Disability Insurance and the Great Recession

Update: A new note from the Office of the Chief Actuary of the Social Security Administration finds that allowance rates actually fell during the Great Recession. The Coe and Rutledge brief appears to have been removed from the website for the time being. This blog includes an extra paragraph discussing the SSA's findings.

Recently, Norma Coe and Matthew Rutledge from the Center for Retirement Research at Boston College published a brief that examined the Social Security Disability Insurance program and how it was affected by the Great Recession. One concern of those advocating on behalf of the DI program is that it could create a disincentive to work and serve as a more costly version of unemployment assistance.

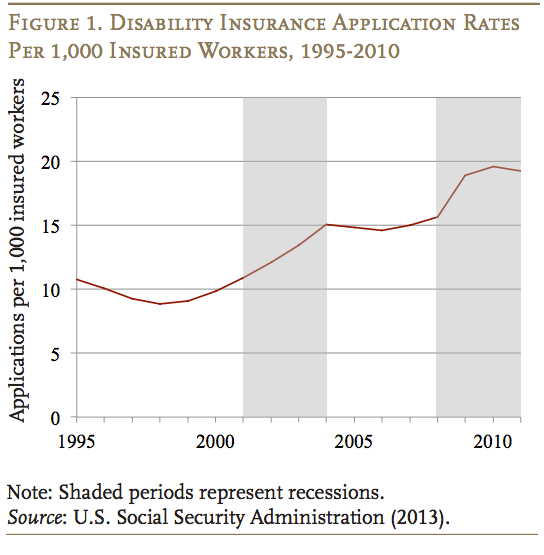

Coe and Rutledge explain that economic conditions can affect individuals' decisions to apply for disability insurance. During a recession, applying for disability insurance benefits becomes more attractive as individuals are more likely to be unemployed. Unemployed individuals' health is likely to worsen, which can increase the likelihood of receiving disability insurance. The brief cites other studies which have found that individuals with borderline health problems are less to apply during good economic times and more likely to apply during recessions.

Source: CRR

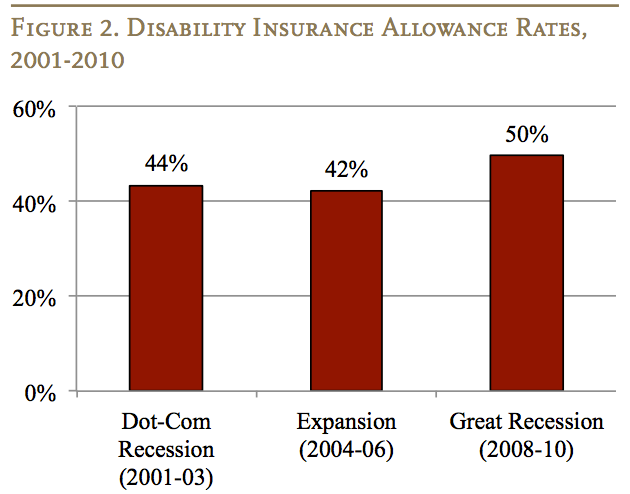

Consistent with expectations, applications for Social Security Disability Insurance rose by around 33 percent from 2007 to 2010. However, allowance rates, the rate of applications that are granted disability benefits, also rose during this period from 42 percent to 50 percent. This is surprising, as traditional thinking suggests that as relatively healthier people enter the applicant pool due to economic distress, the rate of payout will decrease.

Source: CRR

Coe and Rutledge did not find a correlation between education level and allowance rate that was significantly different from the allowance rate during an economic expansion, and were unable to identify the cause of the growth in allowance rates.

Notably, the Social Security Administration's Chief Actuary found results to the contrary. According to their data, allowance rates fell from 58 percent in 2008 to 54 percent in 2011 (based on preliminary data). According to their data set, the 2011 allowance rate would be the lowest since 1995, when it was 53 percent. They also found that allowance rates were lower than would be expected given two different models of the relationship between unemployment rates and allowance rates.

The Social Security Disability Insurance trust fund is due to be exhausted by 2016, according to the latest Trustee's Report. At that point, benefits will either need to be cut by 20 percent or funds will need to be transferred from the Old-Age Fund, which has its own solvency problems. With many possible reforms that could improve the program as well as make it solvent, it does not make sense to wait three more years before giving DI needed attention.