CRFB Releases Analysis of CBO's 2014 Budget and Economic Outlook

Yesterday, the Congressional Budget Office released its 2014 Budget and Economic Outlook, serving as a budget baseline for the new year. To help make sense of the 182-page dense but informative report, CRFB has released a concise 7-page analysis that puts the new numbers in perspective.

As we said yesterday, much of the deterioration in CBO's new projections reflects weaker expectations for economic growth. CBO still expects the economy to recover to its full potential around 2018, but expects slower economic growth when it reaches that point due to slower productivity growth, less investment, and a smaller labor force than in previous projections. Economic growth was expected to average 2.9 percent over ten years last February, but new projections expect economic growth to average only 2.5 percent.

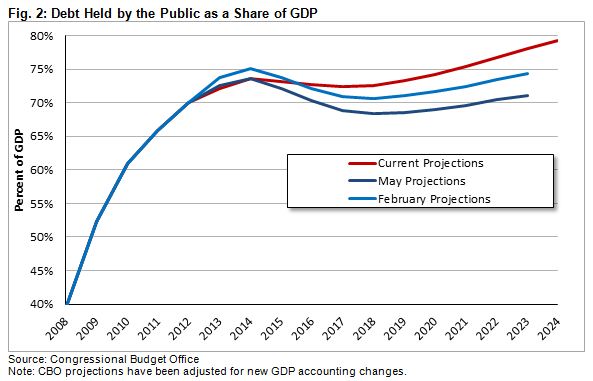

When combined with other technical and legislative changes, debt projections are significantly worse than in the last update. Debt as percentage of GDP will fall from 73.6 percent of GDP in 2014 to 72.3 percent in 2017 before then returning to an upward trajectory, reaching 78.0 percent of GDP in 2023 and 79.2 percent in 2024. For comparison, debt was projected to be 71.1 percent of GDP in 2023 in last May's projections. Average revenues over ten years are expected to be lower at 18.1 percent of GDP, compared to the previous ten-year average of 18.3 percent. Furthermore, average spending over ten years is expected to be significantly higher at 21.7 percent of GDP, compared to the previous ten-year average of 21.1 percent.

Last May, there was some excitement over the improvement in budget projections from February, and even suggestions that getting our fiscal house in order was no longer a pressing issue. However, as the graph below shows, the changes in this baseline from May were twice the size of those between February and May, only in the wrong direction. This report should be taken as a reminder that putting debt on on a sustainable path needs to be a priority.

Yesterday's summary could not cover everything in the report, which is why we will be continuing with a new blog series on the CBO report for the remainder of the week. In the coming days, we will explain why the deficit fell in 2014, what consequences high debt could have on the economy, what changed in CBO's economic projections this year, and many more topics. Check our first two posts, our reaction to the report and an examination of spending growth, and keep reading The Bottom Line as we continue to analyze the CBO report.

CBO's new outlook is a reminder that budget projections are always subject to uncertainty. It's important to make sure we put our debt on a sustainable downward path over the long term – if projections are better than expected, it is always easier to undo some changes than to enact additional savings. At the same time, we can enact phased-in, structural reforms that will not interfere with our recovering economy, and even stimulate economic growth further. As we conclude in our paper:

Building on recent bipartisan success in agreeing to reform certain spending programs and enact all twelve appropriation bills, we encourage Congress and the President to work toward comprehensive tax reform and structural entitlement reforms designed to put the debt on a clear downward path relative to the economy. At a minimum, policymakers should adhere to strict pay-as-you-go (PAYGO) rules to prevent the record-high debt projections from worsening further.

Follow our 2014 CBO Budget Outlook blog series here and read our full analysis of the CBO outlook here.