More Ways to Reform the Social Security Disability Insurance Program

The recent NPR segment from Chana Joffe-Walt on the disability insurance program has certainly started a conversation. The Washington Post's Wonkblog in particular has been examining the story, and last week Dylan Matthews posted a story with five ways to reform the program. Matthews's list includes:

- Creating an employee-sponsored disability insurance program that would transition to SSDI: This proposal comes from MIT's David Autor and University of Maryland's Mark Duggan, under which employers would be required to pay premiums for their employees for disability insurance. Initially, employees would be covered by that disability insurance but would transition into Social Security Disability Insurance after 27 months.

- Imposing higher taxes on businesses that send a great proportion of workers to the DI program: Mary Daly of the San Francisco Federal Reserve and Richard Burkhauser of Cornell have suggested giving a tax break to businesses with low rates of enrollment in disability insurance among their employees, and higher taxes for businesses with high rates.

- Creating demonstration projects: Jeffrey Liebman of Harvard and Jack Smalligan of OMB have proposed creating demonstration projects to see what works including creating the employee-sponsored program, using wage subsidies to incentivize work, and allowing waivers for states so they can experiment with their own reforms.

- Easing the phase-out of benefits as earnings increase: Reducing the severity of the phase-out would decrease disincentives to work.

- Increasing the waiting period: Extending the waiting period from 5 months to 12 months would reduce the cost of benefits and potential fraud.

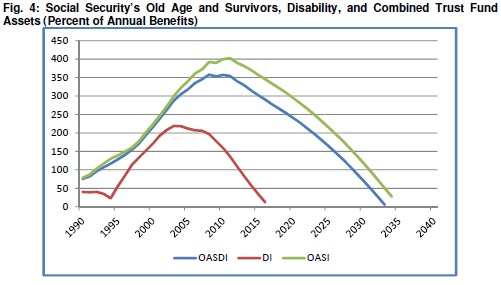

These are all ideas worth considering, but this list is no by no means exhaustive. Given that the Social Security Disability trust fund is due to be exhausted by 2016, all ideas for how to make the program solvent should be on the table.

Source: Social Security Administration

Reforming disability insurance benefits and eligibility should be considered, as well as ways to raise additional revenues for the program. Other options not mentioned above (explained further here) include:

- Increase funding for continuing disability reviews

- Limit months of retroactive benefit payments (currently 12 months)

- Increase the 1.8 percent DI payroll tax

- Eliminate or increasing the taxable maximum on the 1.8 percent DI payroll tax

- Hold constant the ratio between DI benefits and EEA benefits as the NRA increases

- Instruct the Social Security Administration to tighten vocational grids

- Increase the ages in the vocational grids

- Close the record for the submission of evidence one week before hearings

- Require beneficiaries to regularly reapply to DI

- Disallow those above the EEA to apply for DI benefits (could be phased in beginning at an early age)

- Increase work requirements (currently 5 of the past 10 years) to apply for DI

- Restrict disability claimants to one application at a time

- Eliminate the "Reconsideration" level of disability appeal

- Time limit benefits based on likelihood of improvement

- Adjust DI payments to account for veterans disability benefits

- Reform the workers' compensation offset

- Disallow DI for the highest earners

Other temporary solutions to avoid a funding cliff include reallocating a portion of the payroll tax to DI or allowing the DI fund to borrow from the old age fund. However, none of these options would strengthen the combined OASDI trust fund, due to be exausted by 2033. CFRB Senior Policy Director Marc Goldwein laid out what a plan should accomplish if it must use these temporary financing mechanisms in an op-ed in The Hill:

Making the disability system solvent simply by taking money from the already-underfunded old-age system would represent a double policy failure by committing a disservice to both programs. Instead, policymakers should use the fast-approaching insolvency date in the same way they did when the trust funds ran low in 1983 – come together and fix both programs for this generation and the next.

Specifically, any plan which reallocates money from the old age program to the disability program should do the following:

- Enact reforms to improve Disability Insurance over the short-term...

- Take steps toward more structural reform...

- Fix Social Security: Make it sustainable solvent

The Social Security Disability Insurance program could benefit from these reforms, which help reduce fraud and abuse while better targeting benefits to those who need the support the most. In any case, the trust fund needs to be shored up to preserve this valuable program. There are many options out there, so a reasonable solution should be possible.