seem likely that applying the Penny Plan to the mandatory spending that Trump does not exempt would yield enough savings to bring the total savings to $1 trillion. Savings of $700 billion to $800 billion over a decade are more likely.

Trump's Penny Plan is a welcome proposal to offset a portion the cost of his tax plan and other proposals. It appears that the savings would fall slightly short of the $1 trillion the campaign claims but would still generate substantial budget savings. Still, implementing the proposal would be quite difficult without eliminating or dramatically scaling back several government functions, and we would encourage the Trump campaign to identify where at least some of these cuts would come from.

In addition, this Penny plan would only pay for a fraction of Trump's tax plan, so significant additional savings – particularly from the fastest growing parts of the budget – will ultimately be necessary.

This policy explainer is a part of our Fiscal FactCheck series on the 2016 presidential election. Read more policy explainers and factchecks: