Debt Will Likely Rise, Not Fall, Under the President's Budget

According to the Office of Management and Budget (OMB), the President’s Fiscal Year (FY) 2021 budget would reduce debt from 80 percent of Gross Domestic Product (GDP) today to 66 percent by 2030 and reduce deficits from $1.1 trillion (4.9 percent of GDP) in 2020 to $261 billion (0.7 percent) in 2030. However, a more realistic assessment would show debt to continue to rise, albeit more slowly than under current law.

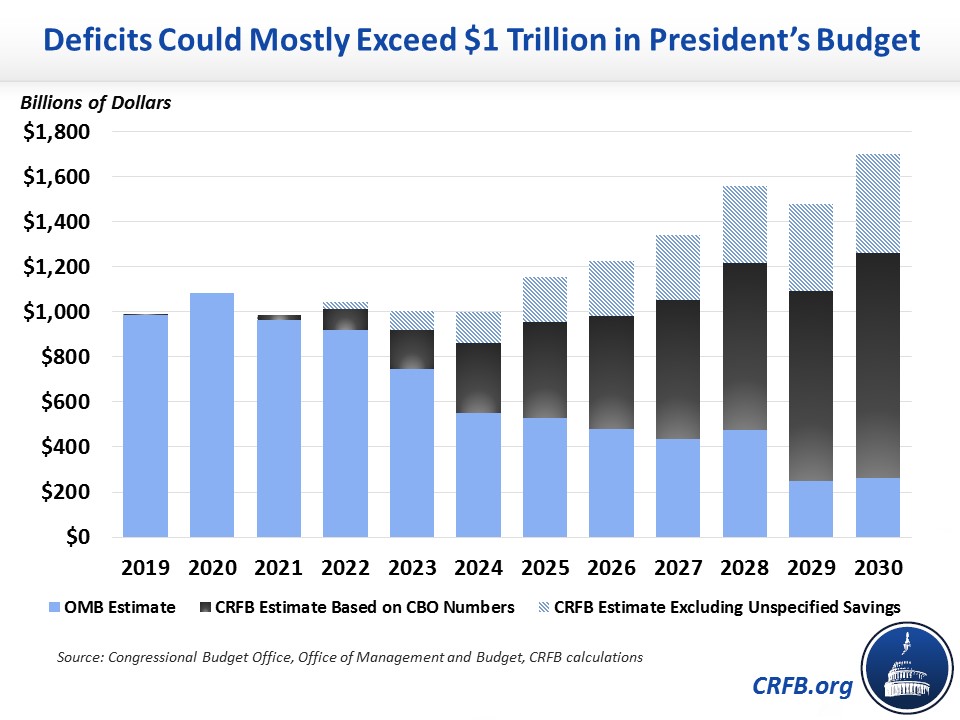

Based on Congressional Budget Office (CBO) assumptions and estimates, we believe debt under the President's budget will be estimated to rise to roughly 90 percent of GDP, while deficits will remain at about $1 trillion per year over the next decade. Removing unspecified policy savings would lead debt to rise even further, to roughly 96 percent of GDP, and deficits to reach $1.7 trillion. By comparison, CBO estimates debt will rise to 98 percent of GDP by 2030 under current law. In other words, the policies in President's budget, taken together, might do little to reduce projected deficits and debt.

As explained in our analysis of the President's budget, OMB relies on very rosy economic assumptions, in particular the assumption that real GDP growth will average nearly 3 percent per year over the next decade, much higher than just about every other economic forecast (and higher than the 2.3 percent growth we actually saw in 2019). CBO expects economic growth will average 1.7 percent over the same period. As a result, OMB expects baseline GDP to be 13 percent higher and baseline revenue to be 10 percent higher than CBO. This leads to a stark disparity in their baseline debt projections: while CBO believes debt will rise to nearly the size of the economy by 2030, OMB's economic forecast results in debt stabilizing at the current level of 80 percent of GDP under current law. Indeed, the Administration's growth assumptions are enough to balance the budget by roughly mid-century even without any changes to policy.

On top of this issue, many of the policies the Administration put forward are likely to save less under CBO scoring. Based on past differences in policy estimates, we expect that CBO will find smaller savings for several health care policies, student loan changes, farm subsidy changes, postal service reform, increases in fees for Fannie Mae and Freddie Mac guarantees, and a few tax changes. We also expect that CBO will find insufficient detail to estimate savings related to the Supplemental Nutrition Assistance Program and Social Security Disability Insurance. On the other hand, we expect that CBO will estimate lower costs from the extension of the individual tax cuts in the 2017 tax law and the infrastructure spending increase.

Overall, we believe estimating differences reduce OMB's tally of debt reduction by about $435 billion by 2030 (1 percent of GDP), increase baseline debt by $2.9 trillion (8 percent of GDP), and further increase debt by 11 percent of GDP as a direct result of lower assumed economic output.

Bridge From OMB Estimate of Debt in President's Budget to CRFB Estimate

| 2030 Debt (Percent of GDP) | |

|---|---|

| OMB Estimate | 66% |

| Lower Deficit Reduction | +1% |

| Higher Baseline Debt | +8% |

| Lower GDP | +11% |

| Interactions | +4% |

| CRFB Estimate Based on CBO Numbers | 90% |

| Unspecified Policy Savings | +6% |

| Estimate w/ Unspecified Savings Removed | 96% |

Sources: CRFB calculations based on Congressional Budget Office and Office of Management and Budget data.

These adjustments alone would increase debt under the President's budget from a claimed 66 percent of GDP in 2030 to roughly 90 percent. Even this is an optimistic estimate, since it counts roughly $2 trillion of totally unspecified savings: $1.1 trillion from the "two-penny" plan to reduce nondefense discretionary spending by two percent per year and another $845 billion from "Advancing the President's Health Reform Vision." The budget does not identify policies or even policy direction in either of these areas.

Excluding these unspecified savings would erase most of the remaining deficit reduction in the President's budget, bringing debt up to 96 percent of GDP by 2030, compared to 98 percent under CBO's current law estimate.

We also expect much higher deficits in CBO's estimate of the budget, especially when unspecified savings are excluded. Whereas OMB projects deficits will fall from $1.1 trillion (4.9 percent of GDP) in 2020 to $261 billion (0.7 percent of GDP) in 2030, we estimate deficits will rise to $1.3 trillion (3.9 percent of GDP) using CBO-like estimates and to $1.7 trillion (5.3 percent of GDP) if unspecified savings are also removed. Indeed, it is possible that under the President's budget deficits will remain above $1 trillion every year over the next decade besides 2021.

These estimates show that CBO is likely to estimate much higher debt and deficits in the President's budget than OMB, as it has in the previous three years. Excluding unspecified nondefense discretionary and health care savings would result in the budget barely reducing debt compared to CBO's bleak current law estimate. The budget does put forward a number of important and thoughtful policies, especially proposals to reduce Medicare costs. But as we said in our initial analysis of the President's budget, the budget relies too much on gimmicks and not enough on real deficit-reducing policies to truly correct the fiscal situation.